- Taiwan

- /

- Semiconductors

- /

- TWSE:2455

Asian Market Value Stocks: 3 Companies Priced Below Intrinsic Estimates

Reviewed by Simply Wall St

Amidst ongoing global trade tensions and economic fluctuations, Asian markets have shown resilience, with Chinese stocks seeing a boost from expectations of government stimulus. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities below intrinsic estimates; these stocks often present potential for growth as market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.30 | CN¥76.30 | 49.8% |

| Taiyo Yuden (TSE:6976) | ¥2415.00 | ¥4731.15 | 49% |

| Taiwan Union Technology (TPEX:6274) | NT$214.00 | NT$422.85 | 49.4% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.10 | CN¥43.49 | 49.2% |

| Peijia Medical (SEHK:9996) | HK$6.39 | HK$12.67 | 49.6% |

| Kanto Denka Kogyo (TSE:4047) | ¥853.00 | ¥1683.91 | 49.3% |

| J&T Global Express (SEHK:1519) | HK$6.74 | HK$13.29 | 49.3% |

| Good Will Instrument (TWSE:2423) | NT$44.50 | NT$87.13 | 48.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.57 | CN¥52.34 | 49.2% |

| APAC Realty (SGX:CLN) | SGD0.46 | SGD0.90 | 49.1% |

We're going to check out a few of the best picks from our screener tool.

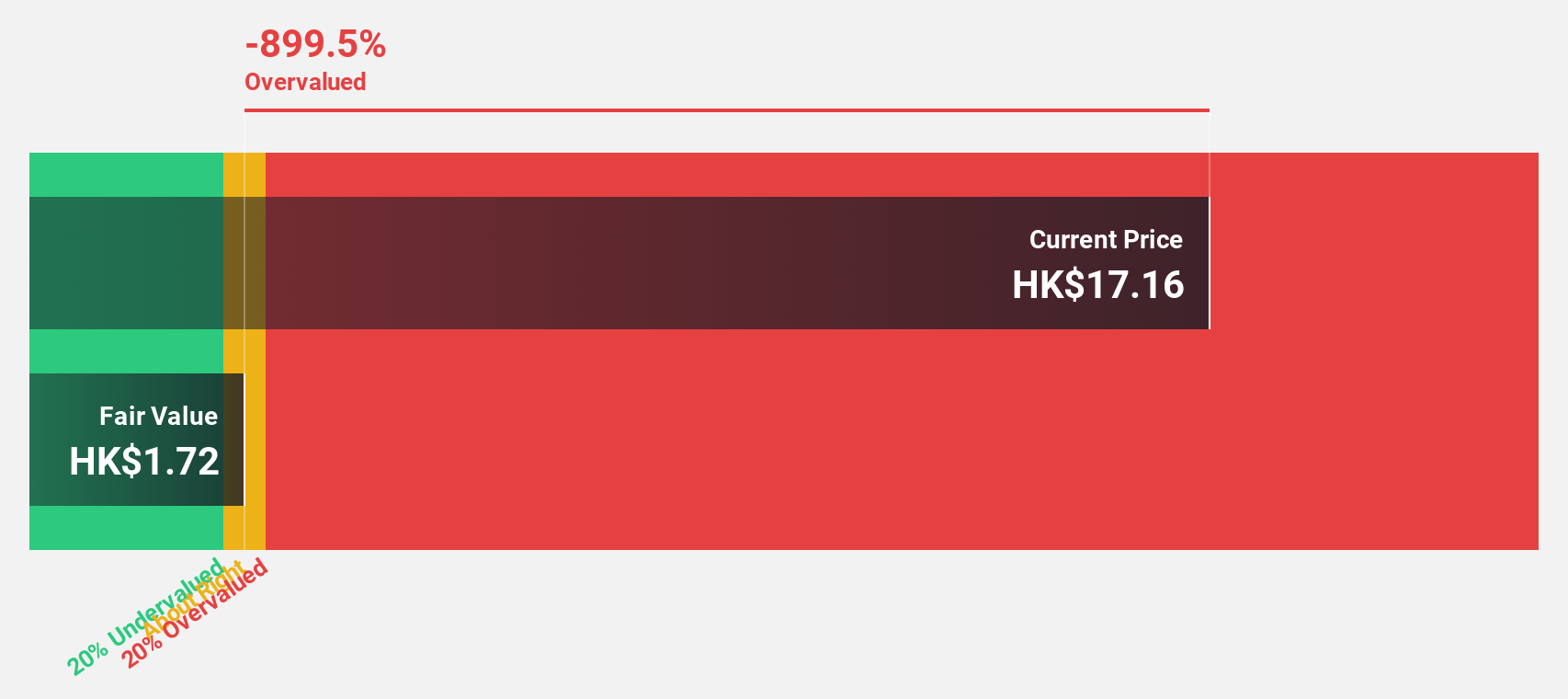

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company offering intra-city on-demand delivery services in the People’s Republic of China, with a market cap of HK$15.21 billion.

Operations: The company's revenue is primarily derived from its intra-city on-demand delivery service business, totaling CN¥15.75 billion.

Estimated Discount To Fair Value: 17%

Hangzhou SF Intra-city Industrial appears undervalued, trading at HK$16.64 below its estimated fair value of HK$20.04, with earnings expected to grow significantly by 42.2% annually over the next three years—surpassing the Hong Kong market's forecasted growth. Despite recent substantial insider selling, revenue is projected to increase by 18.7% per year, outpacing the broader market's growth rate of 8.1%. Recent amendments to their employee incentive scheme could further impact future financials positively.

- Our earnings growth report unveils the potential for significant increases in Hangzhou SF Intra-city Industrial's future results.

- Unlock comprehensive insights into our analysis of Hangzhou SF Intra-city Industrial stock in this financial health report.

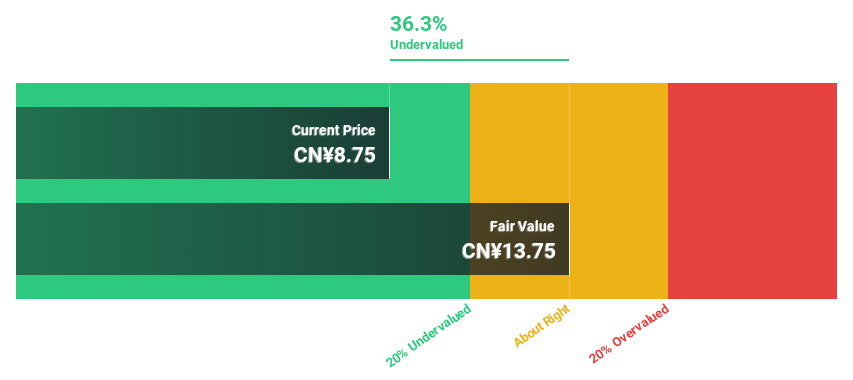

Goldwind Science&Technology (SZSE:002202)

Overview: Goldwind Science&Technology Co., Ltd. and its subsidiaries offer wind power solutions both in China and internationally, with a market cap of CN¥37.63 billion.

Operations: Goldwind Science&Technology Co., Ltd. generates revenue through its wind power solutions offered both domestically and internationally.

Estimated Discount To Fair Value: 32.1%

Goldwind Science & Technology is trading at CN¥9.5, significantly below its estimated fair value of CN¥14, representing a notable undervaluation based on discounted cash flow analysis. Despite a low forecasted return on equity and unsustainable dividend coverage by free cash flows, earnings are expected to grow 24.85% annually over the next three years, outpacing the Chinese market's growth rate. Recent share repurchase plans may further enhance shareholder value by reducing registered capital using company funds.

- Our expertly prepared growth report on Goldwind Science&Technology implies its future financial outlook may be stronger than recent results.

- Take a closer look at Goldwind Science&Technology's balance sheet health here in our report.

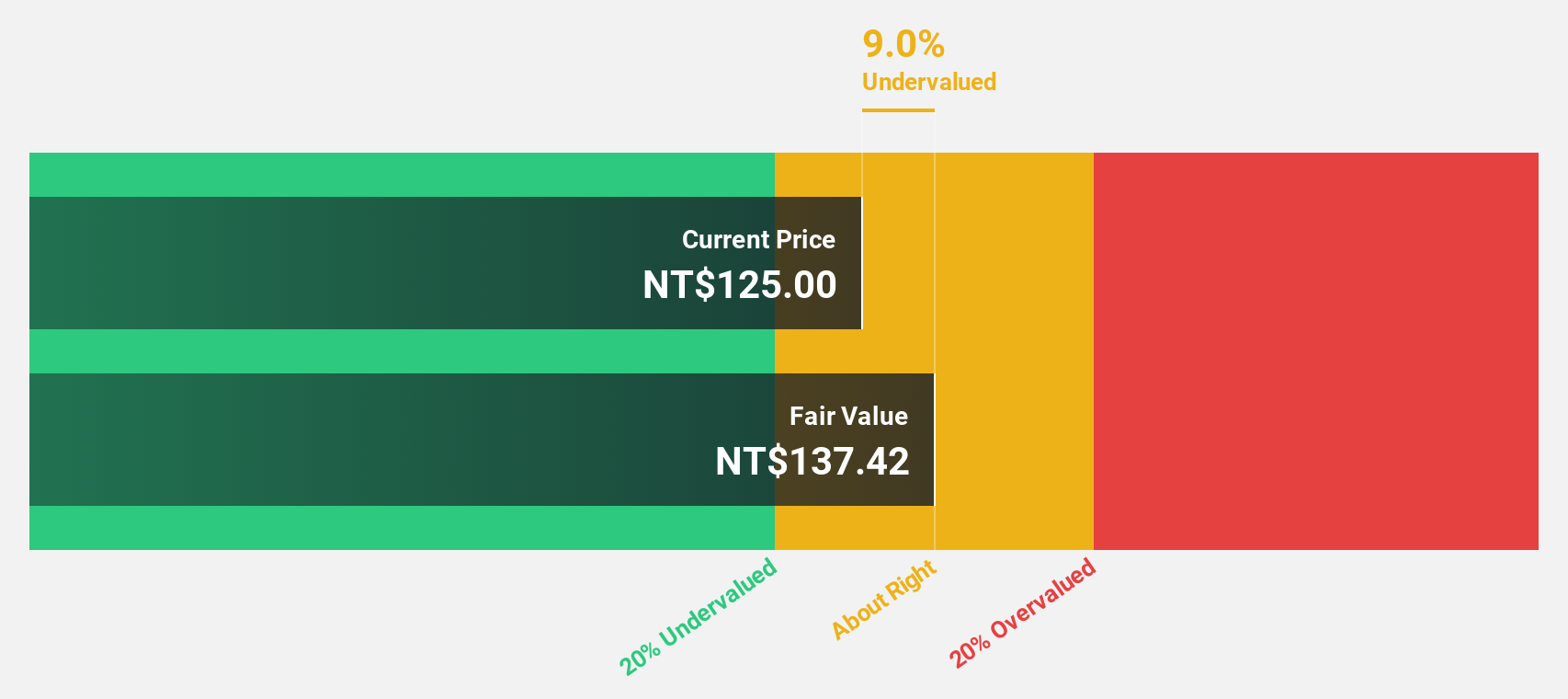

Visual Photonics Epitaxy (TWSE:2455)

Overview: Visual Photonics Epitaxy Co., Ltd. focuses on the R&D, manufacturing, and sale of optoelectronic semiconductors and components globally, with a market cap of NT$22.53 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, which generated NT$3.20 billion.

Estimated Discount To Fair Value: 13.8%

Visual Photonics Epitaxy, trading at NT$122.5, is undervalued relative to its fair value estimate of NT$142.1. Despite a volatile share price recently and a dividend yield of 2.61% not well covered by earnings, the company's forecasted earnings growth of 32.31% annually surpasses the Taiwan market's rate. Recent buybacks totaling TWD 98.81 million may bolster shareholder value by reducing outstanding shares as part of their employee transfer strategy.

- According our earnings growth report, there's an indication that Visual Photonics Epitaxy might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Visual Photonics Epitaxy.

Where To Now?

- Investigate our full lineup of 300 Undervalued Asian Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2455

Visual Photonics Epitaxy

Engages in the research and development, manufacture, and sale of optoelectronic semiconductors epitaxy and optoelectronic components products in Taiwan, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.