As global markets grapple with trade tensions and economic uncertainties, the Asian market remains a focal point for investors seeking stability and growth opportunities. In this environment, dividend stocks in Asia offer potential value as they provide consistent income streams, which can be particularly appealing amid fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.17% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.79% | ★★★★★★ |

| NCD (TSE:4783) | 4.00% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.47% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.11% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

| Daicel (TSE:4202) | 4.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.79% | ★★★★★★ |

Click here to see the full list of 1129 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market cap of approximately HK$138.31 billion.

Operations: Lenovo Group's revenue is primarily derived from its Intelligent Devices Group ($50.53 billion), Solutions and Services Group ($8.46 billion), and Infrastructure Solutions Group ($14.52 billion).

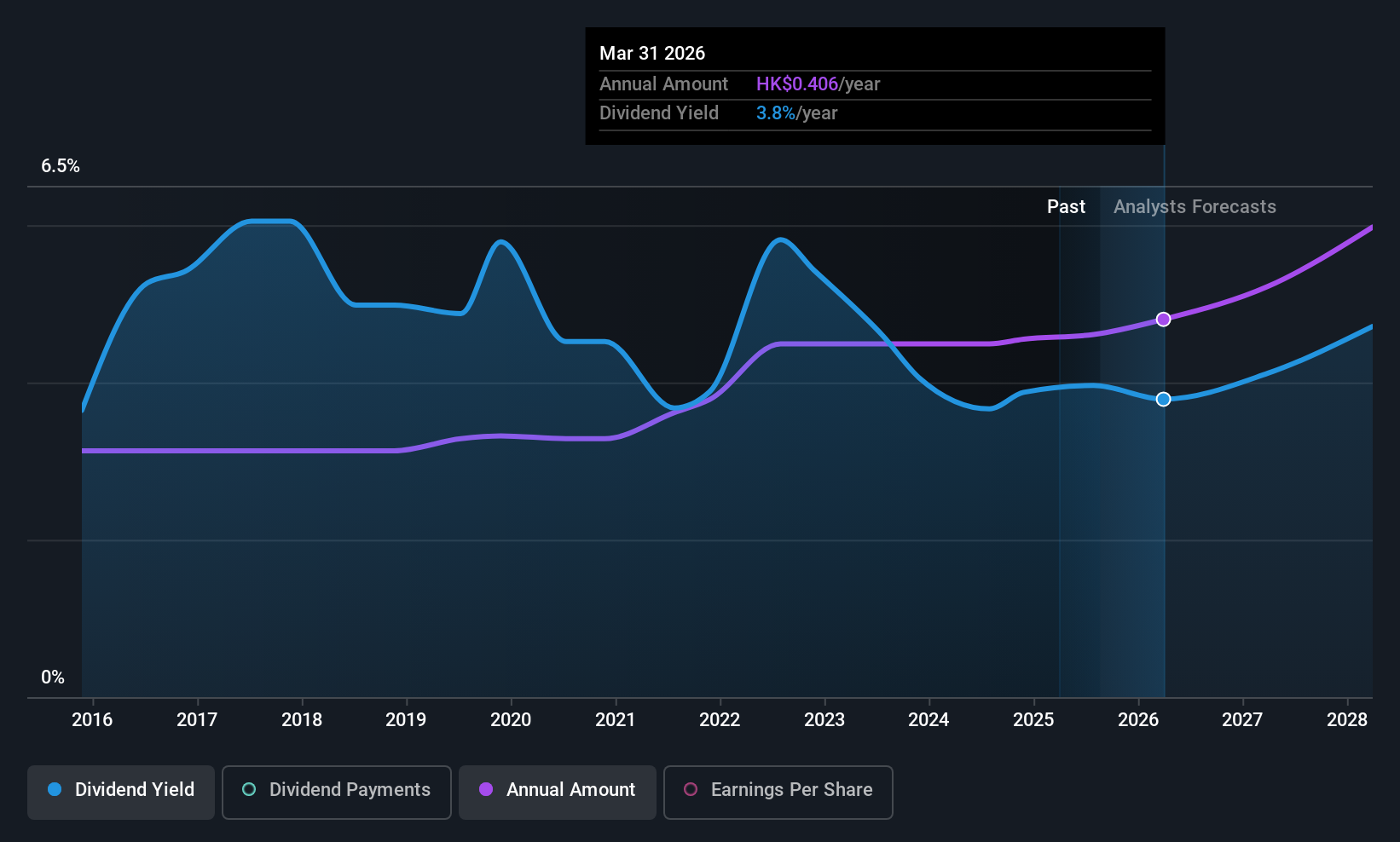

Dividend Yield: 3.5%

Lenovo Group's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 44.4%, indicating they are well-covered by earnings. However, the dividend yield of 3.5% is lower than the top quartile in Hong Kong's market, and concerns exist about coverage from free cash flows. Recent strategic partnerships and product innovations may bolster future financial performance, potentially impacting its ability to sustain or increase dividends further.

- Click here and access our complete dividend analysis report to understand the dynamics of Lenovo Group.

- Insights from our recent valuation report point to the potential undervaluation of Lenovo Group shares in the market.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD11.18 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates revenue primarily through its shipbuilding operations across multiple international markets, including Canada, Japan, Italy, Greece, Germany, Bulgaria, the United Kingdom, and Singapore.

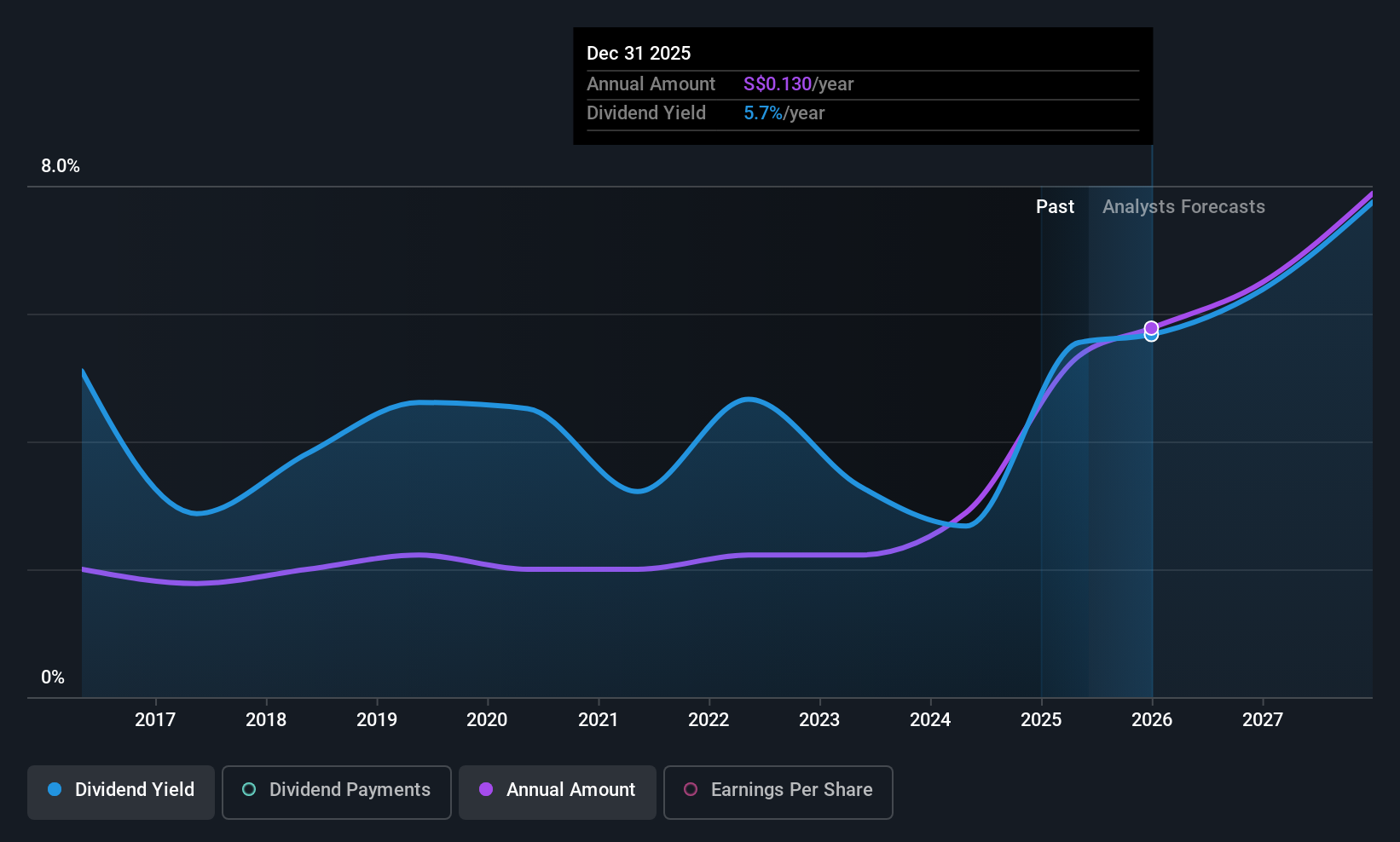

Dividend Yield: 4.2%

Yangzijiang Shipbuilding's dividends have been stable and growing over the past decade, supported by a low payout ratio of 32.7%, indicating strong coverage by earnings. Despite a reliable dividend yield of 4.18%, it falls short compared to the top quartile in Singapore's market. Recent earnings growth, with net income rising to CNY 4.18 billion, highlights financial strength that may support continued dividend payments, though its yield remains less competitive among peers.

- Click here to discover the nuances of Yangzijiang Shipbuilding (Holdings) with our detailed analytical dividend report.

- The analysis detailed in our Yangzijiang Shipbuilding (Holdings) valuation report hints at an deflated share price compared to its estimated value.

Test Research (TWSE:3030)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Test Research, Inc. designs, assembles, manufactures, sells, and maintains automated inspection and testing equipment globally, with a market cap of NT$37.91 billion.

Operations: Test Research, Inc.'s revenue is primarily derived from the design, assembly, manufacture, sale, and maintenance of automatic testing equipment, amounting to NT$6.79 billion.

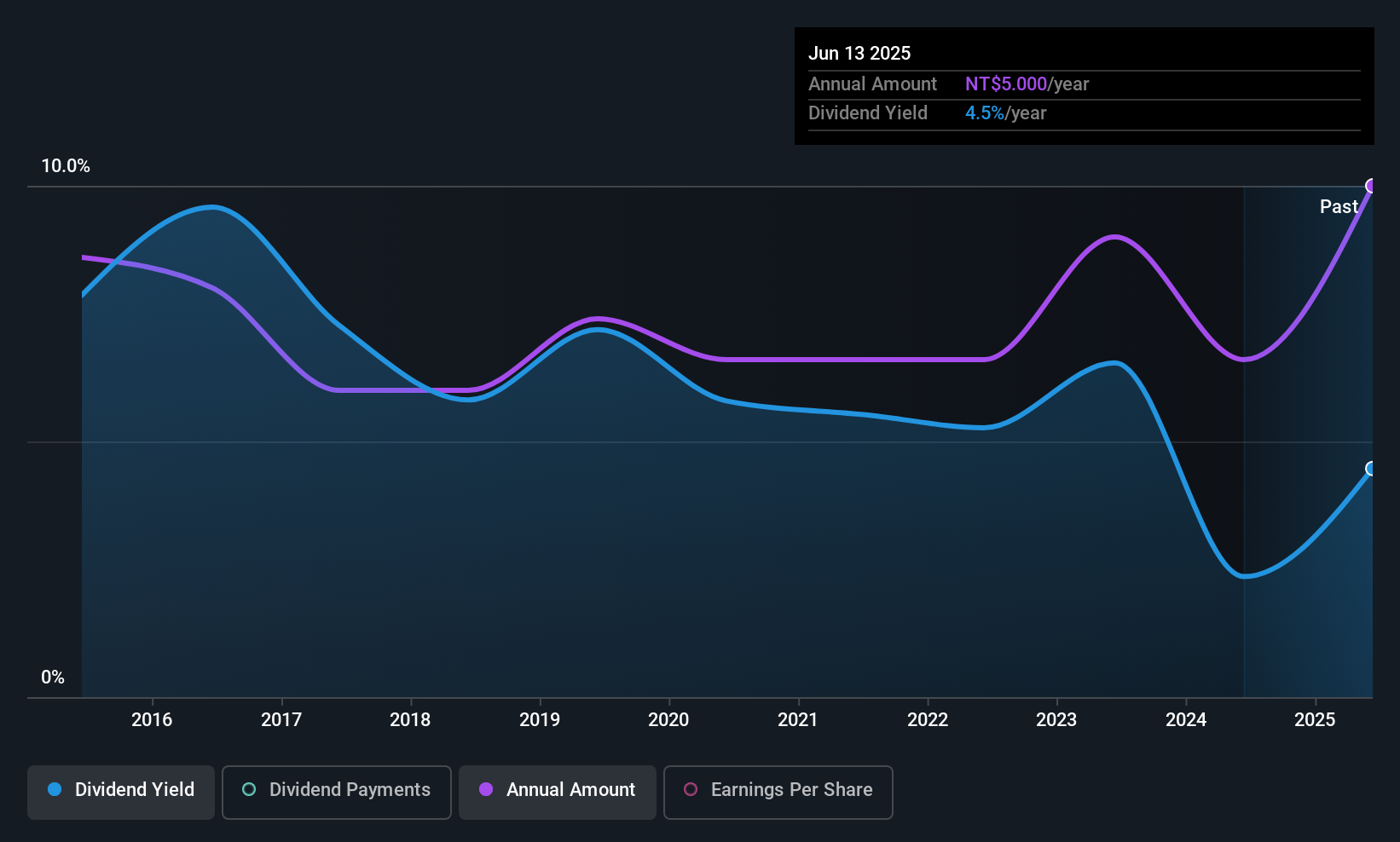

Dividend Yield: 3.1%

Test Research's dividends have increased over the past decade, though they remain volatile and unreliable. The recent dividend increase to TWD 5 per share reflects improved earnings, with net income rising to TWD 1.1 billion for the first half of 2025. Despite a reasonable payout ratio of 60.3% and coverage by cash flows, its yield of 3.12% is below Taiwan's top quartile, suggesting limited competitiveness in dividend returns compared to leading payers in the market.

- Delve into the full analysis dividend report here for a deeper understanding of Test Research.

- Upon reviewing our latest valuation report, Test Research's share price might be too optimistic.

Taking Advantage

- Delve into our full catalog of 1129 Top Asian Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BS6

Yangzijiang Shipbuilding (Holdings)

An investment holding company, engages in the shipbuilding activities in the Greater China, Canada, Japan, Italy, Greece, Germany, Bulgaria, United Kingdom, Singapore, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives