Asian Stocks That Might Be Trading Below Estimated Value In August 2025

Reviewed by Simply Wall St

As of August 2025, Asian markets are navigating a complex landscape marked by trade tensions and evolving monetary policies, with China's export strength and Japan's robust corporate earnings providing some positive momentum. In this environment, identifying undervalued stocks requires careful consideration of companies that demonstrate resilience and potential for growth despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimicron Technology (TWSE:3037) | NT$138.00 | NT$274.48 | 49.7% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥112.51 | CN¥223.99 | 49.8% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥51.21 | CN¥98.84 | 48.2% |

| Matsuya R&DLtd (TSE:7317) | ¥713.00 | ¥1425.87 | 50% |

| Kolmar Korea (KOSE:A161890) | ₩78700.00 | ₩153062.78 | 48.6% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$10.48 | HK$20.24 | 48.2% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥59.40 | CN¥115.84 | 48.7% |

| GEM (SZSE:002340) | CN¥6.69 | CN¥13.07 | 48.8% |

| Finger (KOSDAQ:A163730) | ₩13230.00 | ₩26205.35 | 49.5% |

| Andes Technology (TWSE:6533) | NT$275.00 | NT$543.02 | 49.4% |

Let's dive into some prime choices out of the screener.

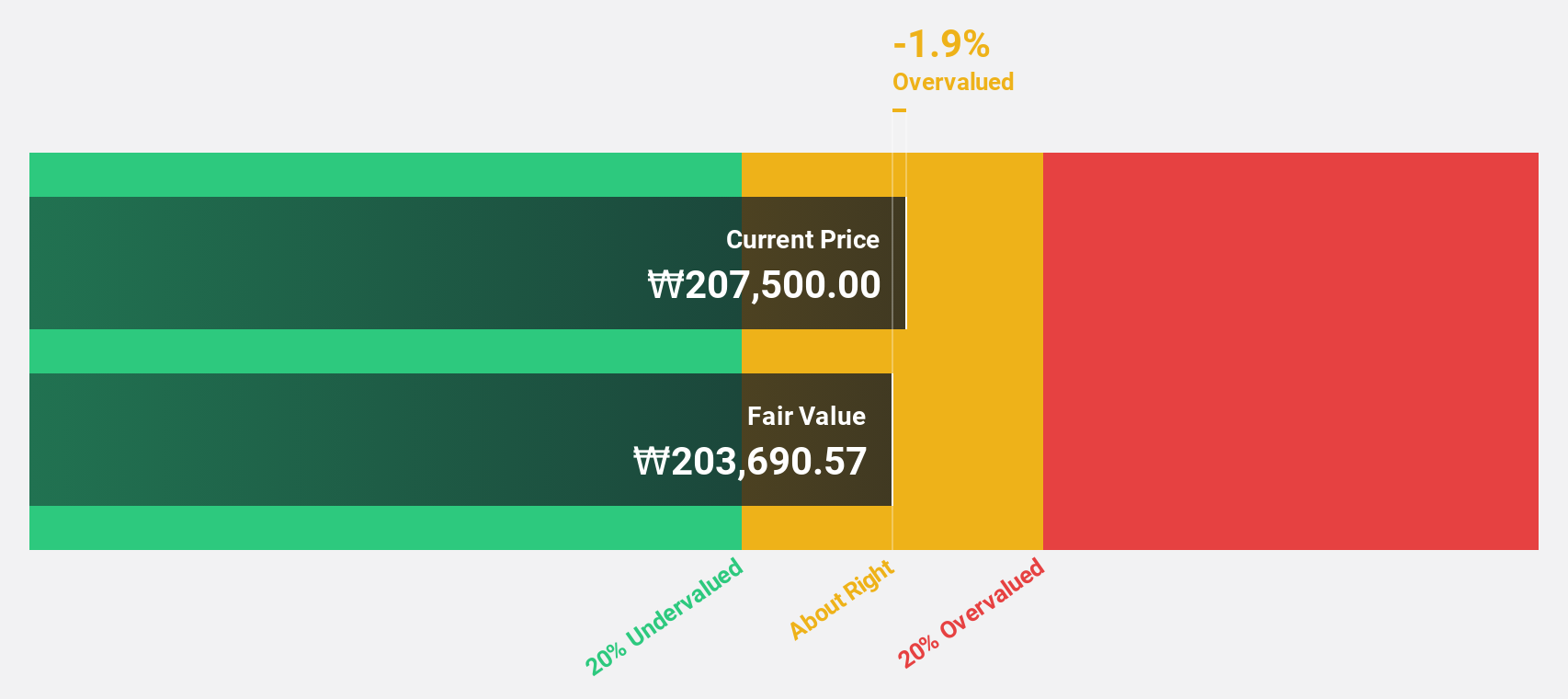

NCSOFT (KOSE:A036570)

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩4.16 trillion.

Operations: The company's revenue segment primarily consists of online games and game services, generating ₩1.54 trillion.

Estimated Discount To Fair Value: 17.8%

NCSOFT is trading at ₩214,500, below its estimated fair value of ₩260,834.1. Despite a decline in Q1 2025 sales and net income compared to the previous year, earnings are forecast to grow significantly at 47.2% annually over the next three years, outpacing the Korean market's growth rate. However, profit margins have decreased from last year due to large one-off items impacting financial results. Revenue growth is expected to exceed the broader market but remains moderate at 11.6% per year.

- Our earnings growth report unveils the potential for significant increases in NCSOFT's future results.

- Delve into the full analysis health report here for a deeper understanding of NCSOFT.

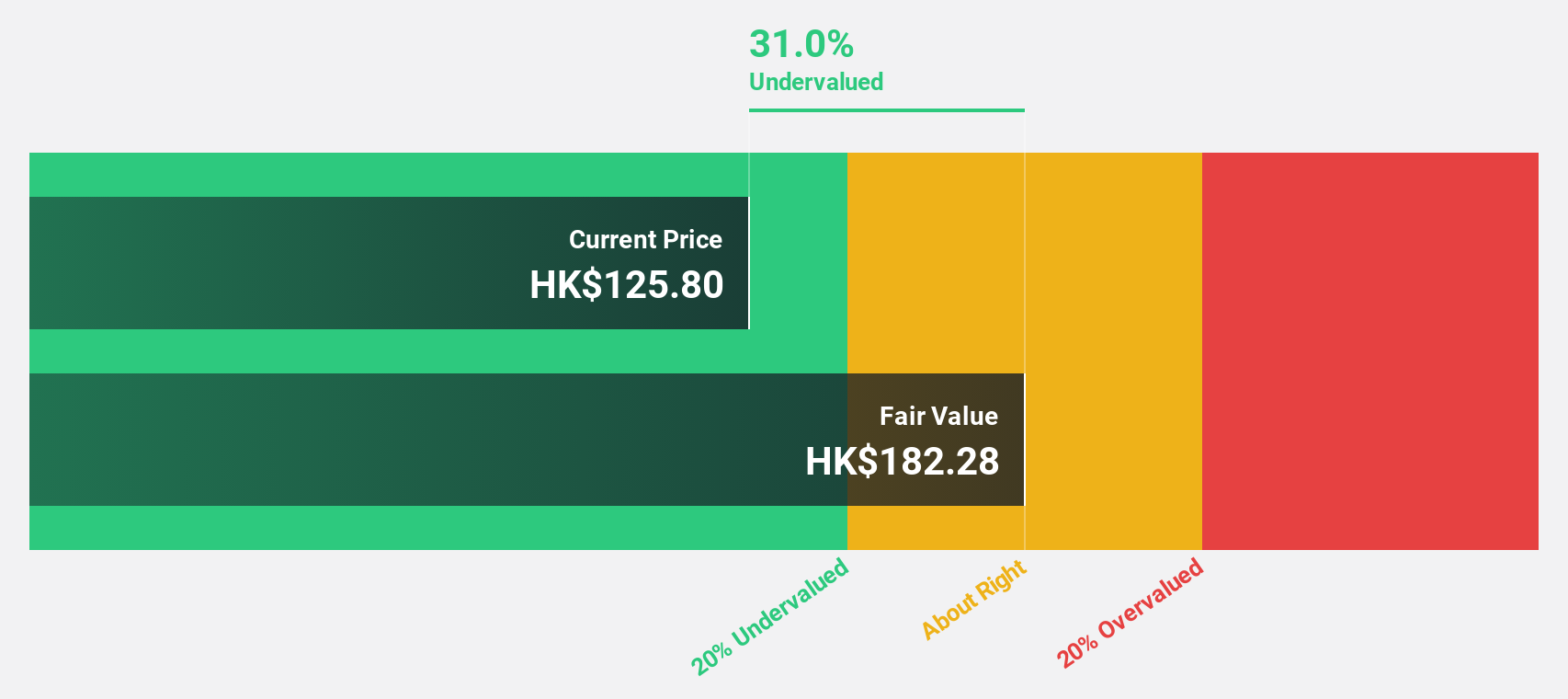

BYD (SEHK:1211)

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People's Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$1056.59 billion.

Operations: BYD's revenue primarily stems from its operations in the automobiles and batteries sectors across various regions, including the People's Republic of China, Hong Kong, Macau, Taiwan, and international markets.

Estimated Discount To Fair Value: 20.4%

BYD's stock is trading at HK$115, significantly below its estimated fair value of HK$144.5, indicating potential undervaluation. Recent sales and production figures show robust growth, with year-to-date sales reaching 2.49 million units compared to last year's 1.96 million units. Earnings are forecasted to grow at 15.9% annually, surpassing the Hong Kong market average of 10.8%. Strategic partnerships and expansions in Europe further bolster BYD's position in the electric vehicle sector.

- Upon reviewing our latest growth report, BYD's projected financial performance appears quite optimistic.

- Click here to discover the nuances of BYD with our detailed financial health report.

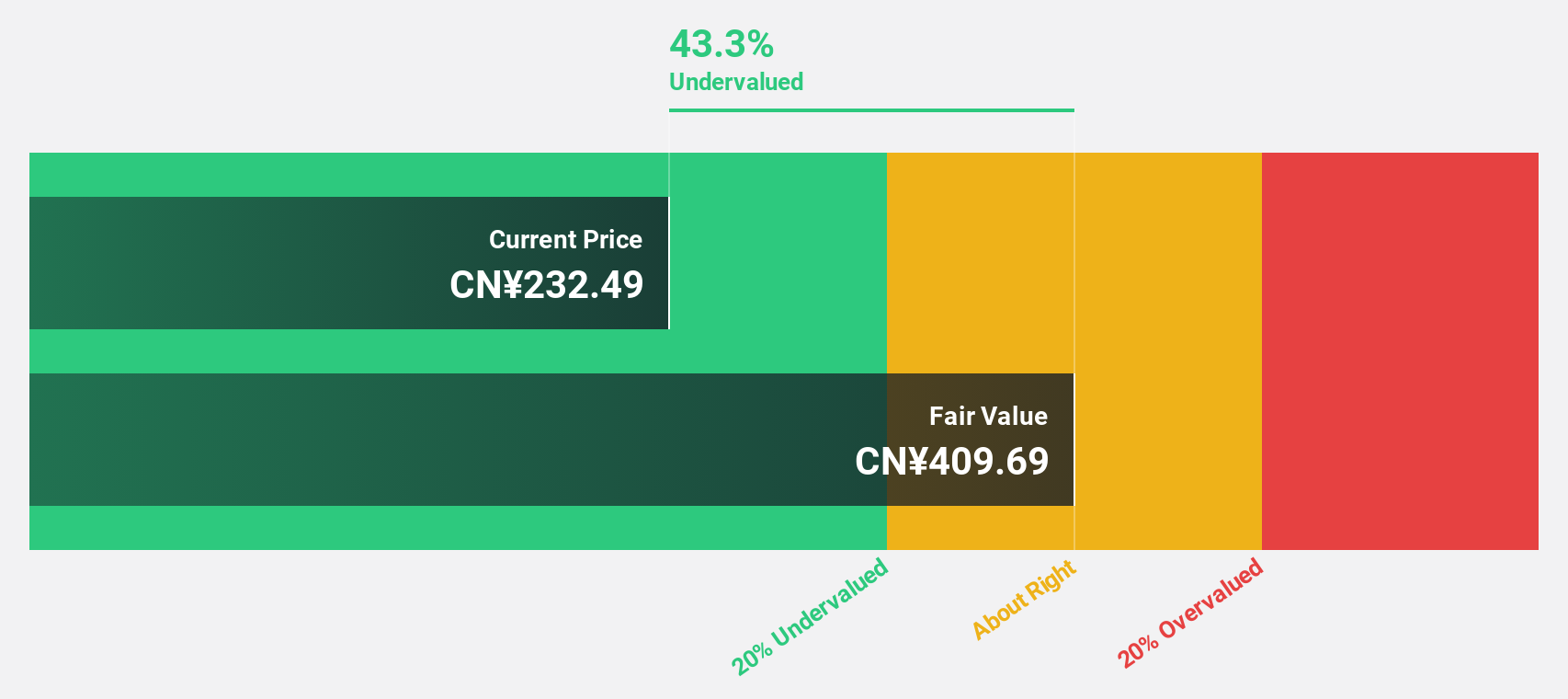

Zhejiang Cfmoto PowerLtd (SHSE:603129)

Overview: Zhejiang Cfmoto Power Co., Ltd, with a market cap of CN¥41.65 billion, is involved in the development, manufacture, marketing, and delivery of motorcycles, off-road vehicles, engines, frames, parts, apparel, and accessories across China and various international markets including Asia, North America, Oceania, Africa, South America and Europe.

Operations: The company's revenue is derived from the development, manufacture, marketing, and delivery of motorcycles, off-road vehicles, engines, frames, parts, apparel, and accessories across multiple regions including China and international markets such as Asia, North America, Oceania, Africa, South America and Europe.

Estimated Discount To Fair Value: 28.7%

Zhejiang Cfmoto Power Ltd is trading at CNY 272.99, significantly below its estimated fair value of CNY 382.64, suggesting it may be undervalued based on cash flows. The company reported strong half-year results with net income rising to CNY 1 billion from the previous year’s CNY 708.81 million, and earnings are forecasted to grow by over 20% annually. Despite recent share price volatility, its revenue growth outpaces the broader Chinese market's expectations.

- Insights from our recent growth report point to a promising forecast for Zhejiang Cfmoto PowerLtd's business outlook.

- Click to explore a detailed breakdown of our findings in Zhejiang Cfmoto PowerLtd's balance sheet health report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 265 Undervalued Asian Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives