- China

- /

- Electrical

- /

- SHSE:688411

Asian Market Value Picks: 3 Companies That May Be Trading Below Intrinsic Estimates

Reviewed by Simply Wall St

Amidst global economic uncertainties and fluctuating trade policies, Asian markets have shown resilience, with varying impacts on indices across the region. This environment presents opportunities for discerning investors to explore stocks that may be trading below their intrinsic value, particularly those with strong fundamentals and potential for growth despite external pressures.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.51 | CN¥309.46 | 49.7% |

| SpiderPlus (TSE:4192) | ¥506.00 | ¥997.79 | 49.3% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥22.88 | CN¥45.72 | 50% |

| Nanya Technology (TWSE:2408) | NT$43.75 | NT$87.13 | 49.8% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$176.50 | NT$350.51 | 49.6% |

| Insource (TSE:6200) | ¥926.00 | ¥1843.53 | 49.8% |

| H.U. Group Holdings (TSE:4544) | ¥3254.00 | ¥6446.96 | 49.5% |

| Elan (TSE:6099) | ¥850.00 | ¥1696.06 | 49.9% |

| cottaLTD (TSE:3359) | ¥441.00 | ¥871.25 | 49.4% |

| Astroscale Holdings (TSE:186A) | ¥676.00 | ¥1333.68 | 49.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Beijing HyperStrong Technology (SHSE:688411)

Overview: Beijing HyperStrong Technology Co., Ltd. designs, develops, integrates, and operates energy storage power stations across China, Europe, North America, and Australia with a market cap of CN¥16.64 billion.

Operations: The company's revenue segments include the design, development, integration, and operation of energy storage power stations across its key markets in China, Europe, North America, and Australia.

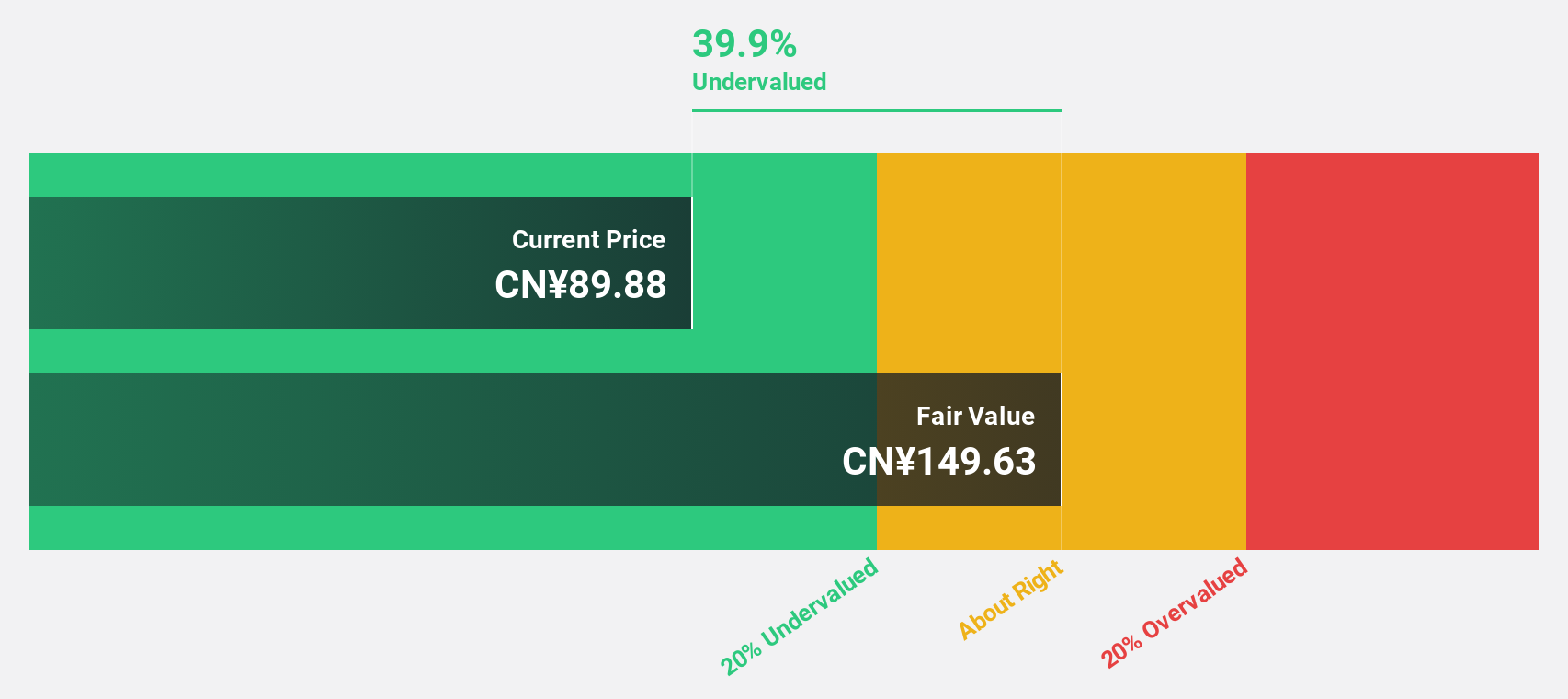

Estimated Discount To Fair Value: 37.2%

Beijing HyperStrong Technology is trading at CN¥92.37, significantly below its estimated fair value of CN¥147.06, suggesting it may be undervalued based on cash flows. Its revenue and earnings are forecast to grow over 30% annually, outpacing the Chinese market's growth rates. However, its dividend yield of 1.19% is not well covered by free cash flows. Recent innovations like the HyperBlock M enhance its competitive edge in energy storage solutions through modularity and efficiency improvements.

- Upon reviewing our latest growth report, Beijing HyperStrong Technology's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Beijing HyperStrong Technology stock in this financial health report.

Shenzhen KSTAR Science and Technology (SZSE:002518)

Overview: Shenzhen KSTAR Science and Technology Co., Ltd. operates in the technology sector, focusing on power electronics and renewable energy solutions, with a market cap of CN¥13.86 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Shenzhen KSTAR Science and Technology Co., Ltd.

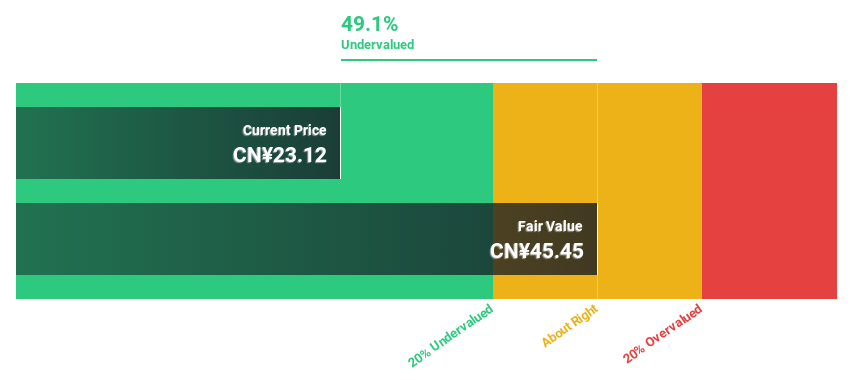

Estimated Discount To Fair Value: 48.5%

Shenzhen KSTAR Science and Technology is trading at CN¥23.8, well below its estimated fair value of CN¥46.24, indicating potential undervaluation based on cash flows. The company's revenue is projected to grow 22.3% annually, surpassing the Chinese market's average growth rate. Despite a forecasted earnings growth of 32.4%, profit margins have declined from last year, and the dividend track record remains unstable with recent reductions in payouts for 2024 dividends.

- The growth report we've compiled suggests that Shenzhen KSTAR Science and Technology's future prospects could be on the up.

- Click here to discover the nuances of Shenzhen KSTAR Science and Technology with our detailed financial health report.

Qingdao Baheal Medical (SZSE:301015)

Overview: Qingdao Baheal Medical INC. is involved in the research, development, production, wholesale, and retail of pharmaceutical products across China, the United States, Hong Kong, and the United Kingdom with a market cap of CN¥11.77 billion.

Operations: Qingdao Baheal Medical INC. generates revenue through its activities in the research, development, production, wholesale, and retail sectors of pharmaceutical products across several international markets including China, the United States, Hong Kong, and the United Kingdom.

Estimated Discount To Fair Value: 18.5%

Qingdao Baheal Medical, trading at CN¥22.39, is priced below its fair value estimate of CN¥27.46, reflecting potential undervaluation based on cash flows. Despite a volatile share price recently, earnings are projected to grow significantly at 20.05% annually over the next three years, although this lags behind the broader Chinese market's growth rate. The company affirmed a dividend payout for 2024, which may appeal to income-focused investors amid stable revenue growth projections of 13% per year.

- In light of our recent growth report, it seems possible that Qingdao Baheal Medical's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Qingdao Baheal Medical.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 271 more companies for you to explore.Click here to unveil our expertly curated list of 274 Undervalued Asian Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing HyperStrong Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688411

Beijing HyperStrong Technology

Engages in the design, development, integration, and operation of energy storage power stations in China, Europe, North America, and Australia.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives