As global markets navigate the complexities of trade policies and economic shifts, investor sentiment remains closely tied to developments in major economies like the U.S. and China. In this context, penny stocks—often smaller or newer companies—continue to attract attention for their potential to offer both affordability and growth opportunities. Despite being an older term, these stocks can still represent significant value when backed by strong financials, making them intriguing prospects for those seeking under-the-radar investments with long-term promise.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.096 | SGD40.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.18 | SGD35.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.40 | HK$50.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.91 | HK$1.59B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,163 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jinhai Medical Technology (SEHK:2225)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jinhai Medical Technology Limited is an investment holding company that primarily provides manpower outsourcing and ancillary services to building and construction contractors in Singapore, with a market cap of HK$6.93 billion.

Operations: The company's revenue is derived from two segments: Products, contributing SGD 25.93 million, and Services, contributing SGD 24.31 million.

Market Cap: HK$6.93B

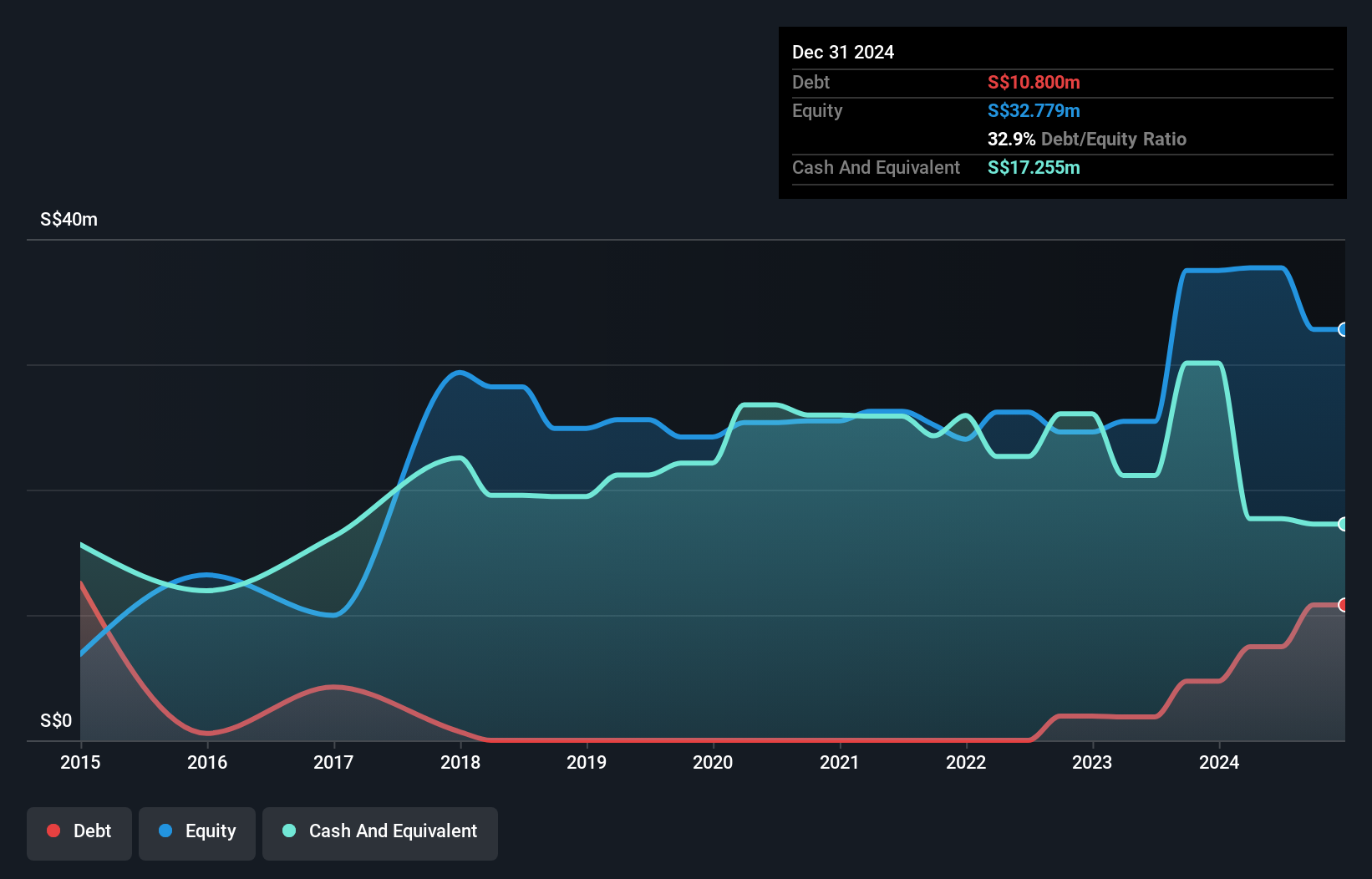

Jinhai Medical Technology Limited, with a market cap of HK$6.93 billion, reported revenue of SGD 50.24 million for 2024, up from SGD 45.64 million the previous year. Despite this growth, the company remains unprofitable with a net loss of SGD 17.97 million due to increased administrative expenses and share-based payments costs. The company's short-term assets exceed its liabilities, providing some financial stability alongside sufficient cash runway for over three years if current cash flow trends persist. However, challenges remain with an inexperienced management team and a rising debt-to-equity ratio now at 32.9%.

- Dive into the specifics of Jinhai Medical Technology here with our thorough balance sheet health report.

- Understand Jinhai Medical Technology's track record by examining our performance history report.

United Energy Group (SEHK:467)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United Energy Group Limited is an investment holding company involved in upstream oil, natural gas, clean energy, and energy trading operations across Pakistan, South Asia, the Middle East, and North Africa with a market cap of HK$12.15 billion.

Operations: The company's revenue is primarily derived from its Exploration and Production segment, generating HK$9.86 billion, followed by the Trading segment with HK$7.66 billion.

Market Cap: HK$12.15B

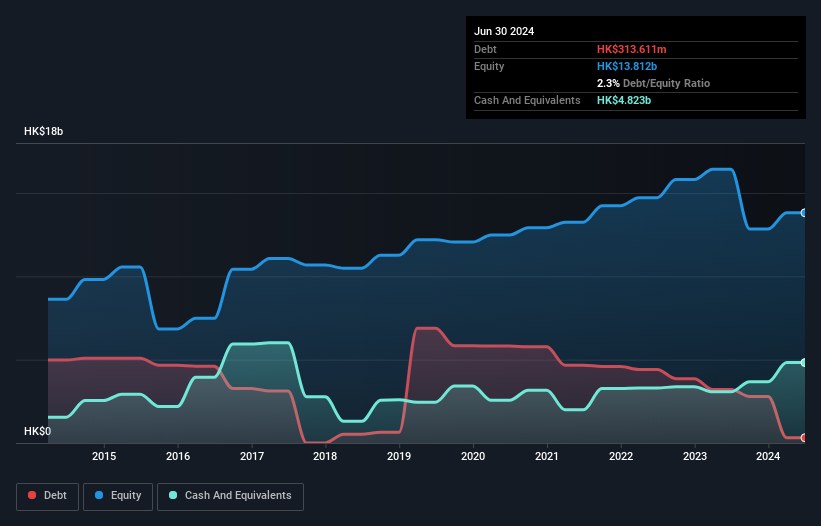

United Energy Group has transitioned from a net loss to a net income of HK$1.56 billion for 2024, driven by reduced one-off impairments and stable operations. The company trades at an attractive valuation, significantly below its estimated fair value, and maintains strong financial health with short-term assets covering liabilities and cash exceeding total debt. Despite insider selling in the last quarter, the seasoned management team provides stability. However, earnings quality is impacted by a large non-recurring loss of HK$442.4 million in 2024. A proposed dividend of HKD 0.05 per share reflects ongoing shareholder returns amidst these dynamics.

- Click here and access our complete financial health analysis report to understand the dynamics of United Energy Group.

- Review our growth performance report to gain insights into United Energy Group's future.

Aurora OptoelectronicsLtd (SHSE:600666)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aurora Optoelectronics Co., Ltd. focuses on the R&D, production, and sale of sapphire crystal materials in China, with a market cap of CN¥7.27 billion.

Operations: Aurora Optoelectronics Co., Ltd. has not reported distinct revenue segments.

Market Cap: CN¥7.27B

Aurora Optoelectronics Ltd. has shown improvement in its financial performance, with a reduction in net loss from CN¥675.28 million to CN¥171.42 million for 2024 and an increase in revenue to CN¥365.97 million from the previous year. The company's short-term assets exceed both its short-term and long-term liabilities, indicating a stable financial position despite being unprofitable with a negative return on equity of -20.51%. While debt levels have decreased significantly over five years, the cash runway remains limited to less than one year, posing challenges for sustained operations without additional financing or revenue growth.

- Get an in-depth perspective on Aurora OptoelectronicsLtd's performance by reading our balance sheet health report here.

- Examine Aurora OptoelectronicsLtd's past performance report to understand how it has performed in prior years.

Summing It All Up

- Gain an insight into the universe of 1,163 Asian Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600666

Aurora OptoelectronicsLtd

Engages in the research and development, production, and sale of sapphire crystal materials in China.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives