- Singapore

- /

- Capital Markets

- /

- SGX:U10

Asian Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, with notable developments such as the U.S. and China finalizing a trade deal, Asian markets have shown resilience and potential for growth. Penny stocks, though often seen as a niche investment category, remain relevant by offering opportunities in smaller or newer companies that may be overlooked by mainstream investors. By focusing on those with strong financial foundations and clear growth potential, investors can uncover promising prospects among these lesser-known equities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.101 | SGD42.92M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.04 | HK$3.53B | ✅ 5 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.05 | HK$1.75B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.184 | SGD36.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.10 | SGD850.49M | ✅ 4 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,005 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Be Friends Holding (SEHK:1450)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Be Friends Holding Limited is an investment holding company that offers all-media services in the People's Republic of China, with a market capitalization of HK$1.59 billion.

Operations: The company's revenue is derived from New Media Services, generating CN¥1.14 billion, and the Television Broadcasting Business, contributing CN¥113.14 million.

Market Cap: HK$1.59B

Be Friends Holding Limited, with a market capitalization of HK$1.59 billion, derives significant revenue from its New Media Services and Television Broadcasting Business in China. Despite experiencing negative earnings growth recently, the company has maintained profitability over five years and reduced its debt-to-equity ratio significantly. Its short-term assets comfortably cover both short- and long-term liabilities. However, operating cash flow remains negative, indicating potential challenges in covering debt obligations through cash generation. Recent board changes include Mr. Lo Chi Sum's resignation as an executive director while remaining CEO of a subsidiary, highlighting ongoing leadership adjustments within the company’s governance structure.

- Click here to discover the nuances of Be Friends Holding with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Be Friends Holding's track record.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company that offers services such as stockbroking, futures broking, structured lending, investment trading, margin financing, and research services with a market cap of SGD2.04 billion.

Operations: The company generates revenue primarily from its securities and futures broking and related services, amounting to SGD631.69 million.

Market Cap: SGD2.04B

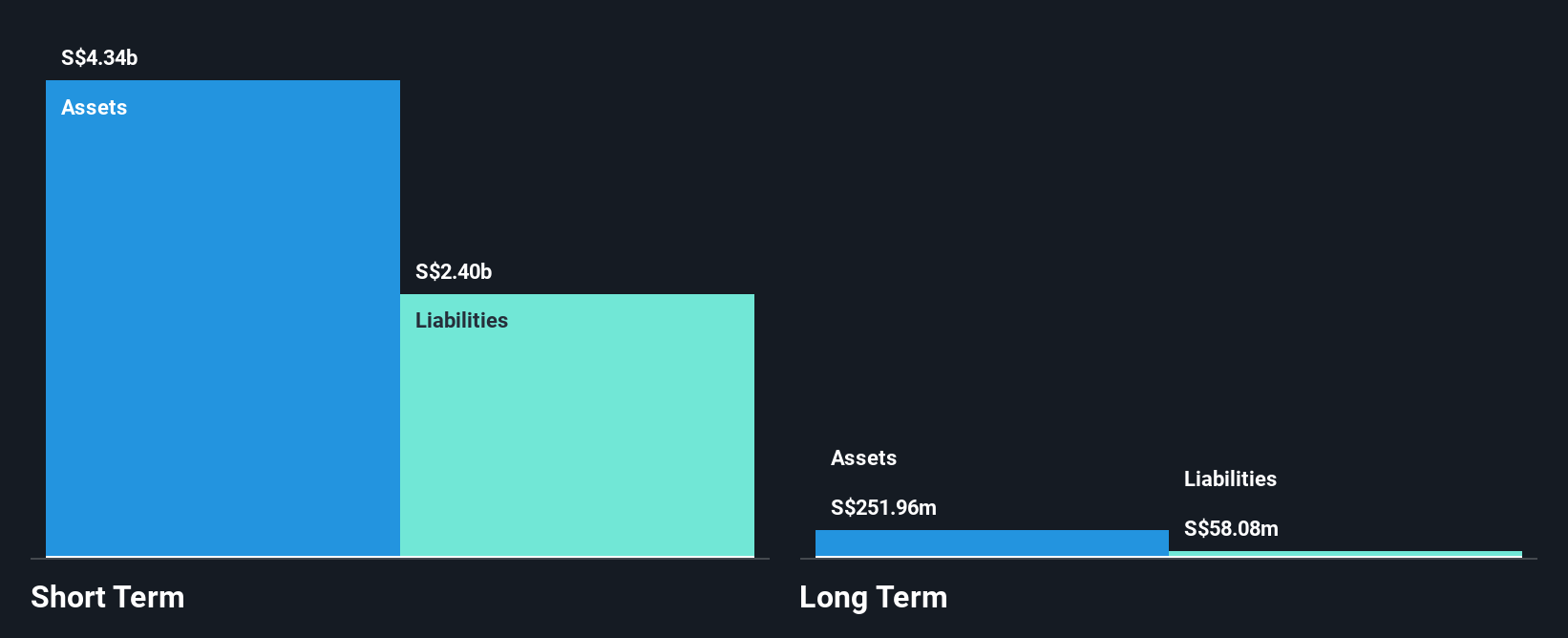

UOB-Kay Hian Holdings, with a market cap of SGD2.04 billion, primarily generates revenue from securities and futures broking services. Its Price-To-Earnings ratio (9.1x) is favorable compared to the Singapore market average (12.9x), indicating potential value for investors. Despite having reduced its debt-to-equity ratio significantly over five years, the company faces challenges with negative operating cash flow impacting its ability to cover debt adequately. Recent board restructuring includes appointing Hui Yat Yan as an Independent Director, reflecting ongoing governance changes aimed at strengthening leadership amidst a relatively inexperienced management team with an average tenure of 1.3 years.

- Click here and access our complete financial health analysis report to understand the dynamics of UOB-Kay Hian Holdings.

- Gain insights into UOB-Kay Hian Holdings' past trends and performance with our report on the company's historical track record.

Yangzijiang Financial Holding (SGX:YF8)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in the People's Republic of China and Singapore, with a market cap of SGD2.58 billion.

Operations: The company generates SGD326.23 million in revenue from its investment business segment.

Market Cap: SGD2.58B

Yangzijiang Financial Holding Ltd., with a market cap of SGD2.58 billion, is exploring a spin-off of its maritime investments to focus on asset management and investment operations in Southeast Asia. The company has shown strong earnings growth over the past year (51%), surpassing industry averages, and maintains robust financial health with more cash than total debt. It offers attractive value with a Price-To-Earnings ratio of 8.5x, below the SG market average. Despite low Return on Equity (7.3%) and an inexperienced board, its interest coverage is substantial at 274.3x EBIT, indicating strong operational efficiency and financial stability.

- Dive into the specifics of Yangzijiang Financial Holding here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Yangzijiang Financial Holding's future.

Key Takeaways

- Click through to start exploring the rest of the 1,002 Asian Penny Stocks now.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U10

UOB-Kay Hian Holdings

An investment holding company, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives