- Hong Kong

- /

- Semiconductors

- /

- SEHK:968

Asian Market Insights: Zhejiang Taimei Medical Technology Among 3 Compelling Penny Stocks

Reviewed by Simply Wall St

The Asian markets have been closely watched as global economic dynamics shift, with the recent U.S.-China trade truce providing a temporary boost to investor sentiment. In this context, penny stocks, though often overlooked, can present intriguing opportunities when they exhibit robust financial health. These smaller or newer companies hold potential for growth and value that larger firms might not offer, and we will explore three such compelling stocks in the Asian market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.96 | HK$2.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.54 | HK$952.52M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.10 | SGD445.82M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.80 | THB2.88B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.48 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 953 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Zhejiang Taimei Medical Technology (SEHK:2576)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Taimei Medical Technology Co., Ltd. operates in the medical technology sector and has a market cap of approximately HK$2.44 billion.

Operations: The company generates revenue through its digital services segment, which accounts for CN¥316.66 million, and its cloud-based software segment, contributing CN¥205.65 million.

Market Cap: HK$2.44B

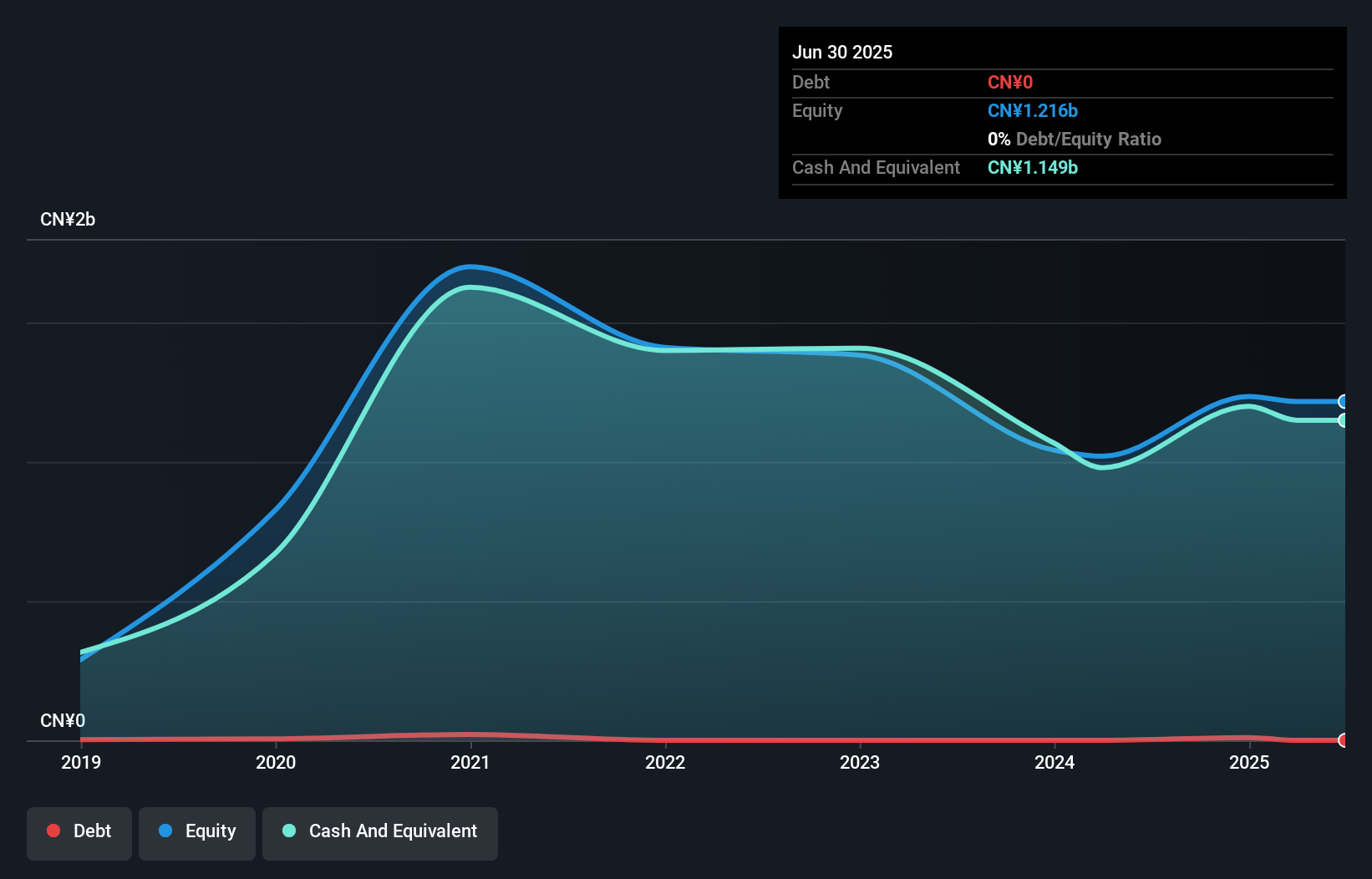

Zhejiang Taimei Medical Technology, with a market cap of approximately HK$2.44 billion, operates in the medical technology sector and is currently unprofitable. Despite this, it has shown significant improvement by reducing its losses at a rate of 30.8% annually over the past five years. The company boasts strong financial health with short-term assets exceeding both short and long-term liabilities and remains debt-free. Recent earnings for the first half of 2025 reported sales of CN¥244.22 million, reflecting a decrease from the previous year but also showing a substantial reduction in net loss to CN¥22.8 million from CN¥171.13 million last year.

- Navigate through the intricacies of Zhejiang Taimei Medical Technology with our comprehensive balance sheet health report here.

- Gain insights into Zhejiang Taimei Medical Technology's historical outcomes by reviewing our past performance report.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces, sells, and trades solar glass products globally, with a market cap of HK$32.75 billion.

Operations: The company's revenue is primarily derived from the sales of solar glass, amounting to CN¥18.07 billion, and its solar farm business, including EPC services, which contributes CN¥3.03 billion.

Market Cap: HK$32.75B

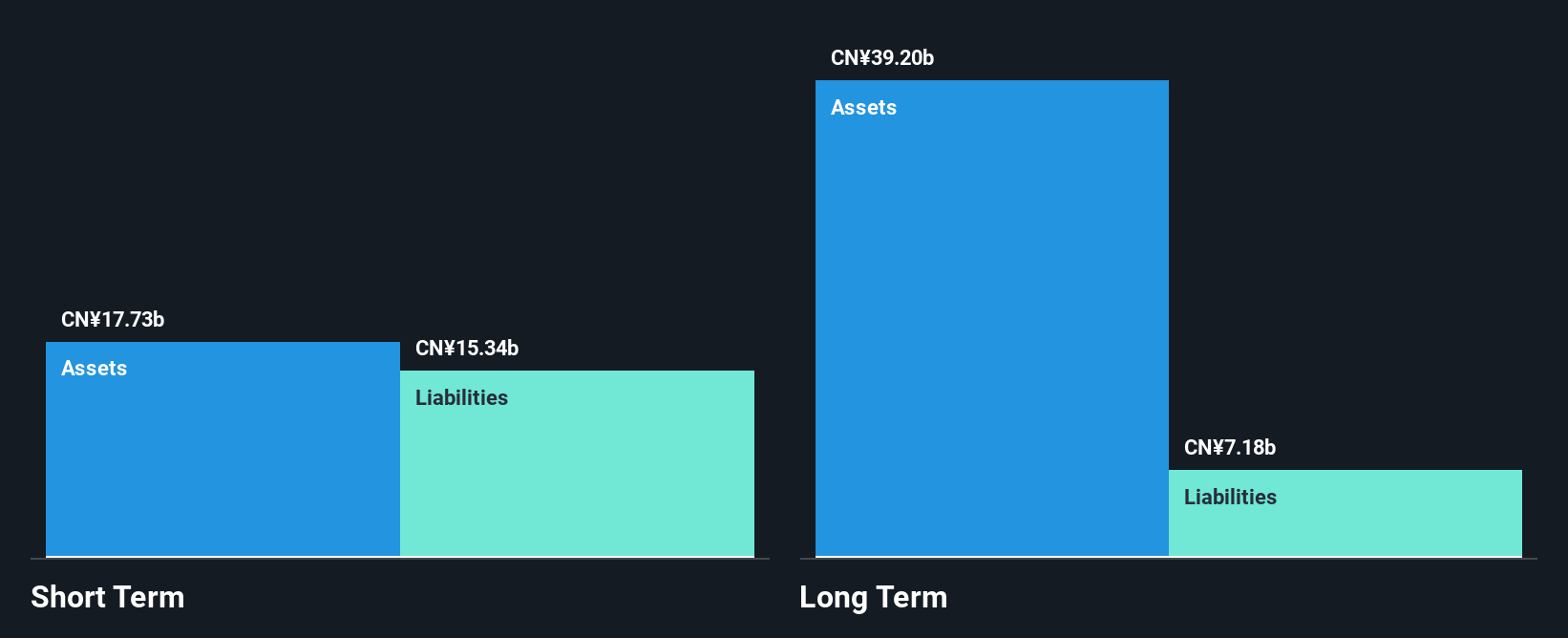

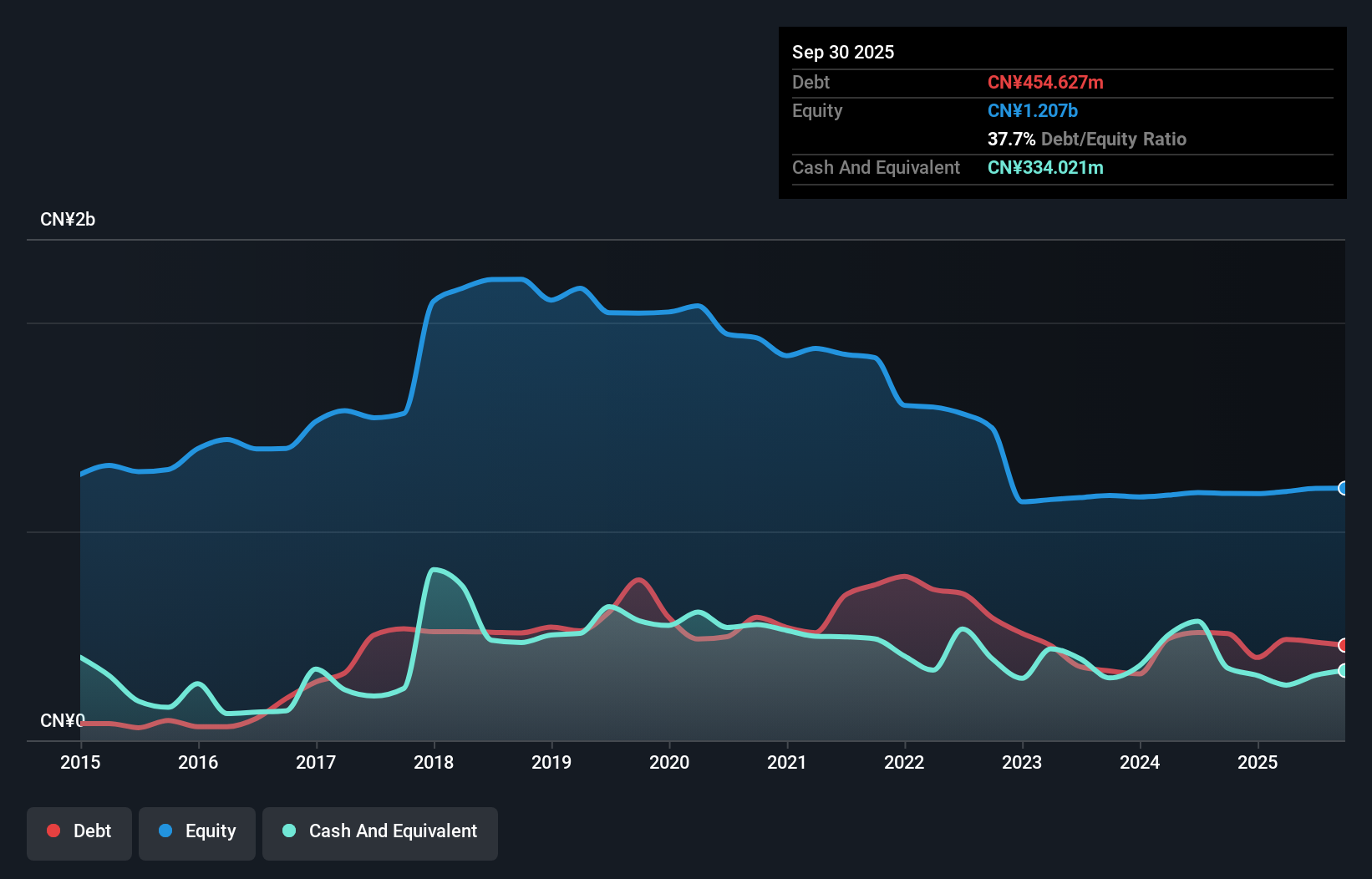

Xinyi Solar Holdings, with a market cap of HK$32.75 billion, derives significant revenue from its solar glass sales (CN¥18.07 billion) and solar farm business (CN¥3.03 billion). Although currently unprofitable, the company has managed to reduce its debt-to-equity ratio over five years to 37.2%, while maintaining satisfactory net debt levels at 28.3%. Its short-term assets cover both long-term and short-term liabilities well, though operating cash flow only covers 12.6% of its debt, indicating financial challenges remain despite good relative value compared to peers and stable weekly volatility at 7%.

- Take a closer look at Xinyi Solar Holdings' potential here in our financial health report.

- Understand Xinyi Solar Holdings' earnings outlook by examining our growth report.

Hunan Mendale HometextileLtd (SZSE:002397)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hunan Mendale Hometextile Co., Ltd operates in the home textile industry both in China and internationally, with a market cap of CN¥3.12 billion.

Operations: The company's revenue segment in the textile business reported a figure of -CN¥95.26 million.

Market Cap: CN¥3.12B

Hunan Mendale Hometextile Co., Ltd, with a market cap of CN¥3.12 billion, has shown notable earnings growth over the past year at 161.8%, surpassing its five-year average of 7.9% annually and outperforming the luxury industry’s decline. Despite this growth, its return on equity remains low at 2.5%. The company's short-term assets (CN¥1 billion) fall short of covering its short-term liabilities (CN¥1.2 billion), indicating liquidity challenges. However, the company maintains a satisfactory net debt-to-equity ratio of 10%, with interest payments well covered by EBIT and operating cash flow covering debt effectively at 41.7%.

- Click to explore a detailed breakdown of our findings in Hunan Mendale HometextileLtd's financial health report.

- Review our historical performance report to gain insights into Hunan Mendale HometextileLtd's track record.

Taking Advantage

- Take a closer look at our Asian Penny Stocks list of 953 companies by clicking here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:968

Xinyi Solar Holdings

An investment holding company, produces, sells, and trades in solar glass products in Mainland China, rest of Asia, North America, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives