- Hong Kong

- /

- Capital Markets

- /

- SEHK:806

Asian Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by economic shifts and policy changes, investors are increasingly looking toward Asia for opportunities. Penny stocks, though often seen as relics of past market eras, continue to capture attention due to their potential for significant returns at a lower entry cost. By focusing on companies with robust financials and clear growth trajectories, investors can uncover promising opportunities within this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.92 | THB3.87B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.00 | HK$2.44B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.65 | HK$1.02B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.08B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.92 | SGD372.87M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.90 | THB2.94B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.19 | SGD12.55B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.97 | THB1.43B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.96 | THB10.02B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 981 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

YH Entertainment Group (SEHK:2306)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YH Entertainment Group, with a market cap of HK$2.08 billion, operates as an artist management company in Mainland China and Korea.

Operations: The company's revenue is primarily derived from Artist Management at CN¥748.30 million, supplemented by Pan-Entertainment Business and Music IP Production and Operation contributing CN¥39.32 million and CN¥43.87 million respectively.

Market Cap: HK$2.08B

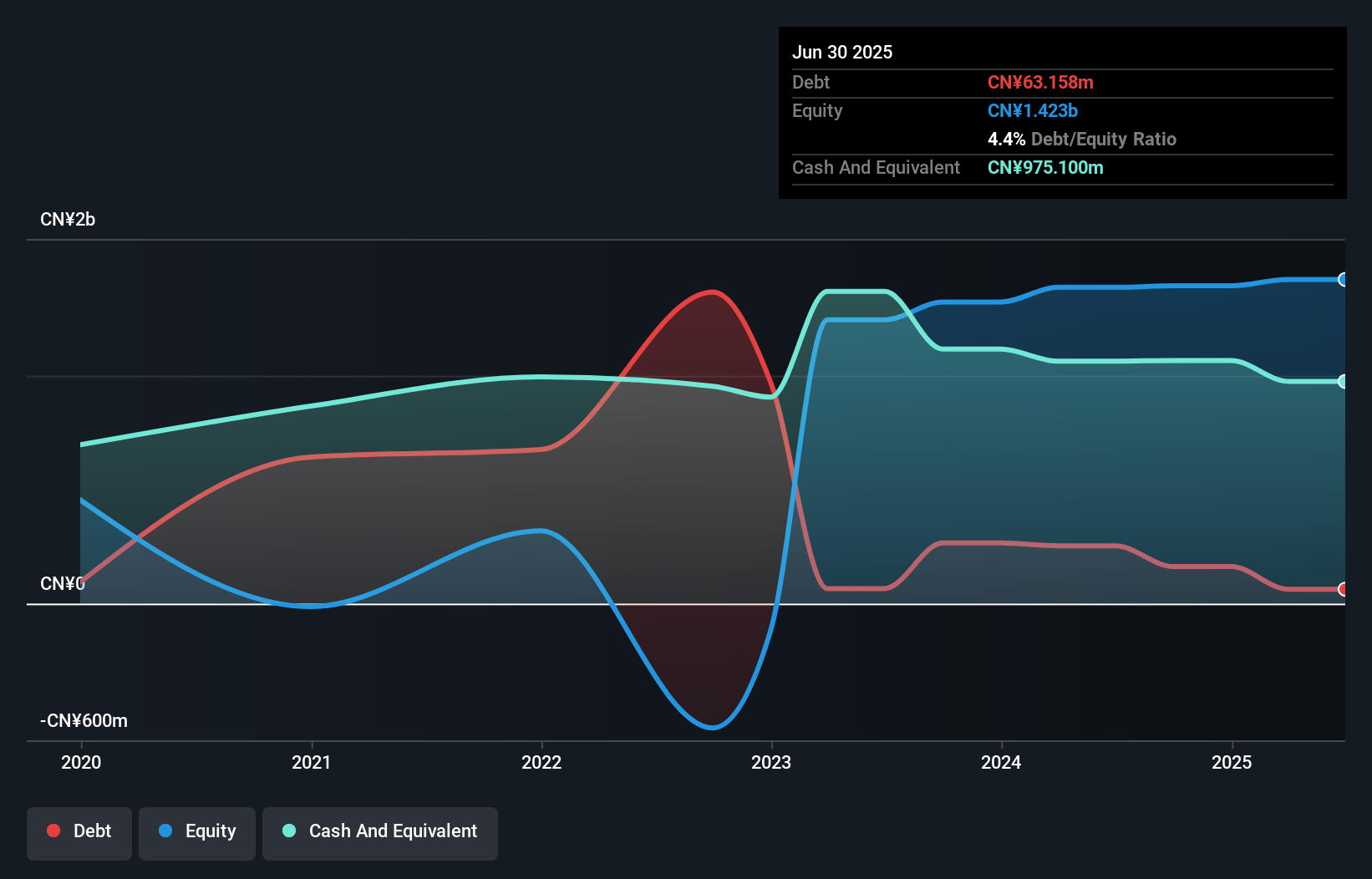

YH Entertainment Group has shown a positive trajectory with recent earnings growth, reporting CN¥414.22 million in sales for the first half of 2025, up from CN¥347.27 million the previous year, and net income rising to CN¥58.1 million. Despite its high share price volatility and low return on equity at 5.3%, the company maintains strong financial health with more cash than debt and well-covered interest payments. The strategic share buyback program, which repurchased 6,873,000 shares for HKD 21.78 million by August 2025, aims to enhance shareholder value through improved earnings per share and net asset value per share metrics.

- Get an in-depth perspective on YH Entertainment Group's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into YH Entertainment Group's track record.

Value Partners Group (SEHK:806)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Value Partners Group Limited is a publicly owned investment manager with a market cap of approximately HK$5.11 billion.

Operations: The company generates revenue of HK$528.88 million from its asset management business.

Market Cap: HK$5.11B

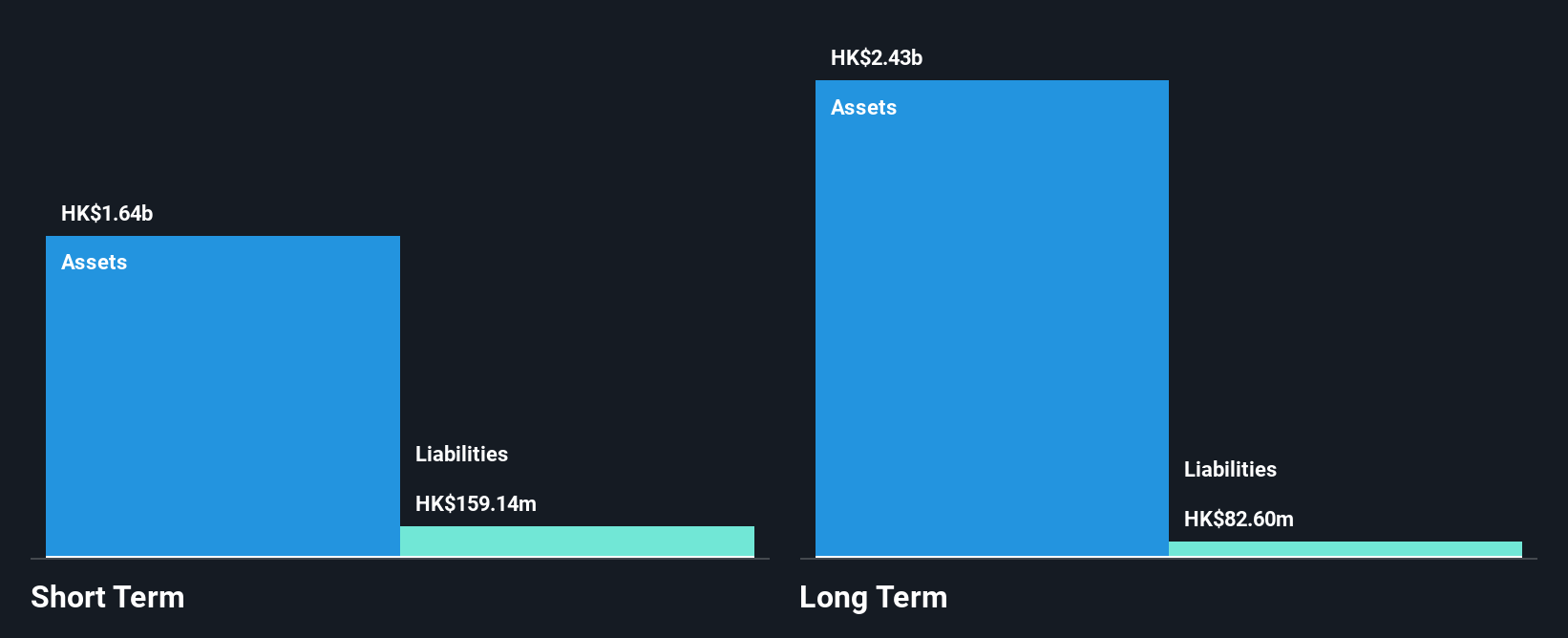

Value Partners Group's recent financial performance highlights significant earnings growth, with net income for the first half of 2025 reaching HK$251.57 million, up from HK$37.37 million a year earlier. This increase is largely due to substantial net fair value gains from investments, totaling approximately HK$240 million. The company maintains strong financial health with short-term assets of HK$1.6 billion covering both short and long-term liabilities comfortably and more cash than debt on hand. However, its management team and board are relatively inexperienced, which could pose challenges in strategic decision-making moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Value Partners Group.

- Examine Value Partners Group's earnings growth report to understand how analysts expect it to perform.

Sheng Siong Group (SGX:OV8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD3.11 billion.

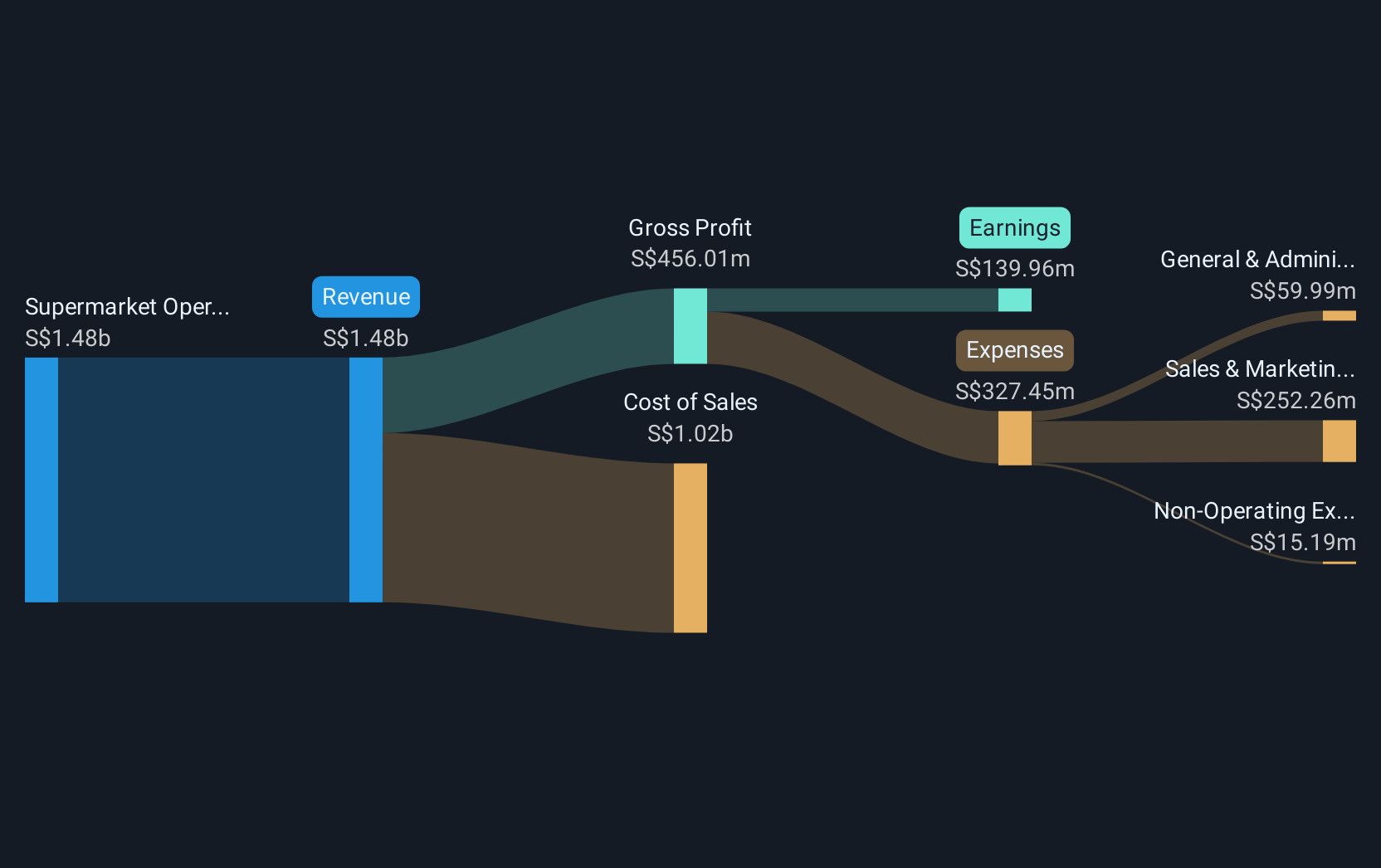

Operations: The company's revenue is primarily generated from its supermarket operations, selling consumer goods, with a total of SGD1.48 billion.

Market Cap: SGD3.11B

Sheng Siong Group exhibits strong financial health, with short-term assets of SGD475.5 million surpassing both its long and short-term liabilities. The company is debt-free, enhancing its financial stability, and has a seasoned management team with an average tenure of 8.3 years. Despite a slight decline in net profit margins from 9.9% to 9.5%, earnings have grown modestly by 1.8% annually over the past five years, though recent growth lags behind industry averages. Recent earnings for the first half of 2025 show increased sales at SGD764.68 million and net income rising to SGD72.35 million compared to last year’s figures.

- Click to explore a detailed breakdown of our findings in Sheng Siong Group's financial health report.

- Explore Sheng Siong Group's analyst forecasts in our growth report.

Seize The Opportunity

- Gain an insight into the universe of 981 Asian Penny Stocks by clicking here.

- Interested In Other Possibilities? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:806

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives