Asian Penny Stock Opportunities: Guangzhou Automobile Group And 2 More Hidden Gems

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties, the Asian market presents intriguing opportunities for investors seeking growth at lower price points. Penny stocks, often associated with smaller or newer companies, offer a unique chance for substantial returns when backed by strong financials and robust fundamentals. Despite being a somewhat outdated term, these stocks remain relevant as potential hidden gems in the investment landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.10 | SGD42.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.10 | HK$1.75B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 3 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.18 | HK$1.97B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.64 | THB792M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.12 | SGD855.97M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.52 | HK$51.78B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,147 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Guangzhou Automobile Group (SEHK:2238)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guangzhou Automobile Group Co., Ltd. is involved in the research, development, manufacture, and sale of vehicles, motorcycles, and related parts both in Mainland China and internationally, with a market cap of approximately HK$69.37 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for Guangzhou Automobile Group Co., Ltd.

Market Cap: HK$69.37B

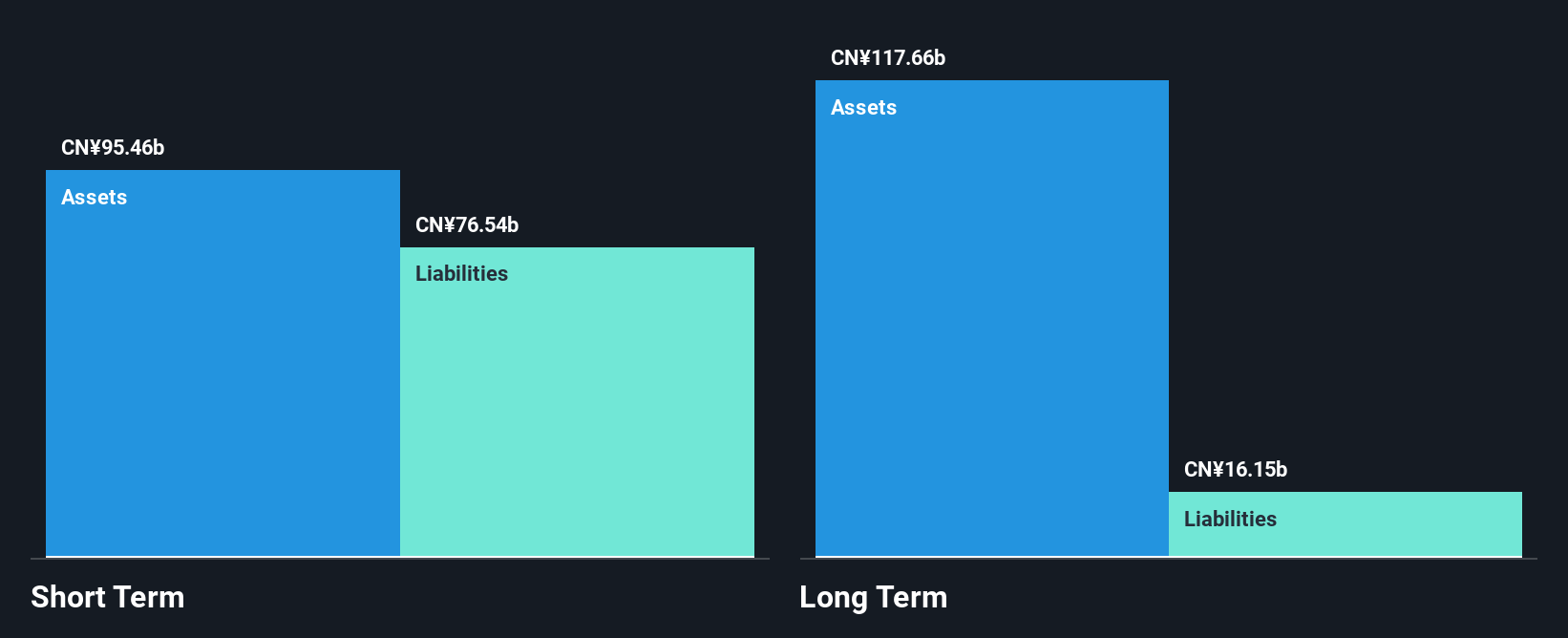

Guangzhou Automobile Group is navigating challenges as a penny stock with its recent strategic initiatives and financial performance. The company has launched a Brazil Action Plan, marking significant expansion efforts in Latin America, which may enhance its global footprint. Despite these strategic moves, the company reported a net loss of CNY 731.61 million for Q1 2025 amid declining sales and production volumes. However, Guangzhou Automobile maintains strong liquidity with short-term assets exceeding both long-term and short-term liabilities. Additionally, its management team is experienced, which could be beneficial in steering through current financial difficulties while focusing on future growth opportunities.

- Unlock comprehensive insights into our analysis of Guangzhou Automobile Group stock in this financial health report.

- Examine Guangzhou Automobile Group's earnings growth report to understand how analysts expect it to perform.

Greentown Service Group (SEHK:2869)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greentown Service Group Co. Ltd. offers residential property management services in China and internationally, with a market cap of HK$13.17 billion.

Operations: The company's revenue is primarily derived from Property Services (CN¥12.40 billion), followed by Community Living Services excluding Technology Services (CN¥2.74 billion), Consulting Services (CN¥2.41 billion), and Technology Services (CN¥341.19 million).

Market Cap: HK$13.17B

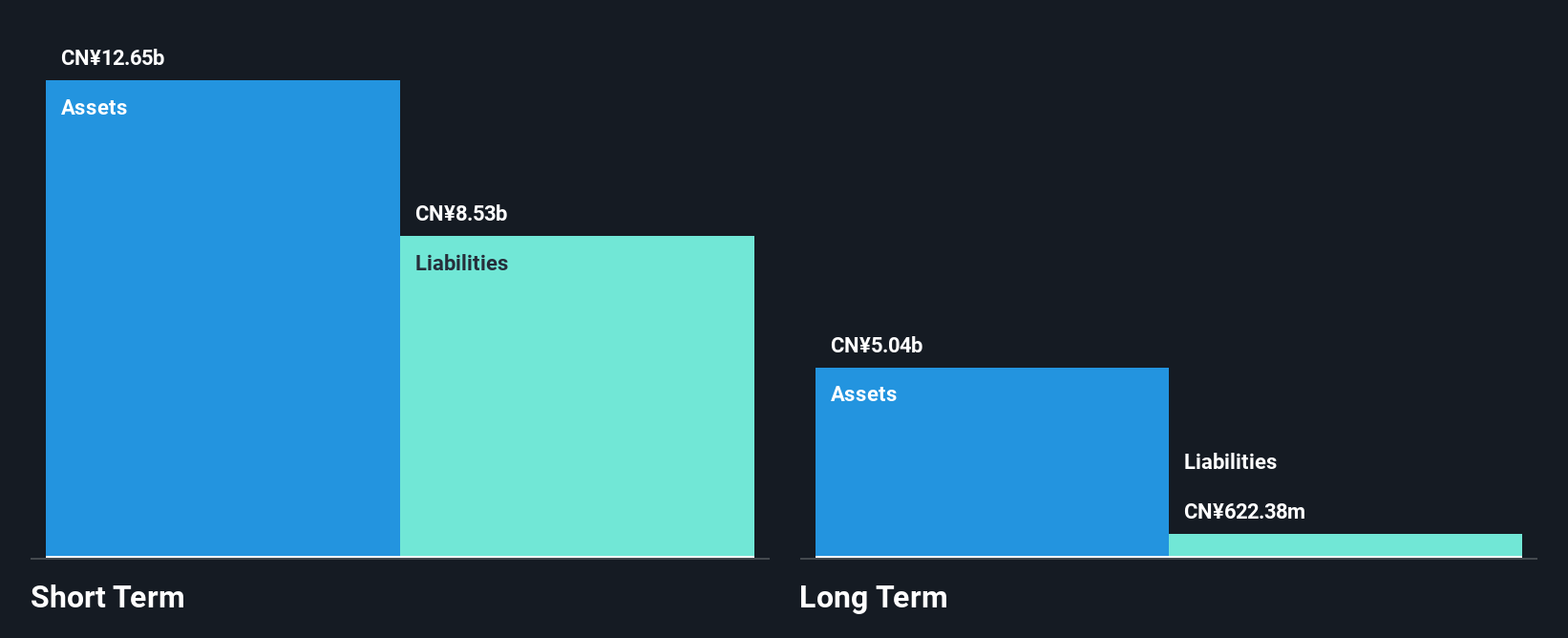

Greentown Service Group demonstrates a mix of strengths and challenges as an investment in the penny stock category. The company has shown significant revenue growth, reaching CN¥17.89 billion for 2024, with net income also rising to CN¥785.08 million. Its earnings growth over the past year outpaced both its five-year average and industry performance, indicating potential resilience in a volatile market. Despite this progress, Greentown's Return on Equity remains low at 8.8%. However, its financial stability is underscored by short-term assets exceeding liabilities and debt being well-covered by operating cash flow, suggesting prudent fiscal management amidst market fluctuations.

- Dive into the specifics of Greentown Service Group here with our thorough balance sheet health report.

- Learn about Greentown Service Group's future growth trajectory here.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces, sells, and trades solar glass products across Mainland China, Asia, North America, Europe, and internationally with a market cap of HK$22.51 billion.

Operations: The company generates revenue primarily from the sale of solar glass, amounting to CN¥18.82 billion, and its solar farm business, including EPC services, which contributes CN¥3.02 billion.

Market Cap: HK$22.51B

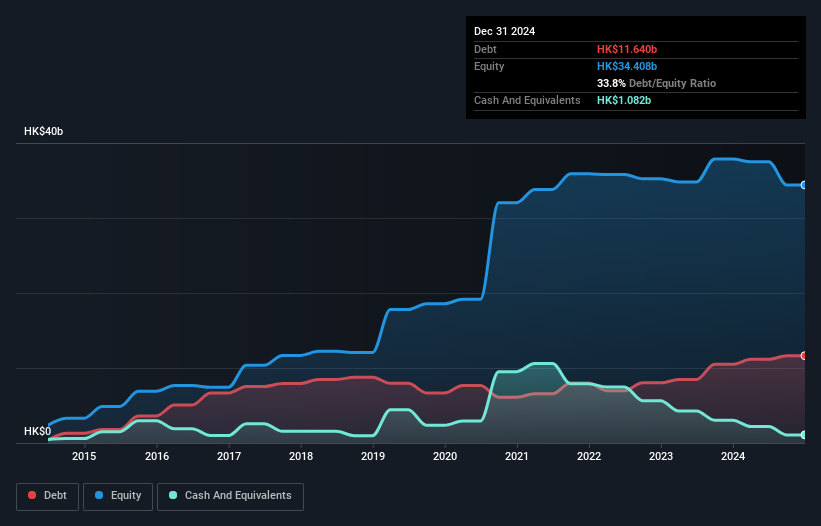

Xinyi Solar Holdings presents a complex picture in the realm of penny stocks. The company has faced challenges with declining profit margins, currently at 4.6% compared to last year's 15.9%, and negative earnings growth over the past year. Despite these setbacks, it maintains a satisfactory net debt to equity ratio of 30.7% and covers its interest payments well with EBIT coverage at 6.2 times. The board's seasoned experience, averaging an impressive tenure of 11.8 years, adds stability amidst recent changes like appointing Ernst & Young as auditors and amending corporate bylaws during its latest AGM on May 30, 2025.

- Click to explore a detailed breakdown of our findings in Xinyi Solar Holdings' financial health report.

- Review our growth performance report to gain insights into Xinyi Solar Holdings' future.

Next Steps

- Embark on your investment journey to our 1,147 Asian Penny Stocks selection here.

- Ready For A Different Approach? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2238

Guangzhou Automobile Group

Engages in the research, development, manufacture, and sale of vehicles and motorcycles, and parts and components in Mainland China and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives