- Singapore

- /

- Construction

- /

- SGX:F9D

Asian Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As global markets show mixed performances, with the U.S. indices reaching record highs and Japan facing trade negotiation challenges, Asia's financial landscape remains a focal point for investors. In this context, penny stocks—often representing smaller or newer companies—continue to capture attention due to their potential for growth at accessible price points. Despite being an older term, these stocks can offer significant opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.37 | HK$864.4M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.22 | HK$1.85B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.13 | HK$1.89B | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.21 | SGD8.7B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.92 | THB1.35B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.225 | SGD45.5M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.25 | SGD891.64M | ✅ 3 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 987 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

China Shengmu Organic Milk (SEHK:1432)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Shengmu Organic Milk Limited is an investment holding company involved in the production and distribution of raw milk and dairy products in the People’s Republic of China, with a market cap of HK$2.35 billion.

Operations: The company generates revenue from its Dairy Farming Business, which amounted to CN¥3.13 billion.

Market Cap: HK$2.35B

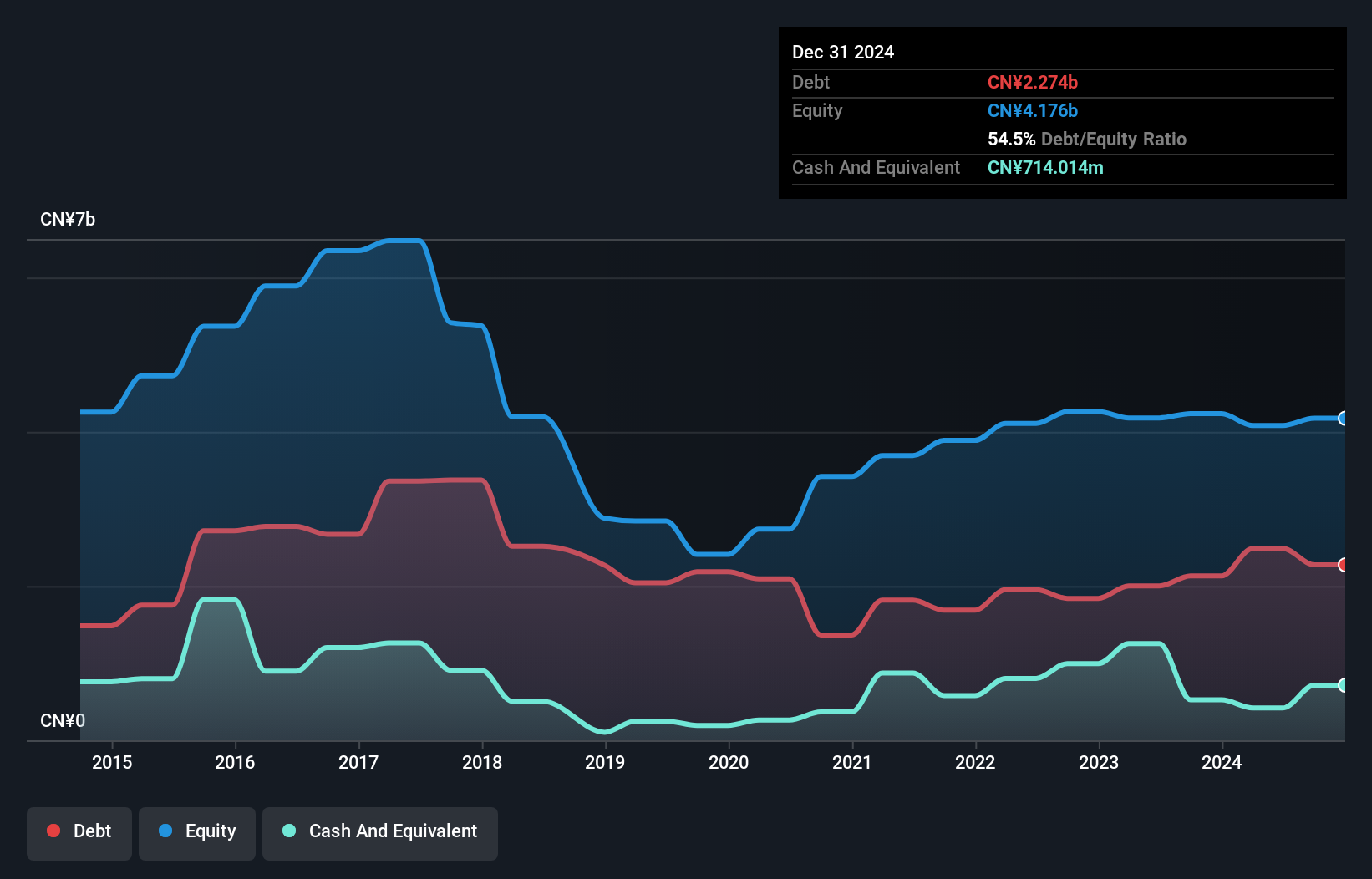

China Shengmu Organic Milk's financial health presents a mixed picture for investors considering penny stocks. While the company has a satisfactory net debt to equity ratio of 37.4% and its interest payments are well covered by EBIT, it remains unprofitable with negative return on equity and declining earnings over the past five years. Short-term liabilities exceed assets, though long-term liabilities are covered. The management team is experienced, which may provide stability amid financial challenges. Recent events include an annual general meeting scheduled for June 2025 to discuss audited financials and director re-elections, reflecting ongoing corporate governance activities.

- Click here and access our complete financial health analysis report to understand the dynamics of China Shengmu Organic Milk.

- Assess China Shengmu Organic Milk's previous results with our detailed historical performance reports.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Travel International Investment Hong Kong Limited offers travel and tourism services with a market cap of HK$9.19 billion.

Operations: The company generates revenue from several segments, including Tourist Attraction and Related Operations (HK$2.35 billion), Passenger Transportation Operations (HK$1.09 billion), Hotel Operations (HK$820.65 million), and Travel Document and Related Operations (HK$344.02 million).

Market Cap: HK$9.19B

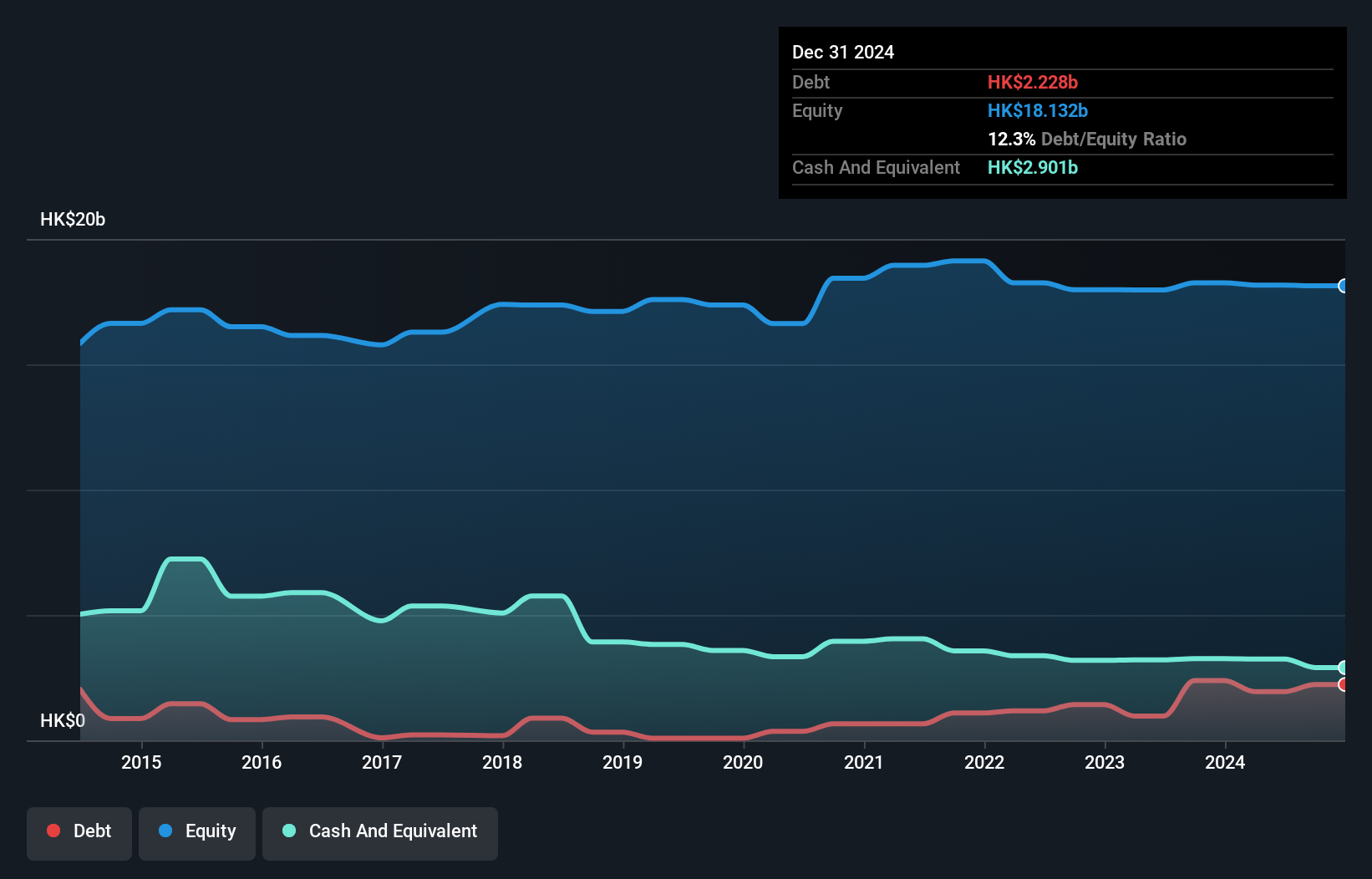

China Travel International Investment Hong Kong Limited offers a complex investment outlook for penny stock investors. The company has experienced management and board teams, with an average tenure of 2.7 and 5.5 years, respectively. Despite having more cash than debt, its net profit margin has decreased from 5.3% to 2.3%, partly due to a large one-off loss of HK$223.5 million in the last year, impacting earnings quality. Short-term assets exceed both short- and long-term liabilities significantly, providing financial stability despite increased share price volatility and negative recent earnings growth of -55.8%.

- Click to explore a detailed breakdown of our findings in China Travel International Investment Hong Kong's financial health report.

- Gain insights into China Travel International Investment Hong Kong's future direction by reviewing our growth report.

Boustead Singapore (SGX:F9D)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various regions including Singapore, Australia, and the United States, with a market capitalization of SGD762.01 million.

Operations: There are no specific revenue segments reported for Boustead Singapore Limited.

Market Cap: SGD762.01M

Boustead Singapore Limited presents a mixed investment case for penny stock investors. The company demonstrates strong financial stability, with short-term assets surpassing both short- and long-term liabilities significantly, and more cash than total debt. Earnings have grown by 48.1% over the past year, supported by a substantial one-off gain of SGD31.1 million, though revenue declined from SGD767.57 million to SGD527.1 million year-on-year. Despite low return on equity at 16.8%, Boustead's debt is well-covered by operating cash flow and it has proposed higher dividends for 2025 compared to the previous year, reflecting confidence in future cash flows despite an unstable dividend track record.

- Get an in-depth perspective on Boustead Singapore's performance by reading our balance sheet health report here.

- Evaluate Boustead Singapore's historical performance by accessing our past performance report.

Seize The Opportunity

- Reveal the 987 hidden gems among our Asian Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boustead Singapore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F9D

Boustead Singapore

An investment holding company, provides energy engineering, real estate, geospatial, and healthcare technology solutions in Singapore, Australia, Malaysia, the United States, Europe, rest of the Asia Pacific, North and South America, the Middle East, and Africa.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives