- Singapore

- /

- Consumer Finance

- /

- SGX:T6I

Asian Penny Stocks With Market Caps Under US$800M

Reviewed by Simply Wall St

As global markets focus on interest rate decisions and economic data, Asian markets are navigating their own set of challenges and opportunities. For investors interested in smaller or newer companies, penny stocks offer a unique blend of affordability and potential for growth. Despite the term's outdated feel, these stocks can still hold significant value when backed by strong financials. In this article, we'll explore three Asian penny stocks that exemplify financial strength and potential for future gains.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.90 | THB3.85B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.04 | HK$2.47B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.60 | HK$989.63M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.975 | SGD395.16M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.19 | SGD12.55B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.98 | THB1.44B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB5.00 | THB10.1B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 983 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Novautek Technologies Group (SEHK:519)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Novautek Technologies Group Limited (SEHK:519) is an investment holding company involved in resort and property development, as well as property investment in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$614.08 million.

Operations: The company generates revenue from property development (HK$18.19 billion) and property investment (HK$10.04 billion), along with its investment holding activities (HK$6.95 million).

Market Cap: HK$614.08M

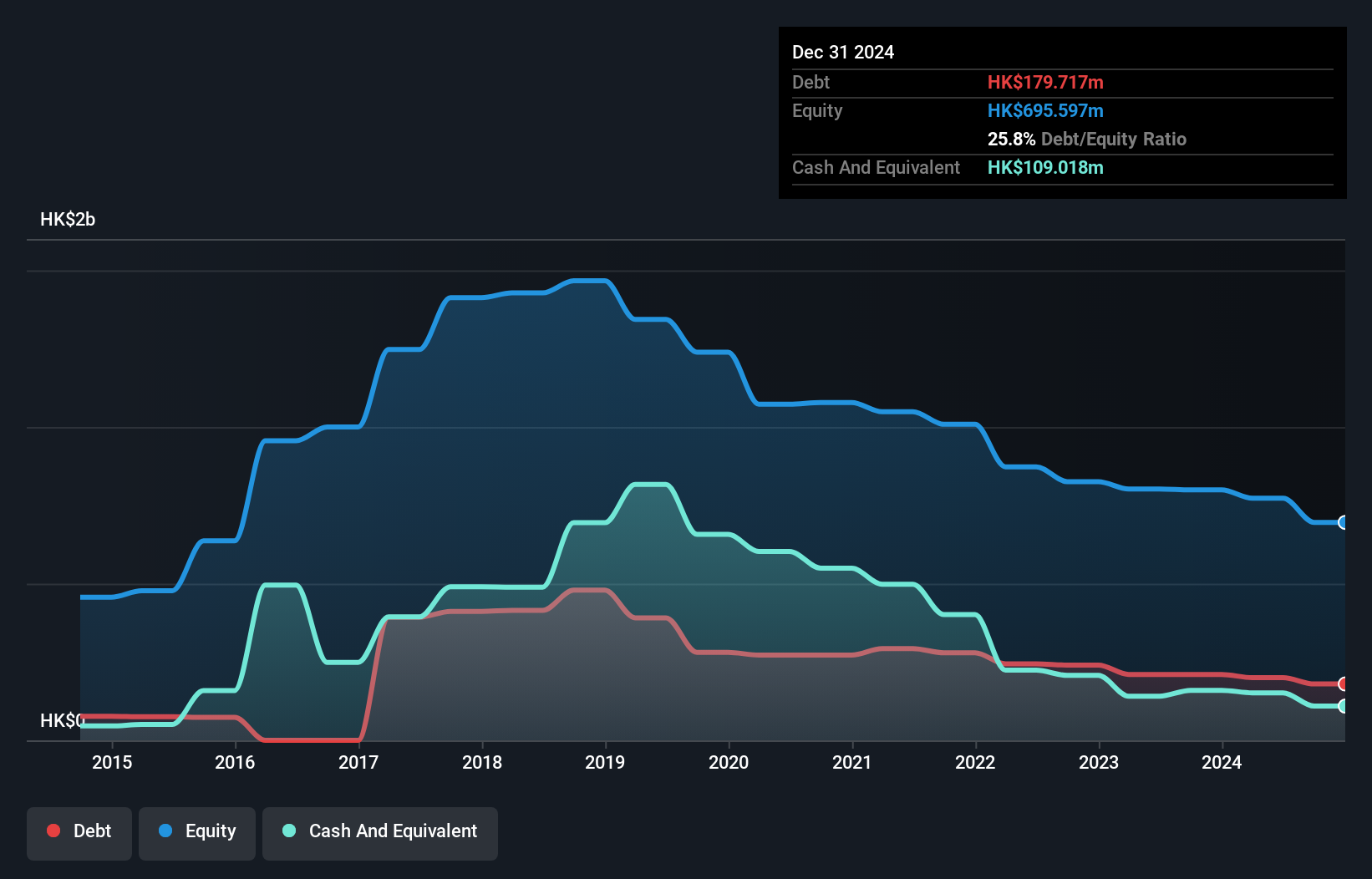

Novautek Technologies Group Limited, with a market cap of HK$614.08 million, remains unprofitable but has reduced its losses over the past five years. The company maintains a strong cash position with sufficient runway for more than three years and has short-term assets exceeding both short and long-term liabilities. Recent strategic collaboration in AI robotics with Malaysia's Mach 1 AI Robotics & Automation SDN BHD aims to expand Novautek's footprint in Southeast Asia, potentially enhancing competitiveness. Despite high share price volatility and an inexperienced board, its management team is seasoned, providing stable leadership amidst ongoing challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Novautek Technologies Group.

- Review our historical performance report to gain insights into Novautek Technologies Group's track record.

Valuetronics Holdings (SGX:BN2)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Valuetronics Holdings Limited is an investment holding company that offers integrated electronics manufacturing services across various countries including the United States, China, and several European nations, with a market cap of SGD361.64 million.

Operations: The company generates revenue from two main segments: Consumer Electronics, contributing HK$367.01 million, and Industrial and Commercial Electronics, accounting for HK$1.36 billion.

Market Cap: SGD361.64M

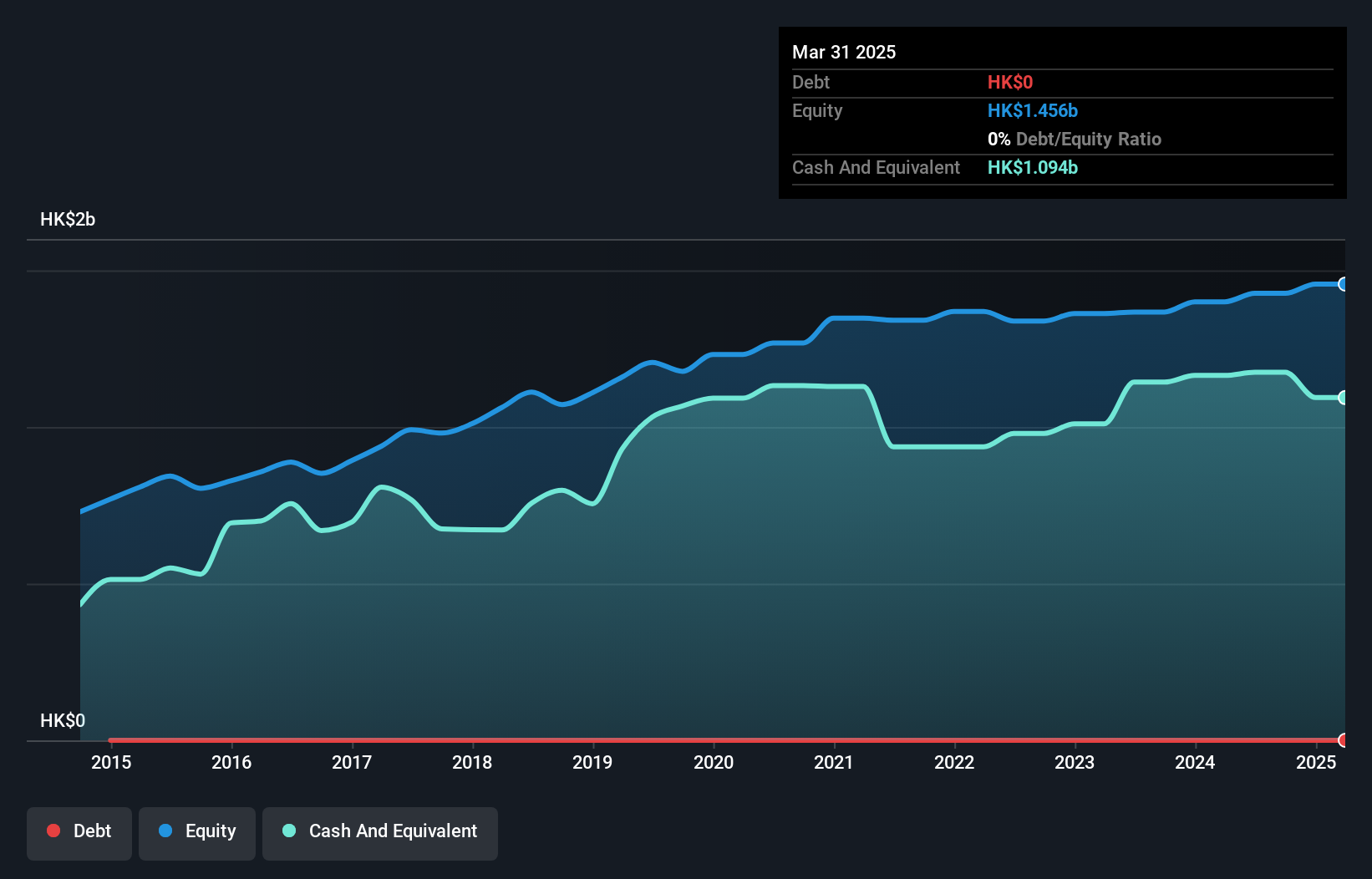

Valuetronics Holdings Limited, with a market cap of SGD361.64 million, demonstrates financial stability as its short-term assets of HK$1.7 billion comfortably cover both short and long-term liabilities. Despite a low return on equity at 11.4%, the company benefits from being debt-free and has not experienced shareholder dilution recently. Earnings growth of 6.8% over the past year surpasses industry averages, although historical profit growth has been negative over five years. Recent dividend increases and special dividends highlight its commitment to returning value to shareholders, yet concerns remain about sustainability given dividends are not well covered by free cash flows.

- Unlock comprehensive insights into our analysis of Valuetronics Holdings stock in this financial health report.

- Assess Valuetronics Holdings' future earnings estimates with our detailed growth reports.

ValueMax Group (SGX:T6I)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ValueMax Group Limited is an investment holding company involved in pawnbroking, moneylending, jewelry and watches retailing, and gold trading primarily in Singapore, with a market cap of SGD964.74 million.

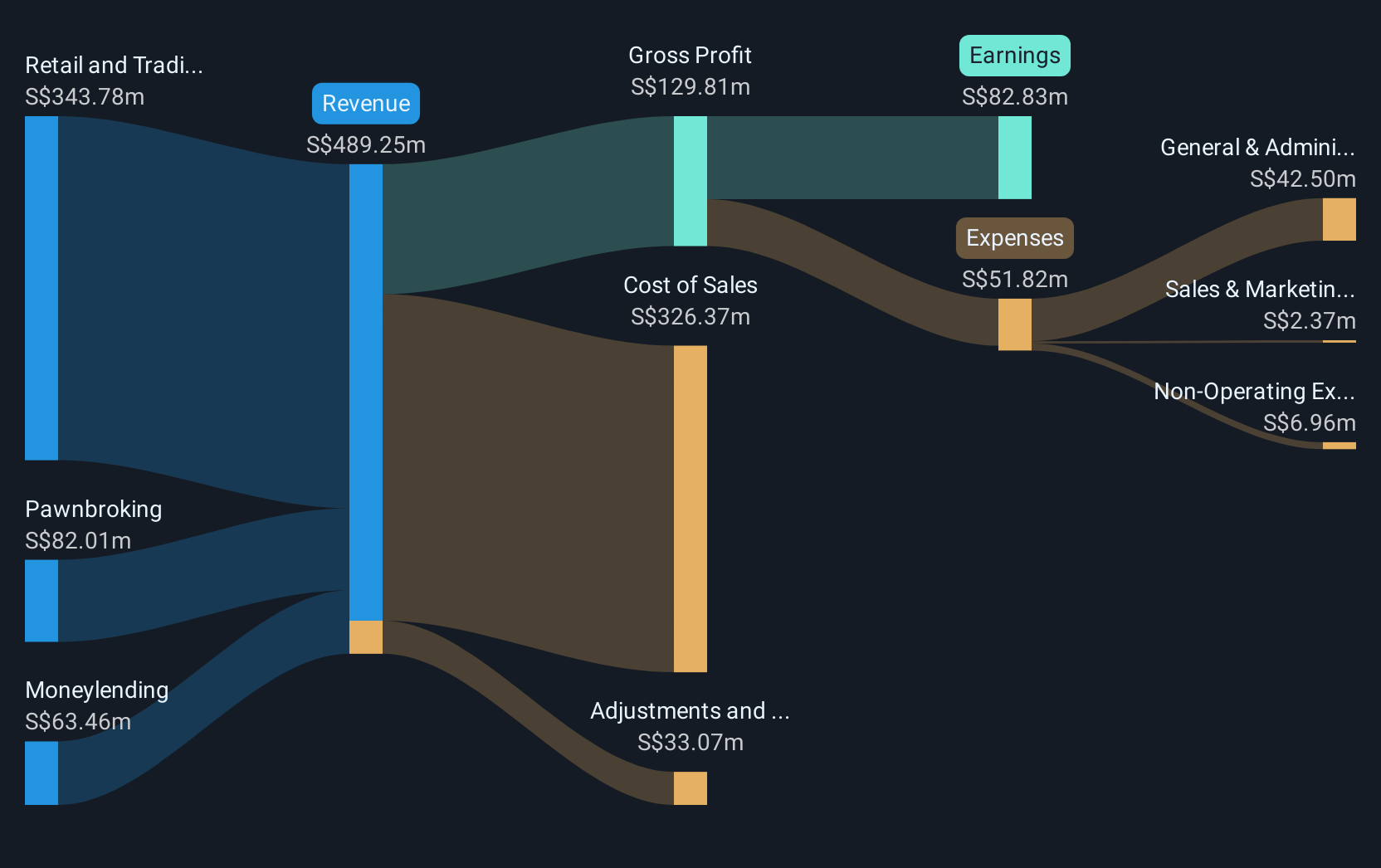

Operations: The company's revenue is primarily derived from its retail and trading of jewellery and gold segment at SGD374.23 million, followed by pawnbroking at SGD85.76 million, and moneylending at SGD66.87 million.

Market Cap: SGD964.74M

ValueMax Group Limited, with a market cap of SGD964.74 million, shows financial resilience as its short-term assets of SGD993.4 million exceed both short and long-term liabilities. The company has achieved significant earnings growth of 51% over the past year, surpassing industry averages and improving net profit margins from 15.5% to 19.3%. However, concerns arise due to negative operating cash flow and a high net debt to equity ratio of 126.2%, indicating potential challenges in covering debt obligations despite well-covered interest payments by EBIT (13.7x). Recent earnings reports also highlight increased sales and net income compared to last year.

- Navigate through the intricacies of ValueMax Group with our comprehensive balance sheet health report here.

- Examine ValueMax Group's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Get an in-depth perspective on all 983 Asian Penny Stocks by using our screener here.

- Curious About Other Options? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:T6I

ValueMax Group

An investment holding company, engages in the pawnbroking, moneylending, jewelry and watches retailing, and gold trading businesses primarily in Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives