- Hong Kong

- /

- Personal Products

- /

- SEHK:2367

Asian Market's July 2025 Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape of inflationary pressures and geopolitical developments, Asian stock markets have shown resilience, with indices in Japan and China posting gains despite external challenges. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that align with favorable economic indicators and market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SpiderPlus (TSE:4192) | ¥502.00 | ¥994.80 | 49.5% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1180.00 | ¥2323.25 | 49.2% |

| Shenzhen Envicool Technology (SZSE:002837) | CN¥31.63 | CN¥62.34 | 49.3% |

| Lucky Harvest (SZSE:002965) | CN¥35.24 | CN¥69.28 | 49.1% |

| Livero (TSE:9245) | ¥1747.00 | ¥3431.97 | 49.1% |

| Hugel (KOSDAQ:A145020) | ₩351500.00 | ₩699950.46 | 49.8% |

| HL Holdings (KOSE:A060980) | ₩41300.00 | ₩81367.57 | 49.2% |

| HDC Hyundai Development (KOSE:A294870) | ₩23300.00 | ₩45966.93 | 49.3% |

| Dive (TSE:151A) | ¥955.00 | ¥1867.69 | 48.9% |

| cottaLTD (TSE:3359) | ¥435.00 | ¥856.73 | 49.2% |

Let's explore several standout options from the results in the screener.

J&T Global Express (SEHK:1519)

Overview: J&T Global Express Limited is an investment holding company providing integrated express delivery services across multiple countries including China, Indonesia, and Brazil, with a market cap of HK$86.12 billion.

Operations: The company's revenue segments include Transportation - Air Freight, which generated $10.26 billion.

Estimated Discount To Fair Value: 31.9%

J&T Global Express appears undervalued based on cash flows, trading at HK$9.68, below its estimated fair value of HK$14.22. Despite a low forecasted return on equity of 18.1% in three years, the company shows robust growth potential with earnings expected to grow significantly at 32.7% annually and revenue outpacing the Hong Kong market at 11.1%. Recent results highlight operational strength with a substantial increase in parcel volume year-on-year.

- The analysis detailed in our J&T Global Express growth report hints at robust future financial performance.

- Dive into the specifics of J&T Global Express here with our thorough financial health report.

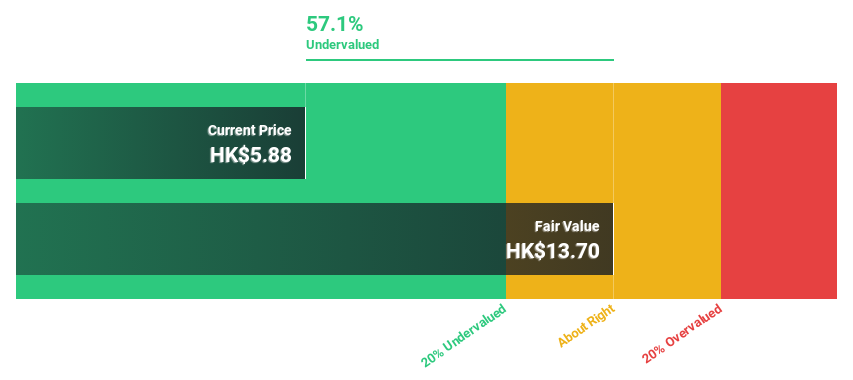

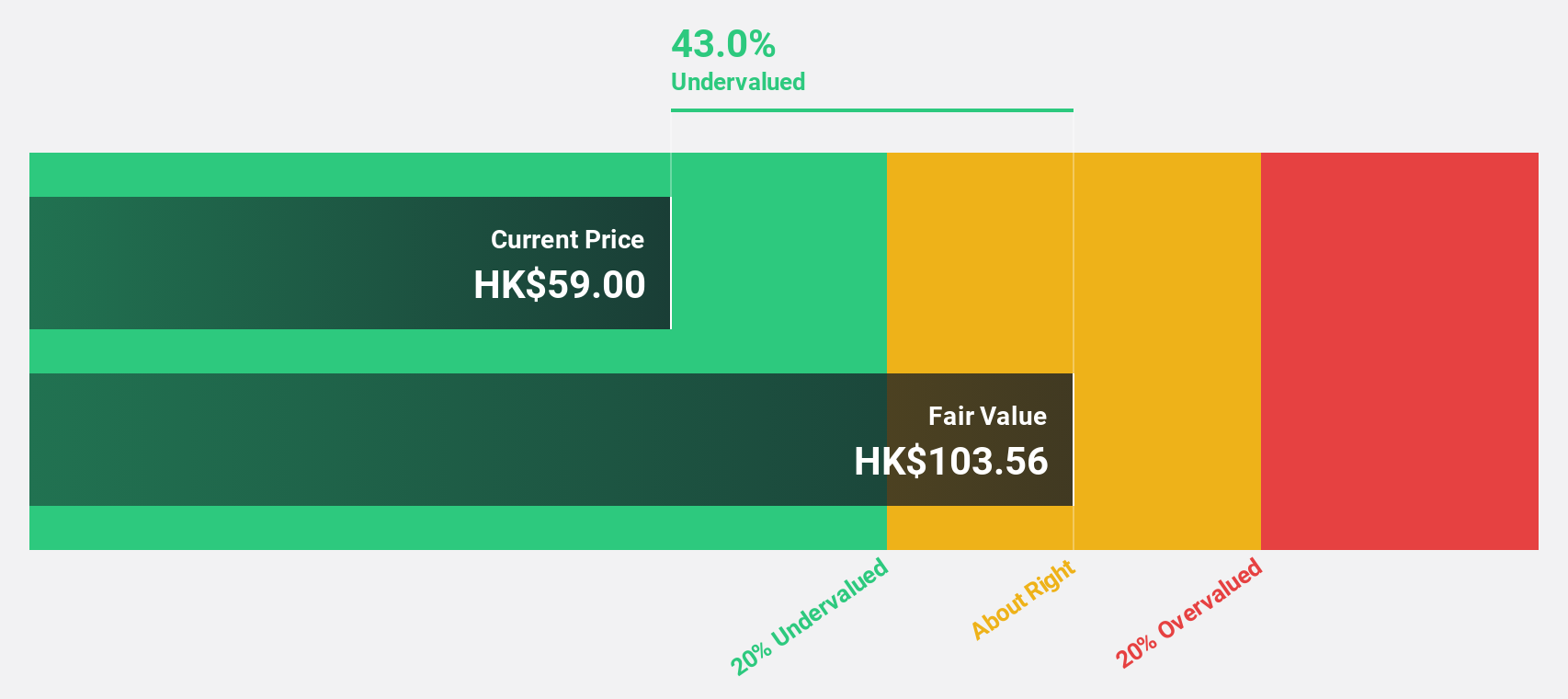

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company that designs, develops, manufactures, and sells skin treatment products featuring recombinant collagen in China, with a market cap of HK$61.82 billion.

Operations: The company's revenue primarily comes from the research, development, manufacture, and sale of bioactive material-based beauty and health products, totaling CN¥5.54 billion.

Estimated Discount To Fair Value: 38.7%

Giant Biogene Holding is trading at HK$58.4, significantly below its estimated fair value of HK$95.21, suggesting undervaluation based on cash flows. Earnings are projected to grow 16.73% annually, outpacing the Hong Kong market's 10.5%, with revenue growth expected at 18.1%. Despite high non-cash earnings, recent events include a follow-on equity offering of HK$2.33 billion and a special dividend announcement, reflecting strong shareholder returns amidst robust financial forecasts.

- The growth report we've compiled suggests that Giant Biogene Holding's future prospects could be on the up.

- Click here to discover the nuances of Giant Biogene Holding with our detailed financial health report.

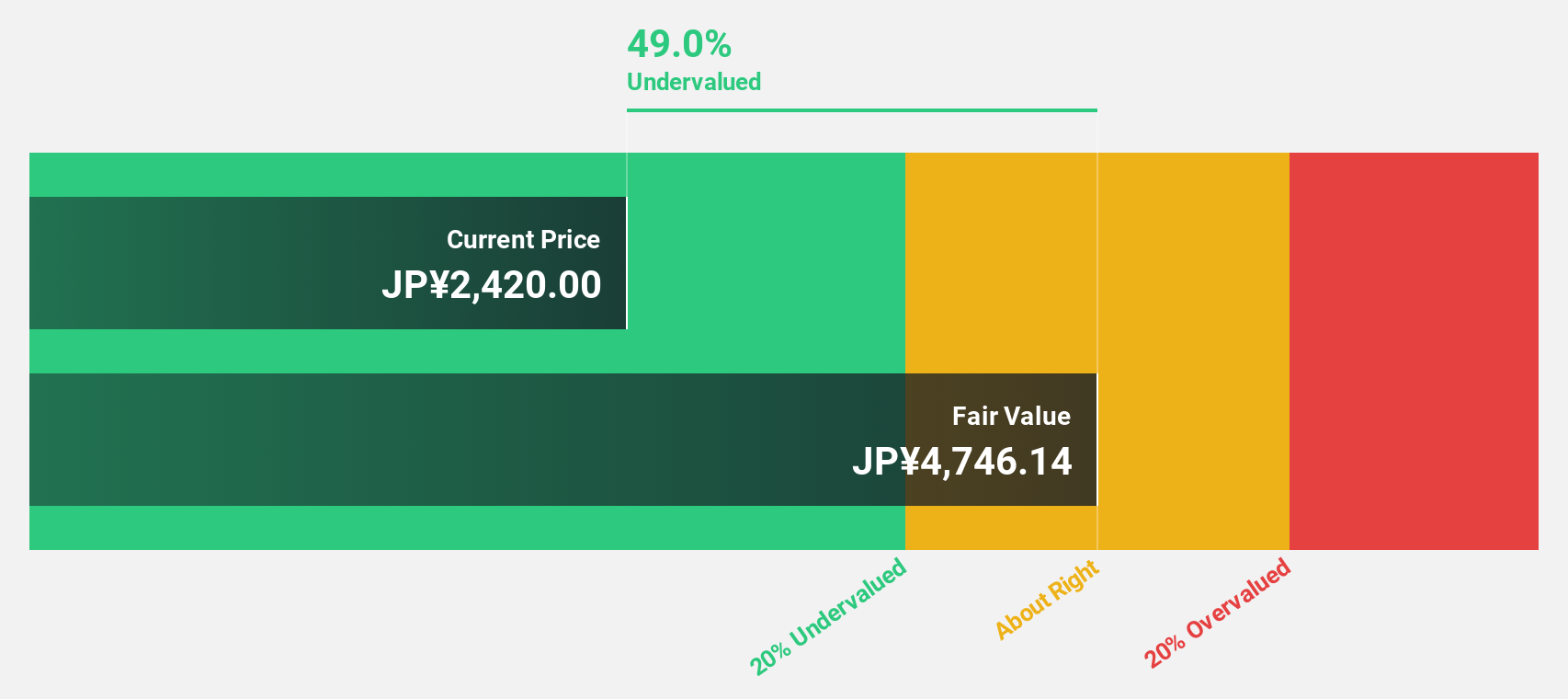

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components across Japan, China, Hong Kong, and internationally with a market cap of ¥338.03 billion.

Operations: The company's revenue is primarily derived from its Electronic Components Business, which generated ¥341.44 billion.

Estimated Discount To Fair Value: 45.3%

Taiyo Yuden is trading at ¥2710, below its estimated fair value of ¥4956.89, indicating potential undervaluation based on cash flows. Despite a volatile share price and lower profit margins compared to last year, earnings are forecast to grow significantly at 35% annually, outpacing the Japanese market's growth rate. Recent product developments in automotive inductors and increased demand have positively impacted sales forecasts, although foreign exchange losses have tempered profit expectations.

- Our expertly prepared growth report on Taiyo Yuden implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Taiyo Yuden's balance sheet by reading our health report here.

Make It Happen

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 257 more companies for you to explore.Click here to unveil our expertly curated list of 260 Undervalued Asian Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2367

Giant Biogene Holding

An investment holding company, designs, develops, manufactures, and sells skin treatment products with recombinant collagen in the People’s Republic of China.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives