- Taiwan

- /

- Semiconductors

- /

- TPEX:3227

Asian Market's Estimated Undervalued Stock Selections For July 2025

Reviewed by Simply Wall St

As global markets experience a rally, buoyed by easing geopolitical tensions and new trade agreements, Asian indices have also shown positive momentum with Japan's Nikkei 225 Index and China's CSI 300 Index posting gains. In this environment of cautious optimism, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst the broader economic developments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.31 | CN¥75.85 | 49.5% |

| T'Way Air (KOSE:A091810) | ₩2010.00 | ₩3992.32 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$232.50 | NT$460.32 | 49.5% |

| SIGMAXYZ Holdings (TSE:6088) | ¥1222.00 | ¥2443.74 | 50% |

| Renesas Electronics (TSE:6723) | ¥1772.00 | ¥3535.56 | 49.9% |

| Prospect Logistics and Industrial Freehold and Leasehold Real Estate Investment Trust (SET:PROSPECT) | THB7.20 | THB14.38 | 49.9% |

| Hibino (TSE:2469) | ¥2396.00 | ¥4771.44 | 49.8% |

| Good Will Instrument (TWSE:2423) | NT$43.75 | NT$86.66 | 49.5% |

| Forum Engineering (TSE:7088) | ¥1200.00 | ¥2376.34 | 49.5% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.86 | CN¥55.72 | 50% |

Let's explore several standout options from the results in the screener.

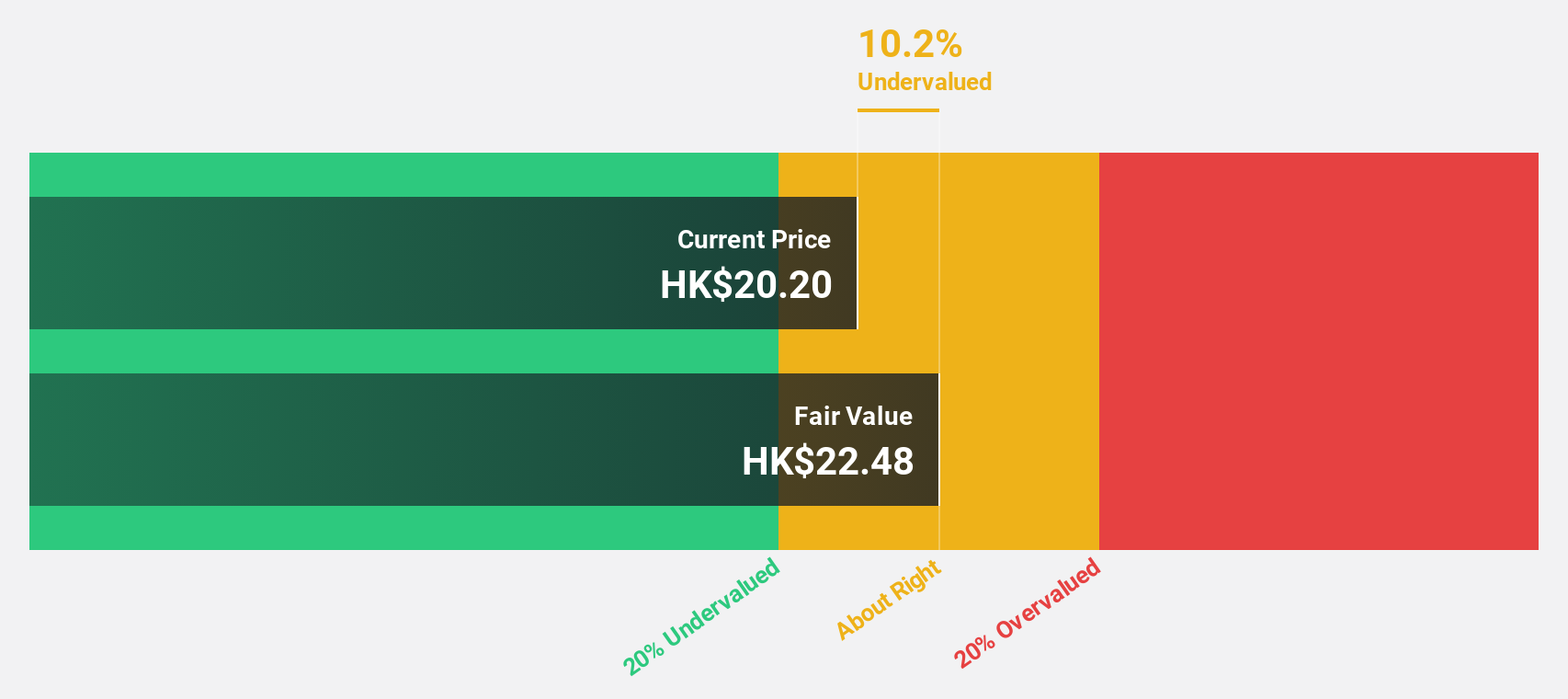

Zhaojin Mining Industry (SEHK:1818)

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and other metallic products both in China and internationally, with a market cap of approximately HK$72.26 billion.

Operations: The company generates revenue through its activities in the exploration, mining, processing, smelting, and sale of gold and other metallic products across China and international markets.

Estimated Discount To Fair Value: 12.1%

Zhaojin Mining Industry, trading at a discount to its fair value (HK$20.4 vs. HK$23.22), shows potential as an undervalued stock based on cash flows despite its debt not being well covered by operating cash flow. The company reported substantial earnings growth in Q1 2025 with net income of CNY 659.18 million, up from CNY 221.38 million a year ago, and forecasts suggest significant annual profit growth of 28.7% over the next three years.

- Our expertly prepared growth report on Zhaojin Mining Industry implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Zhaojin Mining Industry's balance sheet health report.

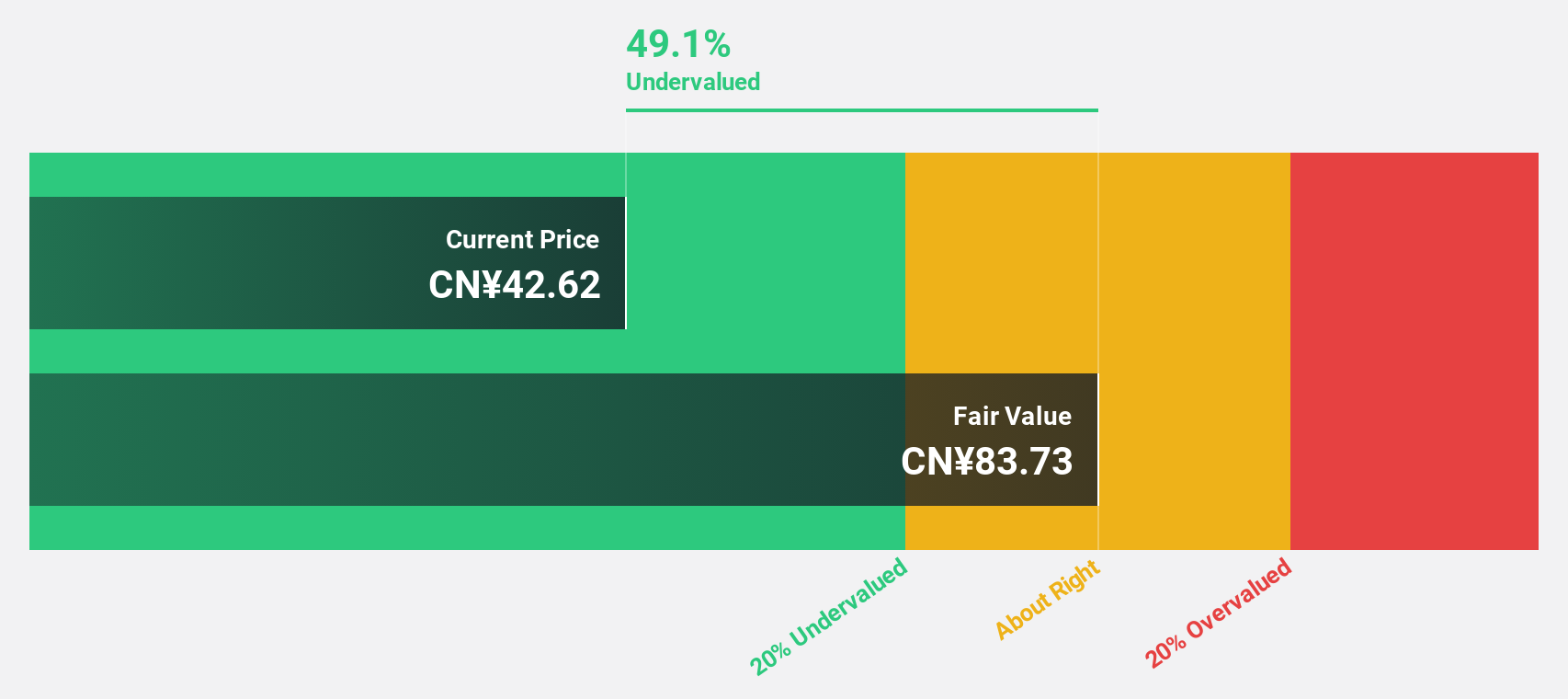

Guangdong Marubi Biotechnology (SHSE:603983)

Overview: Guangdong Marubi Biotechnology Co., Ltd. focuses on the research, design, production, sale, and service of cosmetics in China with a market capitalization of CN¥17.62 billion.

Operations: The company's revenue is primarily derived from its Personal Products segment, which generated CN¥3.16 billion.

Estimated Discount To Fair Value: 46.2%

Guangdong Marubi Biotechnology, trading at CN¥43.94, is significantly undervalued compared to its estimated fair value of CN¥81.73, with shares priced 46.2% below this benchmark. Despite a high level of non-cash earnings and a volatile share price recently, the company posted strong Q1 2025 results with sales increasing to CN¥846.65 million from CN¥661.39 million year-on-year and net income rising to CN¥135.05 million from CN¥110.63 million, highlighting robust revenue growth prospects above market averages.

- Our earnings growth report unveils the potential for significant increases in Guangdong Marubi Biotechnology's future results.

- Click here to discover the nuances of Guangdong Marubi Biotechnology with our detailed financial health report.

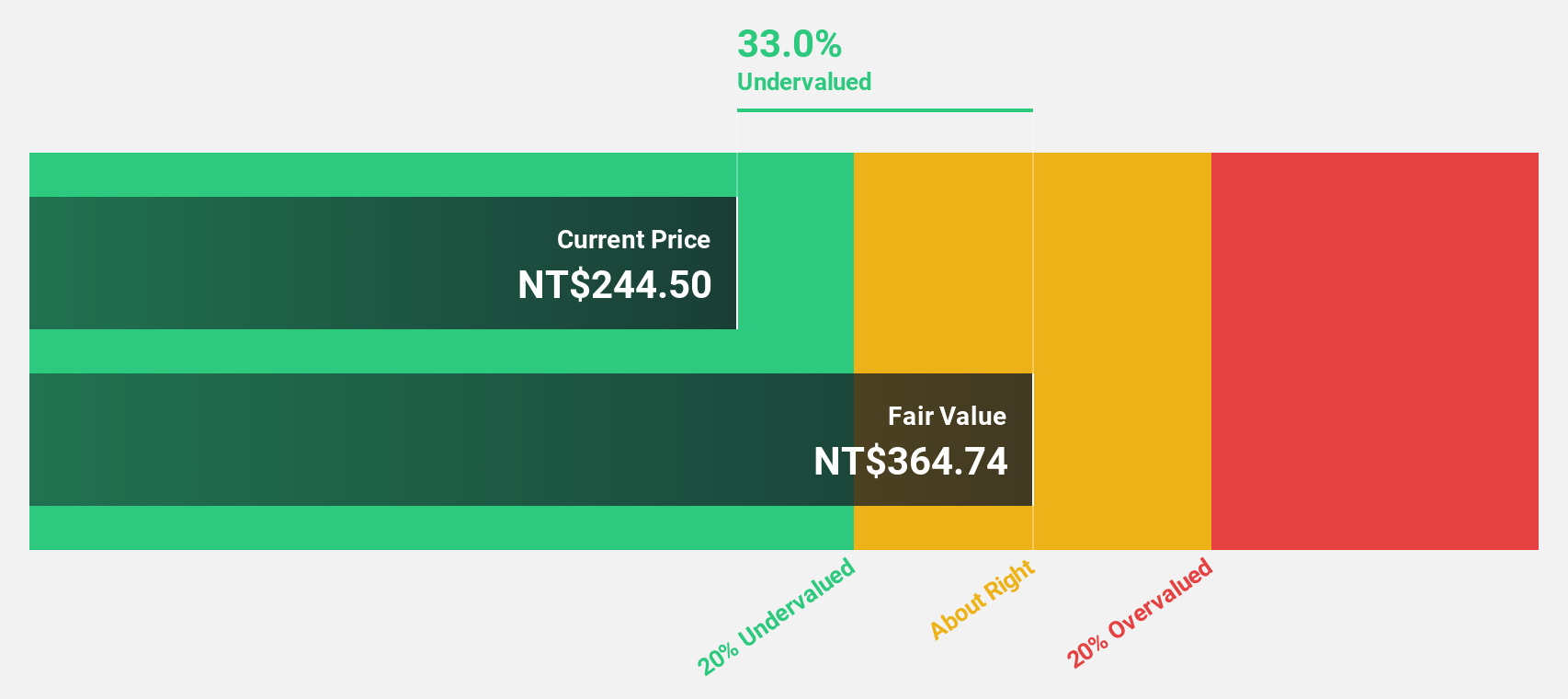

PixArt Imaging (TPEX:3227)

Overview: PixArt Imaging Inc. and its subsidiaries specialize in researching, designing, producing, and selling CMOS image sensors and related ICs across Taiwan, Hong Kong, China, Japan, and other international markets with a market cap of approximately NT$36.41 billion.

Operations: Revenue Segments (in millions of NT$): The company generates revenue through its operations in CMOS image sensors and related integrated circuits across various regions including Taiwan, Hong Kong, China, Japan, and other international markets.

Estimated Discount To Fair Value: 33.6%

PixArt Imaging, trading at NT$244, is undervalued relative to its fair value of NT$367.34. The company reported strong Q1 2025 results with sales rising to TWD 2.35 billion from TWD 1.75 billion year-on-year and net income increasing to TWD 545.21 million from TWD 291.16 million, reflecting robust growth prospects above market averages despite an unstable dividend track record and recent changes in corporate bylaws approved in May 2025.

- In light of our recent growth report, it seems possible that PixArt Imaging's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of PixArt Imaging.

Where To Now?

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 274 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3227

PixArt Imaging

Researches, designs, produces, and sells CMOS image sensors and related ICs in Taiwan, Hong Kong, China, Japan, and internationally.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives