- Thailand

- /

- Specialty Stores

- /

- SET:GLOBAL

Asian Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As global markets experience a wave of optimism, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, attention is turning towards emerging opportunities in Asian markets. Penny stocks, often associated with smaller or newer companies, continue to intrigue investors seeking potential value beyond the established giants. Despite their vintage connotation, these stocks can offer surprising stability and growth potential when backed by solid financials and clear business strategies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.101 | SGD42.92M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.26 | HK$795M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect Medical Health Management (SEHK:1830) | HK$1.76 | HK$2.21B | ✅ 2 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.10 | HK$1.84B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.175 | SGD34.86M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.08 | SGD845M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.46 | HK$51.09B | ✅ 4 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.50 | HK$12.92B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,025 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

SenseTime Group (SEHK:20)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SenseTime Group Inc. is an investment holding company that researches, develops, and sells artificial intelligence software platforms across Mainland China, Northeast Asia, Southeast Asia, and internationally with a market cap of approximately HK$54.03 billion.

Operations: The company generates revenue from its Software & Programming segment, amounting to CN¥3.77 billion.

Market Cap: HK$54.03B

SenseTime Group Inc. is navigating the penny stock landscape with a market cap of approximately HK$54.03 billion and revenue from its Software & Programming segment totaling CN¥3.77 billion. Despite being unprofitable, the company has reduced losses by 17.8% per year over the past five years and maintains a strong cash position, with short-term assets significantly exceeding liabilities. Recent board appointments, including Mr. Chiu Duncan as an independent non-executive director, suggest strategic shifts aimed at bolstering governance and innovation efforts in AI development across Asia and internationally, potentially supporting future growth ambitions despite current profitability challenges.

- Get an in-depth perspective on SenseTime Group's performance by reading our balance sheet health report here.

- Understand SenseTime Group's earnings outlook by examining our growth report.

NagaCorp (SEHK:3918)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NagaCorp Ltd. is an investment holding company that manages and operates a hotel and casino complex in the Kingdom of Cambodia, with a market cap of HK$15.97 billion.

Operations: The company's revenue is primarily generated from casino operations, which account for $542.56 million, supplemented by hotel and entertainment operations contributing $24.51 million.

Market Cap: HK$15.97B

NagaCorp Ltd., with a market cap of HK$15.97 billion, primarily generates revenue from its casino operations, reporting US$171.16 million in gross gaming revenue for Q1 2025, up from US$145.41 million the prior year. Despite a decline in net profit margins and earnings over the past five years, the company has managed to reduce its debt-to-equity ratio significantly and maintains more cash than total debt. Recent board changes include Mr. Philip Lee Wai Tuck assuming leadership roles following Mr. Timothy Patrick McNally's retirement, indicating a potential strategic shift as NagaCorp navigates operational challenges within the penny stock segment in Asia.

- Unlock comprehensive insights into our analysis of NagaCorp stock in this financial health report.

- Gain insights into NagaCorp's future direction by reviewing our growth report.

Siam Global House (SET:GLOBAL)

Simply Wall St Financial Health Rating: ★★★★★★

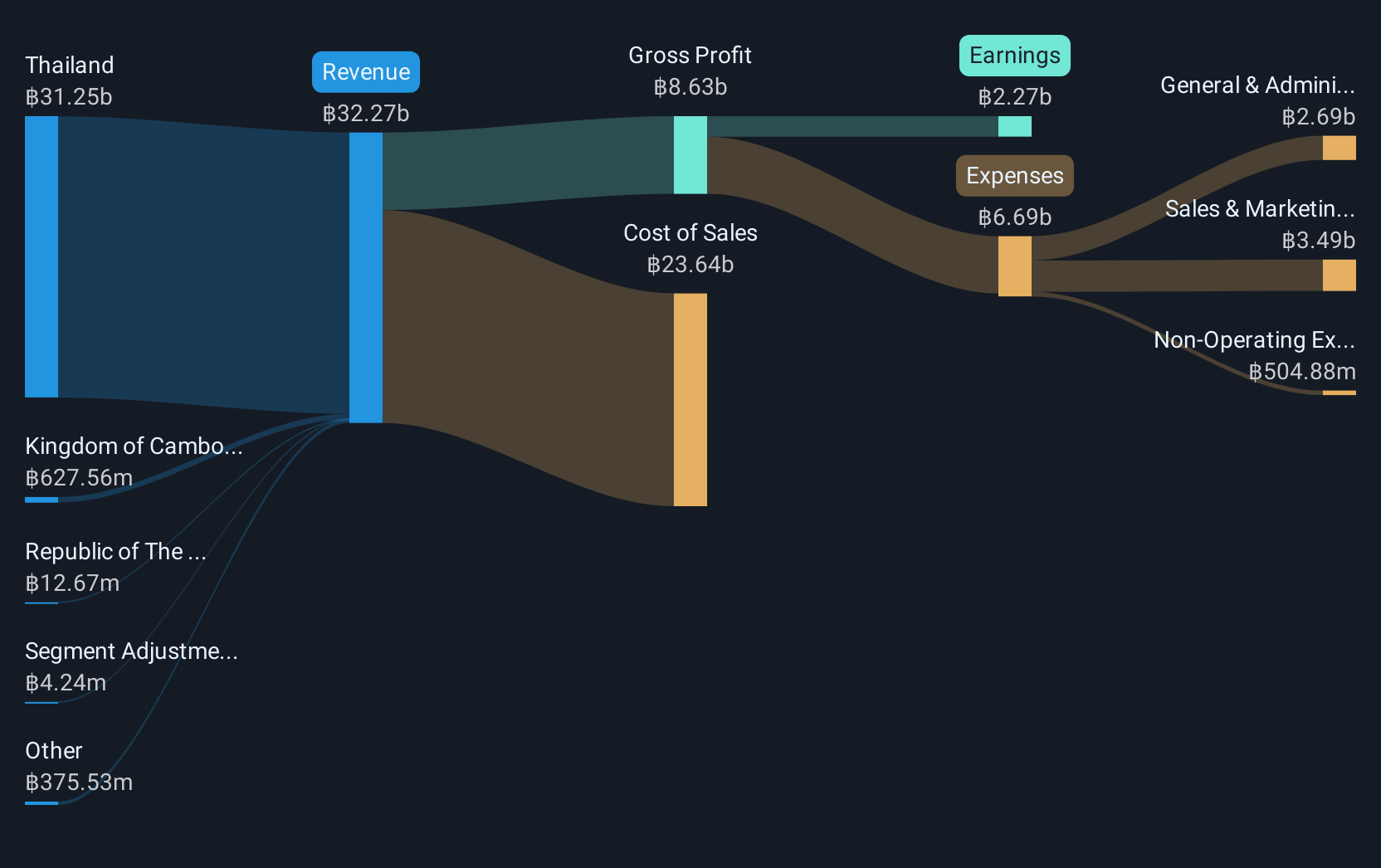

Overview: Siam Global House Public Company Limited operates in the merchandising of construction materials, home decorative products, and tools and equipment across Thailand, Cambodia, Myanmar, and Indonesia with a market cap of THB26.90 billion.

Operations: The company's revenue primarily comes from the merchandising of construction and decoration materials and equipment, totaling THB32.27 billion.

Market Cap: THB26.9B

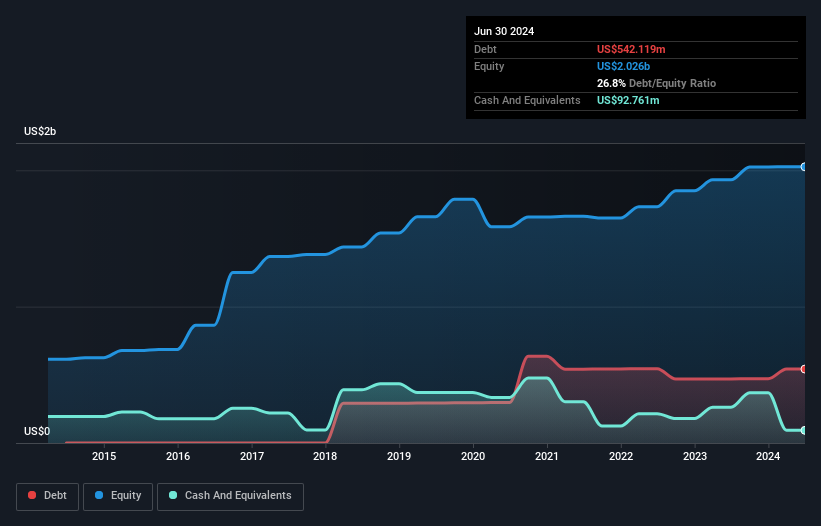

Siam Global House Public Company Limited, with a market cap of THB26.90 billion, has shown resilience despite recent challenges. The company reported a decline in revenue and net income for Q1 2025 compared to the previous year, yet it maintains strong financial health with short-term assets exceeding liabilities and a satisfactory net debt-to-equity ratio of 27.1%. Recent strategic moves include establishing two subsidiaries aimed at expanding business channels and increasing income sources. Although earnings growth has been negative recently, the company is trading at good value relative to peers in the specialty retail industry.

- Dive into the specifics of Siam Global House here with our thorough balance sheet health report.

- Examine Siam Global House's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Click this link to deep-dive into the 1,025 companies within our Asian Penny Stocks screener.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:GLOBAL

Siam Global House

Engages in the merchandising of construction materials, home decorative products, and tools and equipment in Thailand, Kingdom of Cambodia, Republic of the Union of Myanmar, and Republic of Indonesia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives