- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6274

Asian Market Value Stocks: Zhejiang China Commodities City Group Among 3 Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets experience fluctuations, with mixed performances across major indices and economic data presenting a varied outlook, investors are increasingly turning their attention to the Asian markets for potential opportunities. In this context, identifying stocks that may be undervalued relative to their intrinsic value can offer strategic advantages, especially in economies like China where recent indicators suggest both challenges and opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$30.25 | HK$59.90 | 49.5% |

| JRCLtd (TSE:6224) | ¥1160.00 | ¥2305.91 | 49.7% |

| Jiangxi Rimag Group (SEHK:2522) | HK$13.62 | HK$27.23 | 50% |

| Hibino (TSE:2469) | ¥2365.00 | ¥4709.96 | 49.8% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.82 | NZ$1.63 | 49.5% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥42.35 | CN¥84.40 | 49.8% |

| Dive (TSE:151A) | ¥935.00 | ¥1857.63 | 49.7% |

| Darbond Technology (SHSE:688035) | CN¥39.53 | CN¥78.42 | 49.6% |

| cottaLTD (TSE:3359) | ¥430.00 | ¥855.22 | 49.7% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥26.51 | CN¥52.74 | 49.7% |

We'll examine a selection from our screener results.

Zhejiang China Commodities City Group (SHSE:600415)

Overview: Zhejiang China Commodities City Group Co., Ltd. develops, manages, and operates a service online trading platform in China with a market cap of CN¥105.62 billion.

Operations: Zhejiang China Commodities City Group Co., Ltd.'s revenue segments include the development, management, and operation of an online trading service platform in China.

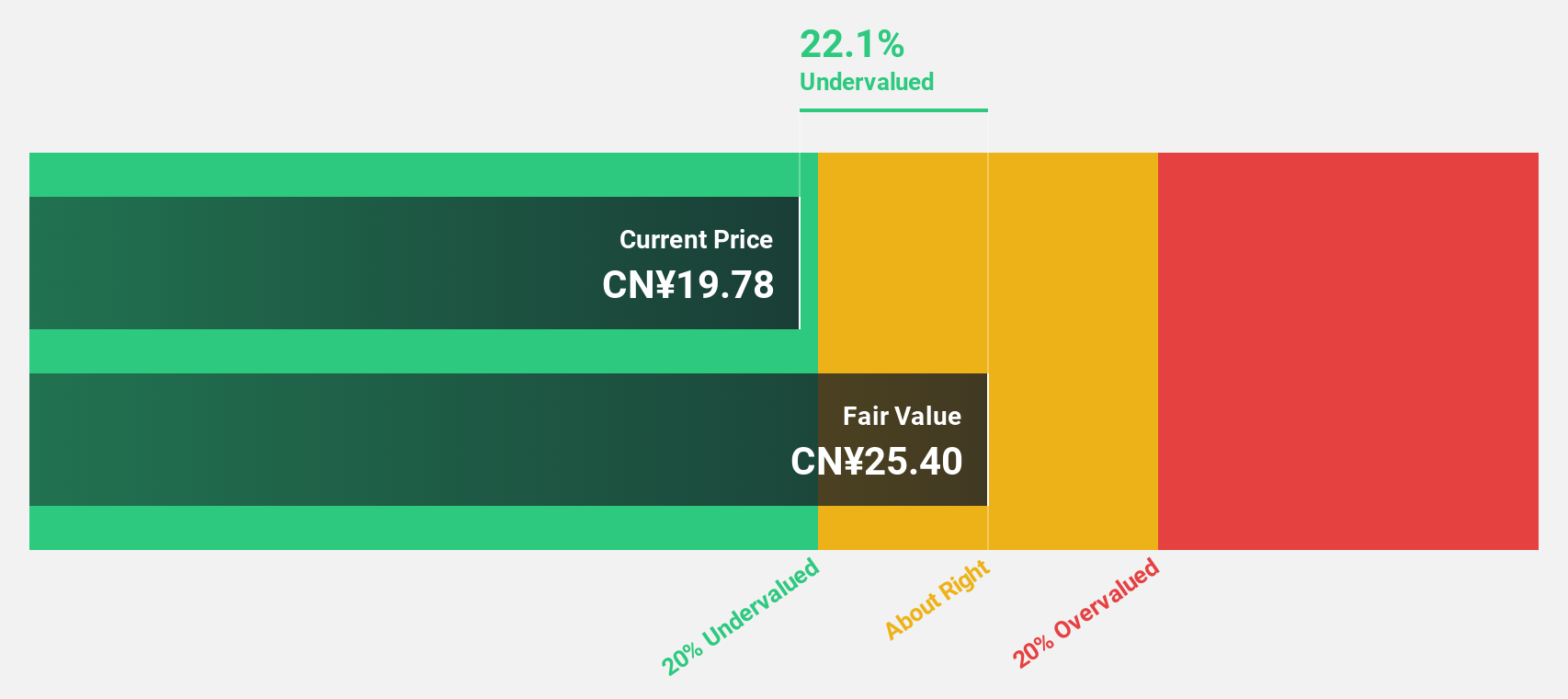

Estimated Discount To Fair Value: 23.2%

Zhejiang China Commodities City Group is trading at CN¥19.26, significantly below its fair value estimate of CN¥25.08, highlighting its undervaluation based on cash flows. With forecasted revenue growth of 22.7% annually and earnings expected to grow by 26.67% per year, the company shows strong potential despite an unstable dividend history. Recent removal from the Shanghai Stock Exchange 180 Value Index may impact investor perception but not fundamental cash flow valuation metrics.

- According our earnings growth report, there's an indication that Zhejiang China Commodities City Group might be ready to expand.

- Get an in-depth perspective on Zhejiang China Commodities City Group's balance sheet by reading our health report here.

Taiwan Union Technology (TPEX:6274)

Overview: Taiwan Union Technology Corporation manufactures and sells copper foil substrates, adhesive sheets, and multi-layer laminated boards both in Taiwan and internationally, with a market cap of NT$69.06 billion.

Operations: Taiwan Union Technology's revenue is primarily derived from the production and sale of copper foil substrates, adhesive sheets, and multi-layer laminated boards.

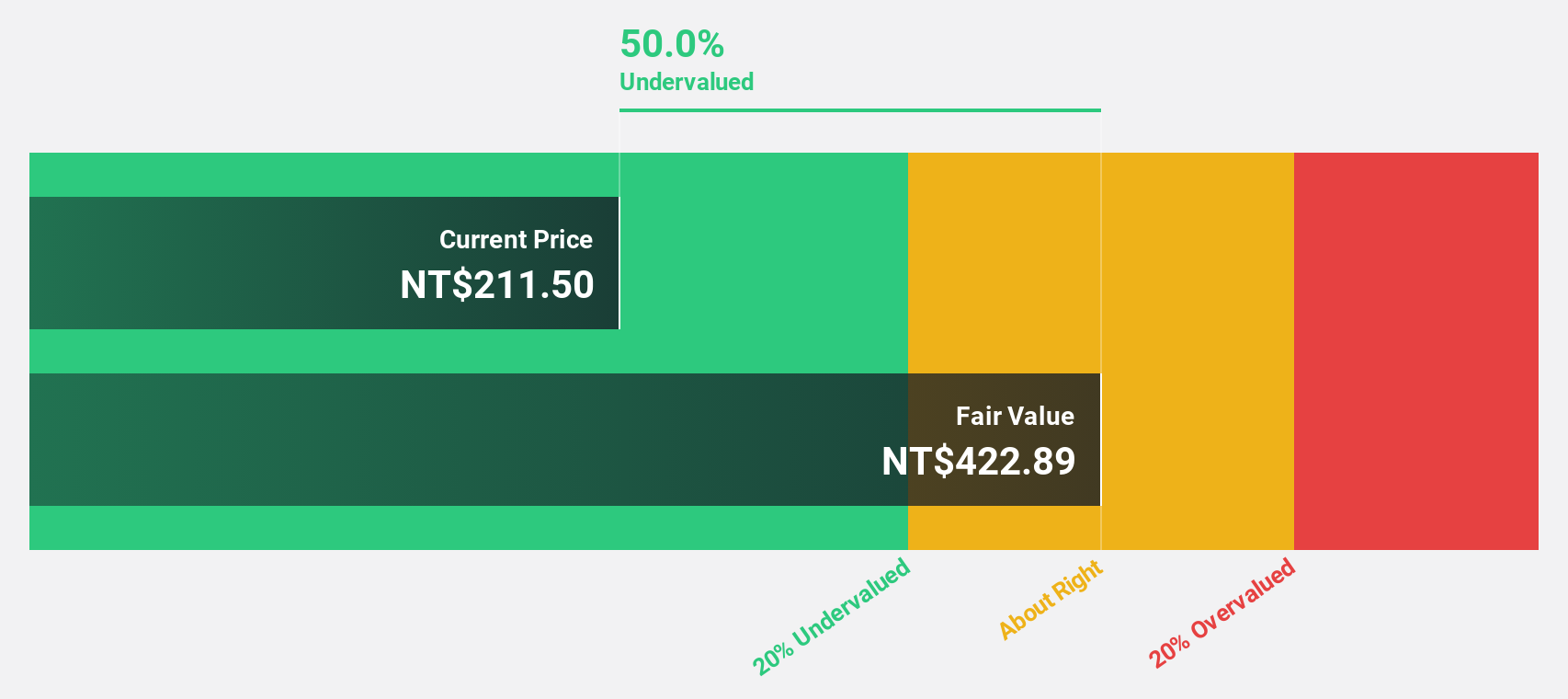

Estimated Discount To Fair Value: 45.3%

Taiwan Union Technology is trading at NT$250, significantly below its estimated fair value of NT$457.14, indicating undervaluation based on cash flows. Despite a dividend yield of 2.6% not being well covered by free cash flows, earnings and revenue are forecast to grow faster than the Taiwan market at 21.7% and 15.5% per year respectively. Recent earnings reports show strong growth with net income increasing to TWD 671.95 million from TWD 451.84 million year-over-year.

- Our expertly prepared growth report on Taiwan Union Technology implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Taiwan Union Technology.

OMRON (TSE:6645)

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market cap of ¥795.45 billion.

Operations: The company's revenue segments include industrial automation, device and module solutions, social systems, and healthcare businesses.

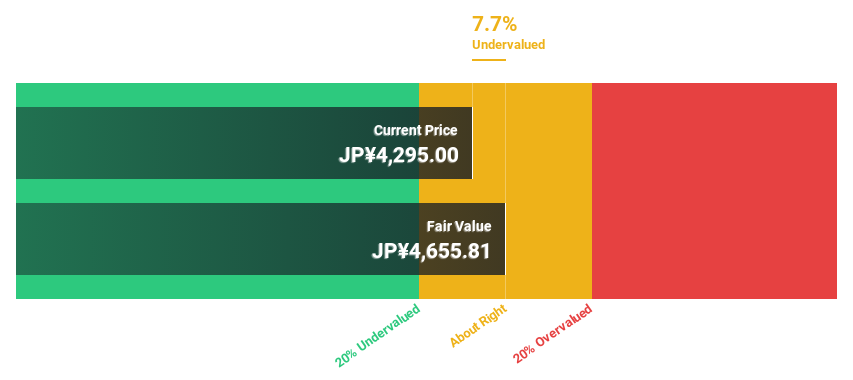

Estimated Discount To Fair Value: 36.2%

OMRON is trading at ¥4040, significantly below its estimated fair value of ¥6329.02, highlighting its undervaluation based on cash flows. Earnings are expected to grow at 25.3% annually, surpassing the Japanese market's growth rate of 7.5%. However, the dividend yield of 2.57% is not well covered by earnings or free cash flows. Recent strategic partnership with Japan Activation Capital could impact future financials positively but also adds uncertainty regarding minority stake acquisition outcomes.

- The analysis detailed in our OMRON growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in OMRON's balance sheet health report.

Next Steps

- Investigate our full lineup of 277 Undervalued Asian Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Union Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6274

Taiwan Union Technology

Engages in the manufacture and sale of copper foil substrates, adhesive sheets, and multi-layer laminated boards in Taiwan and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives