- China

- /

- Electrical

- /

- SHSE:601567

Asian Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of mixed economic data and trade negotiations, Asian stock markets are presenting intriguing opportunities for investors. In such an environment, identifying stocks that may be trading below their estimated value can offer potential upside, especially when companies demonstrate strong fundamentals and resilience amid broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2574.50 | ¥5115.01 | 49.7% |

| Polaris Holdings (TSE:3010) | ¥219.00 | ¥436.36 | 49.8% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥23.12 | CN¥46.19 | 49.9% |

| JRCLtd (TSE:6224) | ¥1160.00 | ¥2306.76 | 49.7% |

| HL Holdings (KOSE:A060980) | ₩41650.00 | ₩82347.91 | 49.4% |

| Hibino (TSE:2469) | ¥2394.00 | ¥4731.64 | 49.4% |

| Dive (TSE:151A) | ¥935.00 | ¥1858.95 | 49.7% |

| cottaLTD (TSE:3359) | ¥431.00 | ¥857.05 | 49.7% |

| Bloks Group (SEHK:325) | HK$146.60 | HK$292.82 | 49.9% |

| APAC Realty (SGX:CLN) | SGD0.475 | SGD0.95 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

LG Chem (KOSE:A051910)

Overview: LG Chem, Ltd., with a market cap of ₩18.96 trillion, operates in the petrochemicals, energy, advanced materials, and life science sectors across Korea and internationally.

Operations: The company's revenue is primarily generated from its LG Energy Solution segment at ₩25.76 billion, followed by the Petrochemical segment at ₩19.41 billion, Advanced Materials at ₩6.36 billion, and Life Sciences at ₩1.33 billion.

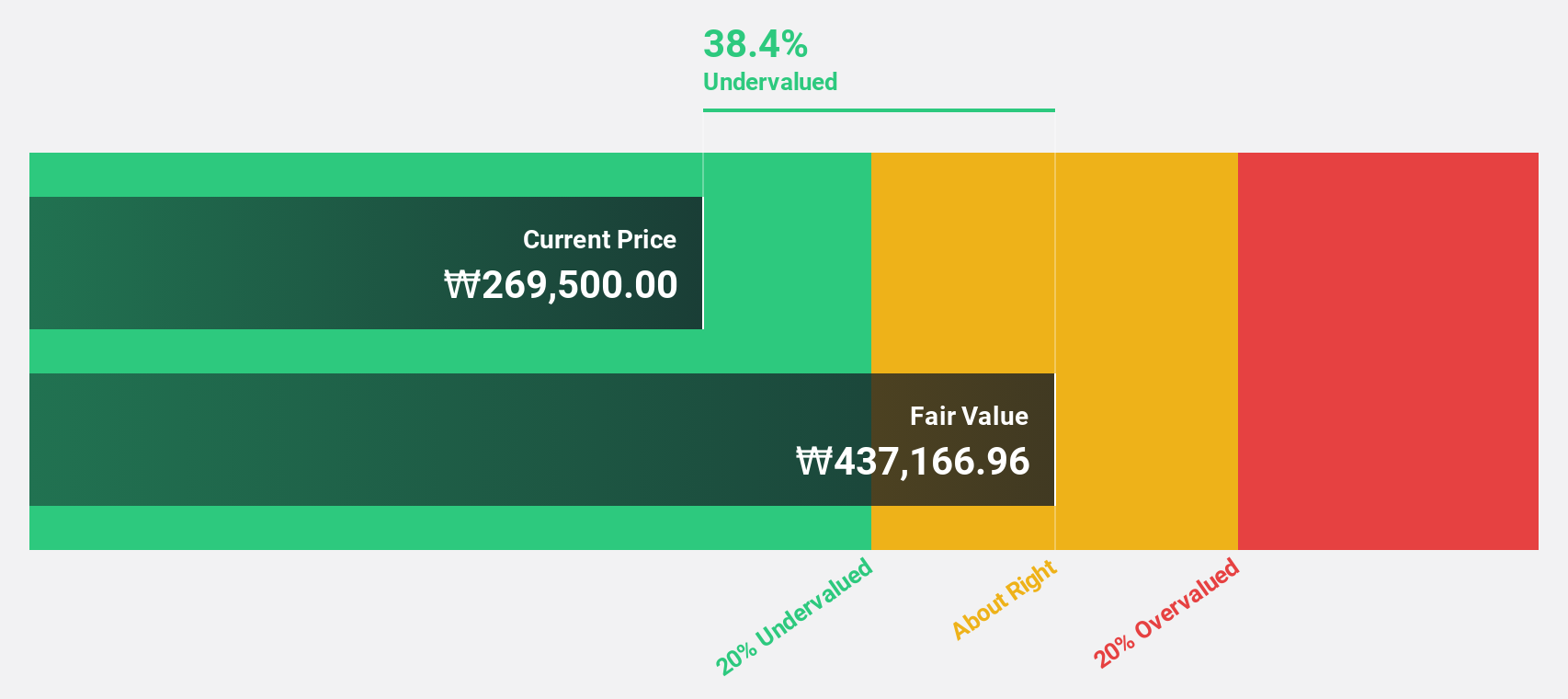

Estimated Discount To Fair Value: 46.6%

LG Chem is trading at 46.6% below its estimated fair value of ₩476,672.19, suggesting undervaluation based on cash flows. Despite a forecasted revenue growth of 9.1% per year outpacing the Korean market, the company faces challenges with low forecasted return on equity and insufficient earnings to cover interest payments. Recent efforts to repurchase US$613 million in bonds aim to strengthen its financial position amid industry downturns, while potential divestment of its water solutions division could further impact cash flow dynamics.

- According our earnings growth report, there's an indication that LG Chem might be ready to expand.

- Get an in-depth perspective on LG Chem's balance sheet by reading our health report here.

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for men and women, with a market cap of ₩6.03 billion.

Operations: The company's revenue is primarily derived from the Cosmetics Sector at ₩1 billion and the Clothing Fashion Sector at ₩49.44 million.

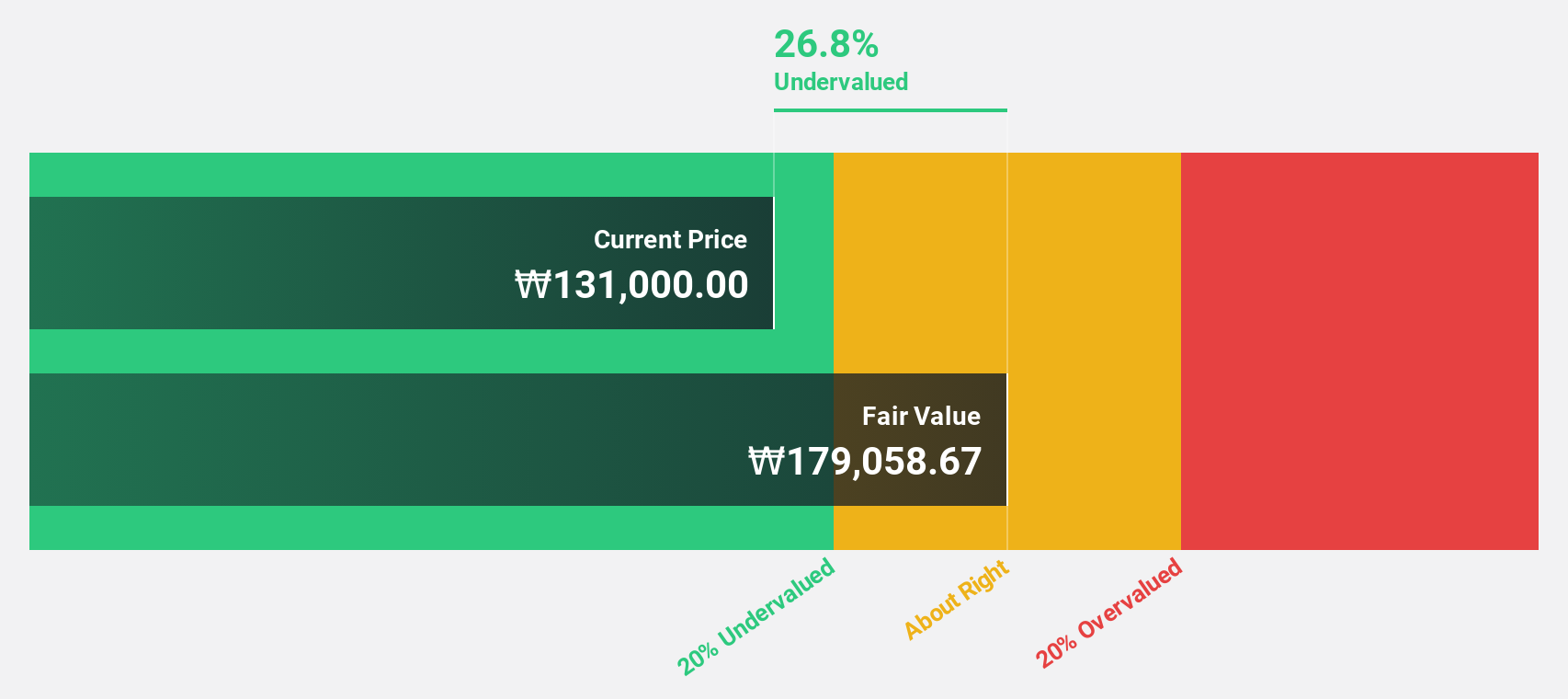

Estimated Discount To Fair Value: 27.8%

APR Co., Ltd. is currently trading 27.8% below its estimated fair value of ₩223,157.49, highlighting potential undervaluation based on cash flows. The company anticipates robust revenue growth of 28.2% annually, surpassing the Korean market's average forecast and earnings are expected to grow significantly at 29.87% per year over the next three years. However, investors should note recent share price volatility and high levels of non-cash earnings impacting perceived quality.

- The analysis detailed in our APR growth report hints at robust future financial performance.

- Take a closer look at APR's balance sheet health here in our report.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems both in China and internationally, with a market cap of CN¥32.62 billion.

Operations: The company generates revenue from the manufacture and sale of power distribution and utilization systems across domestic and international markets.

Estimated Discount To Fair Value: 49.9%

Ningbo Sanxing Medical Electric Ltd. is trading at CN¥23.12, significantly below its estimated fair value of CN¥46.19, suggesting undervaluation based on cash flows. Despite slower forecasted earnings growth of 20.1% annually compared to the Chinese market, revenue growth is expected to outpace the market at 18% per year. However, its dividend yield of 3.85% isn't well covered by free cash flows, which may concern income-focused investors despite strong recent earnings performance and analyst consensus on price appreciation potential.

- Upon reviewing our latest growth report, Ningbo Sanxing Medical ElectricLtd's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Ningbo Sanxing Medical ElectricLtd with our comprehensive financial health report here.

Key Takeaways

- Dive into all 271 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sanxing Medical ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601567

Ningbo Sanxing Medical ElectricLtd

Manufactures and sells power distribution and utilization systems in China and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives