Asian Market Gems: 3 Stocks That Might Be Undervalued In July 2025

Reviewed by Simply Wall St

As global markets experience mixed performances, with the U.S. indices reaching record highs and Asian markets showing varied results, investors are increasingly turning their attention to potential opportunities in Asia. In this environment, identifying undervalued stocks can be a strategic move for those looking to capitalize on market inefficiencies and economic developments across the region.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥37.49 | CN¥74.86 | 49.9% |

| T'Way Air (KOSE:A091810) | ₩2010.00 | ₩3982.45 | 49.5% |

| Taiyo Yuden (TSE:6976) | ¥2573.00 | ¥5104.72 | 49.6% |

| Shanghai Conant Optical (SEHK:2276) | HK$37.15 | HK$73.81 | 49.7% |

| Serko (NZSE:SKO) | NZ$3.16 | NZ$6.27 | 49.6% |

| Lai Yih Footwear (TWSE:6890) | NT$287.50 | NT$571.27 | 49.7% |

| HL Holdings (KOSE:A060980) | ₩41150.00 | ₩81496.10 | 49.5% |

| Hibino (TSE:2469) | ¥2360.00 | ¥4702.31 | 49.8% |

| Darbond Technology (SHSE:688035) | CN¥39.35 | CN¥78.37 | 49.8% |

| APAC Realty (SGX:CLN) | SGD0.475 | SGD0.95 | 49.8% |

Let's uncover some gems from our specialized screener.

China National Software & Service (SHSE:600536)

Overview: China National Software & Service Company Limited operates as a software company in China with a market cap of CN¥42.51 billion.

Operations: The company's revenue segment is comprised of its Software Service Business, generating CN¥5.14 billion.

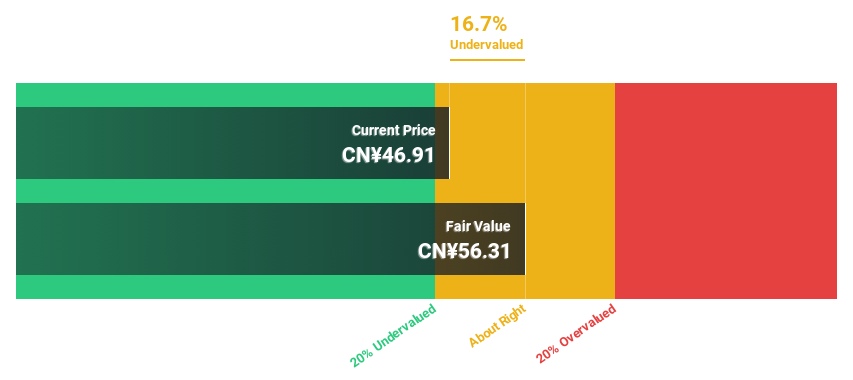

Estimated Discount To Fair Value: 10.4%

China National Software & Service is trading at approximately 10.4% below its estimated fair value of CN¥50.62, with a current price of CN¥45.36, suggesting potential undervaluation based on cash flows. Despite reporting a net loss of CN¥80.62 million for Q1 2025, the company is forecasted to achieve profitability within three years and expects revenue growth at 15.7% annually, surpassing the Chinese market average growth rate of 12.4%.

- The analysis detailed in our China National Software & Service growth report hints at robust future financial performance.

- Get an in-depth perspective on China National Software & Service's balance sheet by reading our health report here.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector, focusing on the production of bio-based materials and ingredients, with a market cap of CN¥9.11 billion.

Operations: Revenue segments for the company are not provided in the text.

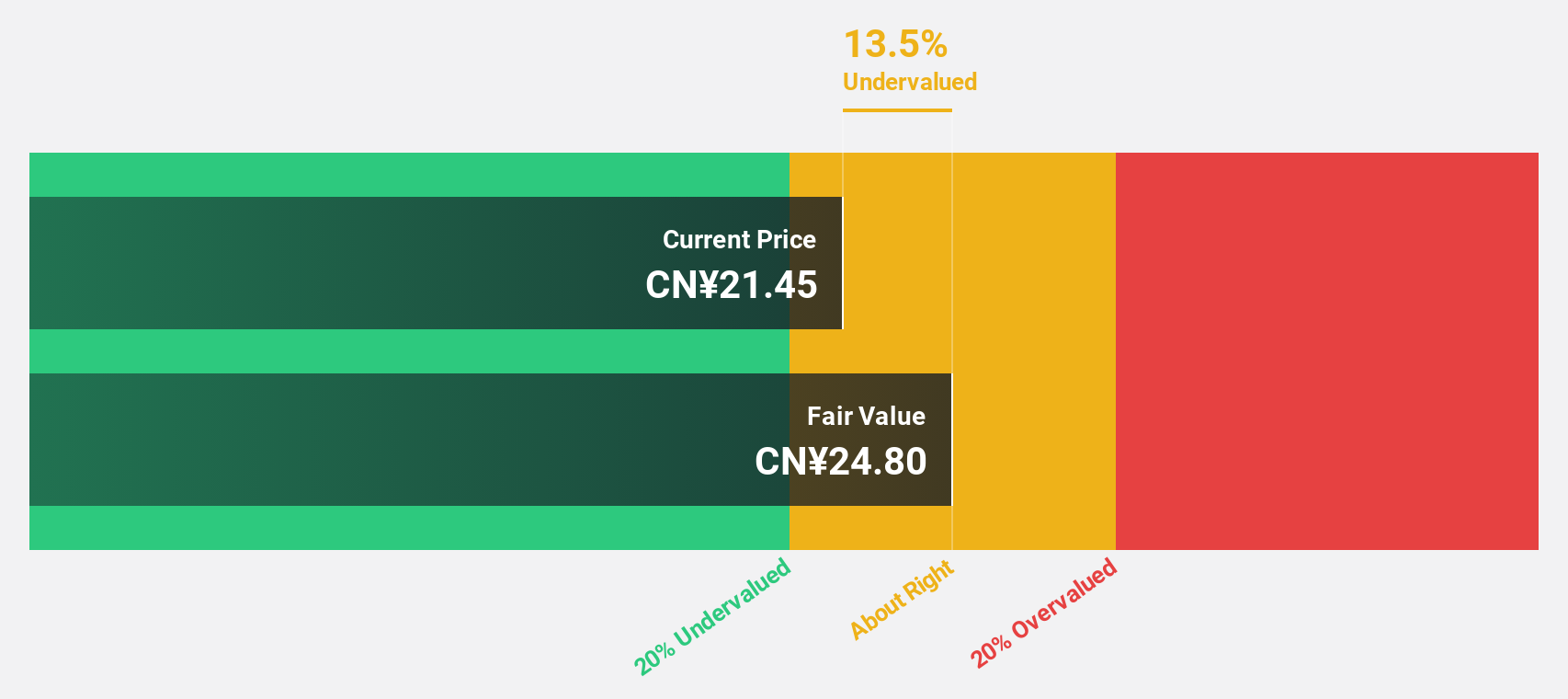

Estimated Discount To Fair Value: 12.6%

Shandong Bailong Chuangyuan Bio-Tech is trading at CN¥21.68, below its estimated fair value of CN¥24.8, indicating potential undervaluation based on cash flows. The company reported Q1 2025 revenue of CN¥313.3 million, up from CN¥252.11 million the previous year, with net income rising to CN¥81.42 million from CN¥53.54 million. Despite a volatile share price and low dividend coverage by free cash flow, revenue is forecasted to grow faster than the market at 20.1% annually.

- Our growth report here indicates Shandong Bailong Chuangyuan Bio-Tech may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Shandong Bailong Chuangyuan Bio-Tech's balance sheet health report.

Ninebot (SHSE:689009)

Overview: Ninebot Limited is involved in the design, R&D, production, sale, and servicing of transportation and robot products globally with a market cap of CN¥43.46 billion.

Operations: Ninebot Limited generates revenue through its global engagement in the design, R&D, production, sale, and servicing of transportation and robot products.

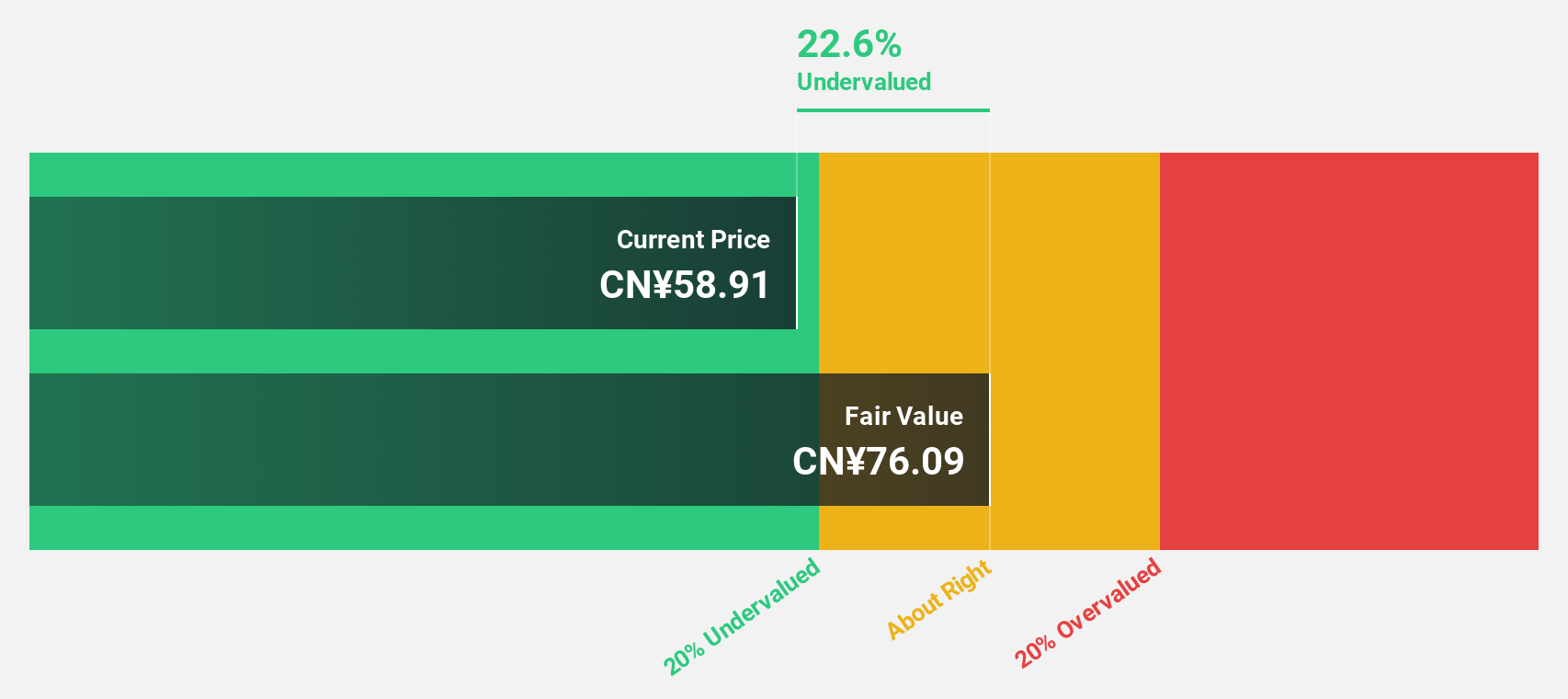

Estimated Discount To Fair Value: 20.4%

Ninebot Limited's recent earnings report showed a significant increase in revenue to CNY 5.11 billion from CNY 2.56 billion year-on-year, with net income rising to CNY 456.17 million. Trading at CN¥60.6, it is considered undervalued based on discounted cash flow analysis, below its fair value of CN¥76.09 by over 20%. With expected annual profit growth of 27%, surpassing the market average, Ninebot presents potential for investors focused on cash flow valuation metrics.

- Upon reviewing our latest growth report, Ninebot's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Ninebot stock in this financial health report.

Key Takeaways

- Navigate through the entire inventory of 269 Undervalued Asian Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ninebot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:689009

Ninebot

Engages in the design, research and development, production, sale, and servicing of transportation and robot products worldwide.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives