- Hong Kong

- /

- Life Sciences

- /

- SEHK:1873

Asian Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The Asian markets have been navigating a complex landscape, with recent U.S. tariffs on countries like Japan and South Korea adding layers of uncertainty. Despite these challenges, opportunities remain for investors willing to explore less conventional avenues such as penny stocks. Although the term "penny stocks" might seem outdated, these low-priced shares can offer significant growth potential when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.10 | SGD42.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.40 | HK$883.33M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.28 | HK$1.9B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.19 | HK$1.99B | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.61 | SGD581.56M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.05B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.92 | THB1.35B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.23 | SGD46.51M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.33 | SGD913.59M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 983 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Viva Biotech Holdings (SEHK:1873)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viva Biotech Holdings is an investment holding company that provides structure-based drug discovery services to biotechnology and pharmaceutical clients globally, with a market cap of HK$3.12 billion.

Operations: The company's revenue is primarily generated from its Drug Discovery Services segment, which contributed CN¥821.31 million, and its Contract Development Manufacture Organisation (CDMO) and Commercialisation Services segment, with revenues of CN¥1.18 billion, complemented by the Viva Bioinnovator segment at CN¥18.09 million.

Market Cap: HK$3.12B

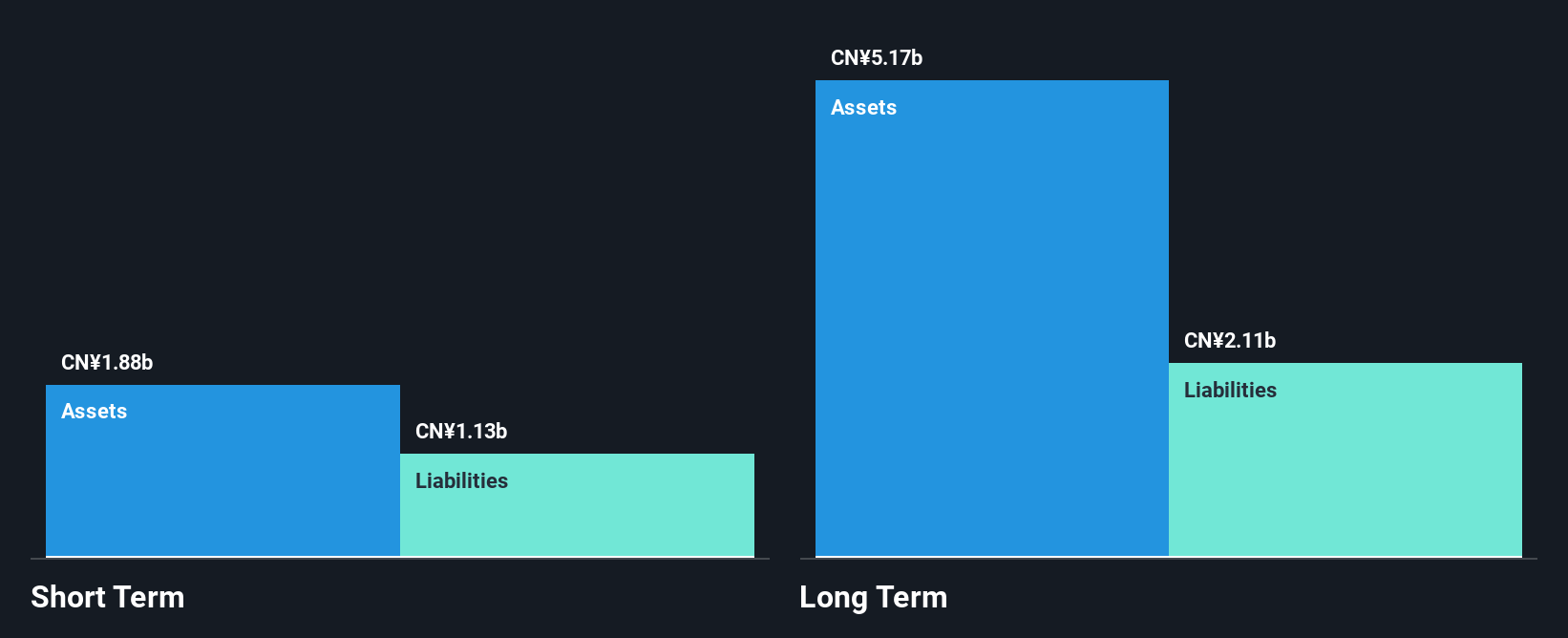

Viva Biotech Holdings has transitioned to profitability, with its revenue primarily driven by the Drug Discovery Services and CDMO segments. The company's debt is well-covered by operating cash flow, and it maintains a satisfactory net debt to equity ratio of 8.2%. Its short-term assets exceed short-term liabilities, though they fall short of covering long-term obligations. Despite a low return on equity at 5.8%, earnings are forecasted to grow significantly at 26.14% annually. While trading below estimated fair value, recent financials were impacted by a large one-off gain of CN¥50.6 million in the last year’s results.

- Jump into the full analysis health report here for a deeper understanding of Viva Biotech Holdings.

- Review our growth performance report to gain insights into Viva Biotech Holdings' future.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ever Sunshine Services Group Limited is an investment holding company that offers property management services in the People's Republic of China, with a market cap of HK$3.84 billion.

Operations: The company generates revenue primarily through its property management services, amounting to CN¥6.84 billion.

Market Cap: HK$3.84B

Ever Sunshine Services Group, with a market cap of HK$3.84 billion, is trading at 40.3% below its estimated fair value, suggesting potential undervaluation in the penny stock segment. The company boasts seasoned management and board teams with average tenures exceeding industry norms, contributing to its stable operations. Short-term assets of CN¥6 billion comfortably cover both short and long-term liabilities, while earnings have grown by 10% over the past year—outpacing industry averages despite a low return on equity of 11%. Recent executive changes may influence future strategic direction, but dividend sustainability remains uncertain amidst insider selling activities.

- Click here and access our complete financial health analysis report to understand the dynamics of Ever Sunshine Services Group.

- Assess Ever Sunshine Services Group's future earnings estimates with our detailed growth reports.

Oiltek International (SGX:HQU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oiltek International Limited is an investment holding company involved in the engineering design and commissioning of oil extraction equipment and plants across Asia, the United States, and Africa, with a market cap of SGD287.43 million.

Operations: The company's revenue is primarily generated from its Edible & Non-Edible Oil Refinery segment, which accounts for MYR193.87 million, followed by Product Sales and Trading at MYR18.78 million, and Renewable Energy at MYR17.65 million.

Market Cap: SGD287.43M

Oiltek International, with a market cap of SGD287.43 million, demonstrates strong financial health in the penny stock realm through significant revenue from its Edible & Non-Edible Oil Refinery segment (MYR193.87 million). The company is debt-free and boasts high-quality earnings with a robust return on equity of 35.2%. Recent executive changes saw Mr. Goh Chee Yong promoted to CFO, potentially strengthening financial strategy execution. Furthermore, new contracts worth MYR61.9 million across global markets boost the order book to MYR402.4 million, likely enhancing financial performance for FY2025 despite recent share price volatility and higher weekly volatility than most SG stocks.

- Navigate through the intricacies of Oiltek International with our comprehensive balance sheet health report here.

- Learn about Oiltek International's future growth trajectory here.

Taking Advantage

- Access the full spectrum of 983 Asian Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1873

Viva Biotech Holdings

An investment holding company, engages in the provision of structure-based drug discovery services to biotechnology and pharmaceutical customers worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives