- Taiwan

- /

- Electrical

- /

- TWSE:3665

Asian Stock Picks Possibly Undervalued For October 2025

Reviewed by Simply Wall St

As of October 2025, the Asian markets have been navigating a complex landscape marked by mixed economic signals and regional developments. With China's manufacturing PMI showing signs of contraction and Japan's stock market experiencing varied performance, investors are keenly assessing opportunities in potentially undervalued stocks across Asia. In such an environment, identifying stocks that offer solid fundamentals and resilience against macroeconomic fluctuations is crucial for those seeking to capitalize on potential value opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.05 | CN¥165.09 | 49.1% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.72 | 49.7% |

| SRE Holdings (TSE:2980) | ¥3240.00 | ¥6427.82 | 49.6% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Kuraray (TSE:3405) | ¥1761.00 | ¥3480.62 | 49.4% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.53 | HK$34.42 | 49.1% |

| freee K.K (TSE:4478) | ¥3375.00 | ¥6523.14 | 48.3% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95922.12 | 49.8% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.21 | CN¥90.85 | 48% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥28.43 | CN¥54.77 | 48.1% |

Let's uncover some gems from our specialized screener.

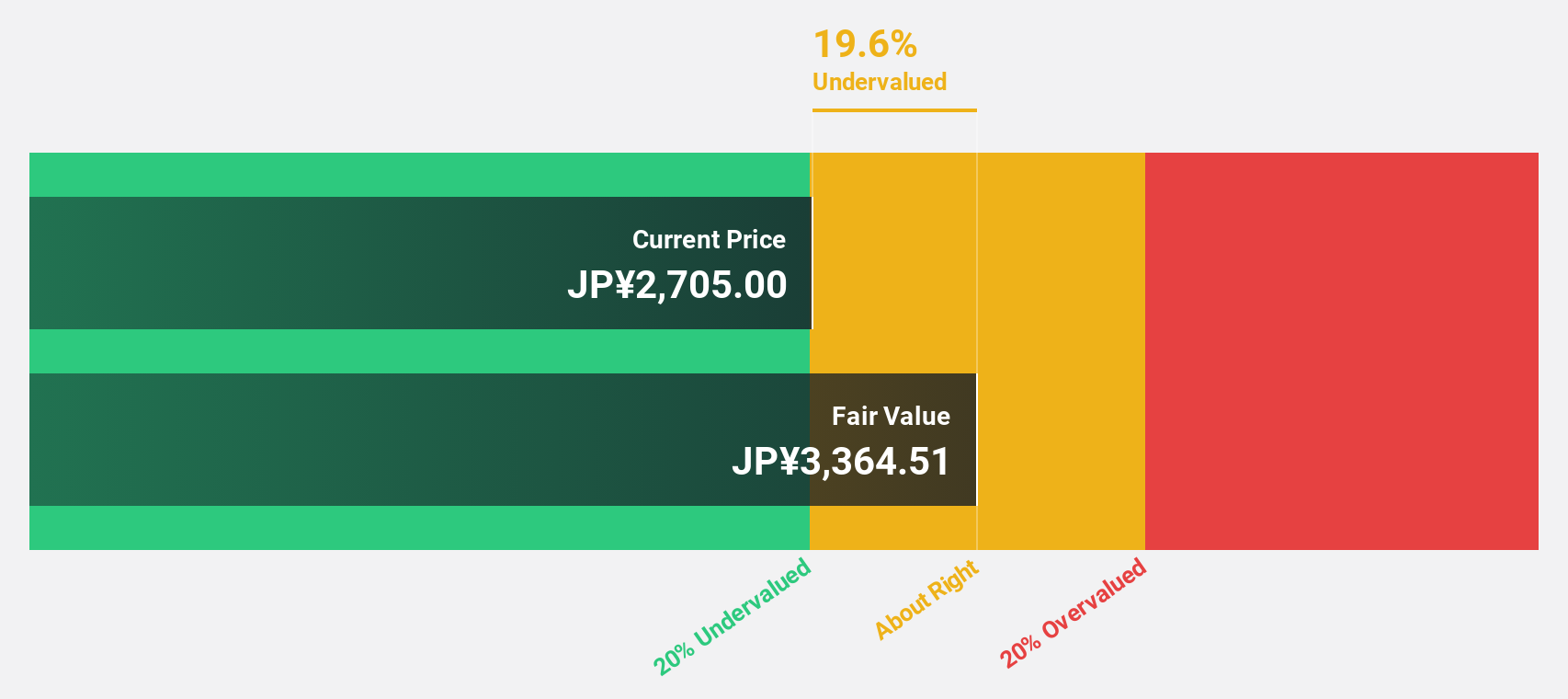

Socionext (TSE:6526)

Overview: Socionext Inc. is a global company that designs, develops, manufactures, and sells system-on-chip (SoC) solutions and services, with a market cap of ¥509.99 billion.

Operations: The company's revenue segment includes SoC Developed with The Solution SoC, generating ¥170.31 billion.

Estimated Discount To Fair Value: 13.3%

Socionext is trading at ¥2,912, below its estimated fair value of ¥3,360.29. Despite a volatile share price and lower profit margins this year (7.3%) compared to last (12.1%), the company's earnings are forecast to grow significantly at 25.75% annually, outpacing the Japanese market's 8.2%. Recent advancements in 3DIC technology for consumer and AI applications highlight Socionext's innovative capabilities, potentially enhancing long-term cash flow prospects amidst growing demand for high-density solutions.

- The growth report we've compiled suggests that Socionext's future prospects could be on the up.

- Click here to discover the nuances of Socionext with our detailed financial health report.

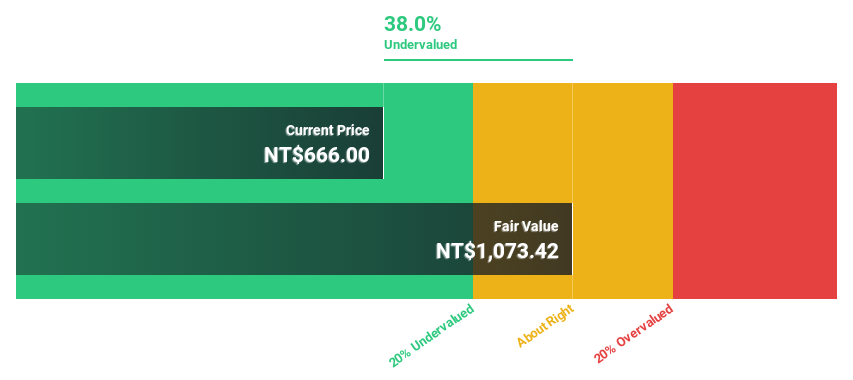

Accton Technology (TWSE:2345)

Overview: Accton Technology Corporation is involved in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and internationally, with a market cap of NT$617.59 billion.

Operations: The company's revenue from its Computer Networks segment is NT$170.52 billion.

Estimated Discount To Fair Value: 19.4%

Accton Technology is trading at NT$1,105, below its estimated fair value of NT$1,370.53. Despite recent share price volatility, the company exhibits strong cash flow potential with earnings growing by 83.2% over the past year and forecasted revenue growth of 24% annually—outpacing Taiwan's market average. Accton's high-quality earnings and robust return on equity projections further underscore its undervaluation based on discounted cash flow analysis amidst significant profit growth expectations.

- Our comprehensive growth report raises the possibility that Accton Technology is poised for substantial financial growth.

- Dive into the specifics of Accton Technology here with our thorough financial health report.

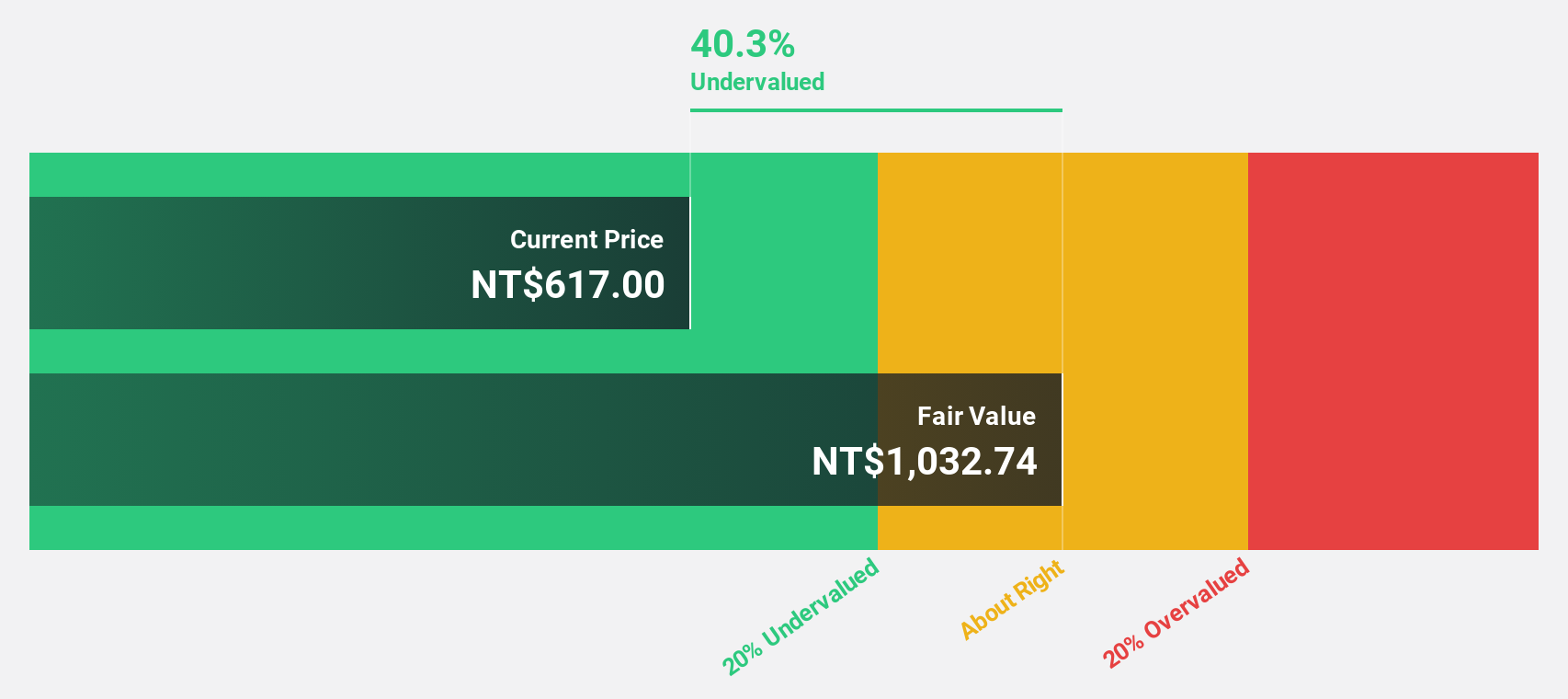

Bizlink Holding (TWSE:3665)

Overview: Bizlink Holding Inc. is engaged in the research, design, development, manufacture, and sale of interconnect products for cable harnesses across various international markets including the United States, China, Germany, Malaysia, Taiwan, and Italy; it has a market cap of NT$205.61 billion.

Operations: Bizlink Holding's revenue is derived from three main segments: Home Appliance at NT$9.97 billion, Industrial Application at NT$23.78 billion, and Computing and Transportation at NT$77.53 billion.

Estimated Discount To Fair Value: 14.8%

Bizlink Holding is trading at NT$1,060, under its fair value estimate of NT$1,244.59. Despite recent share price volatility, earnings grew by 127.8% last year and are expected to grow significantly over the next three years, surpassing Taiwan's market average. The company's inclusion in the FTSE All-World Index highlights its growing prominence. With strong cash flow potential and high return on equity forecasts, Bizlink presents an attractive undervaluation case based on cash flows.

- According our earnings growth report, there's an indication that Bizlink Holding might be ready to expand.

- Navigate through the intricacies of Bizlink Holding with our comprehensive financial health report here.

Next Steps

- Get an in-depth perspective on all 273 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bizlink Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3665

Bizlink Holding

Researches, designs, develops, manufactures, and sells interconnect products for cable harnesses in the United States, China, Germany, Malaysia, Taiwan, Italy, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives