- Japan

- /

- Construction

- /

- TSE:1885

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience a wave of optimism due to easing trade tensions and positive economic indicators, Asian economies are showing signs of resilience, with stock indices reflecting this upward momentum. In this environment, dividend stocks in Asia can offer investors potential stability and income generation, making them an attractive addition to a diversified portfolio.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| NCD (TSE:4783) | 4.28% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.45% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.03% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 5.00% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.11% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

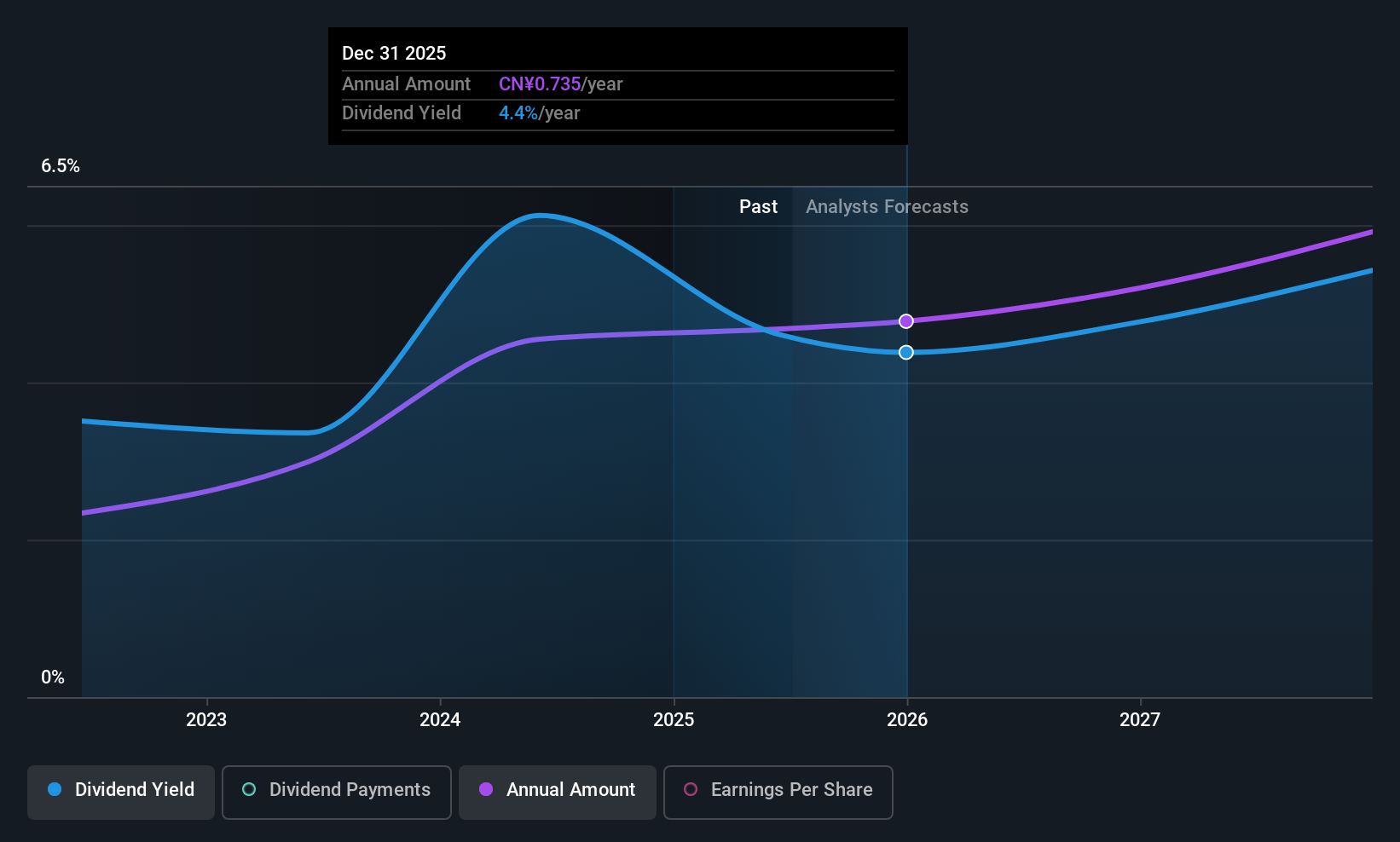

Beijing Caishikou Department StoreLtd (SHSE:605599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Caishikou Department Store Co., Ltd. operates a department store business and has a market cap of CN¥13.41 billion.

Operations: Beijing Caishikou Department Store Co., Ltd. generates its revenue primarily from the sale of gold and jewellery, amounting to CN¥22.14 billion.

Dividend Yield: 4.2%

Beijing Caishikou Department Store Ltd. offers a compelling dividend profile with a 4.18% yield, placing it in the top 25% of CN market payers. The company's dividends are well-covered by earnings and cash flow, boasting payout ratios of 73.5% and 45.8%, respectively. Despite only three years of dividend history, payments have been stable and growing with minimal volatility. Recent Q1 results showed increased revenue (CNY 8.22 billion) and net income (CNY 319.67 million).

- Click here to discover the nuances of Beijing Caishikou Department StoreLtd with our detailed analytical dividend report.

- The analysis detailed in our Beijing Caishikou Department StoreLtd valuation report hints at an inflated share price compared to its estimated value.

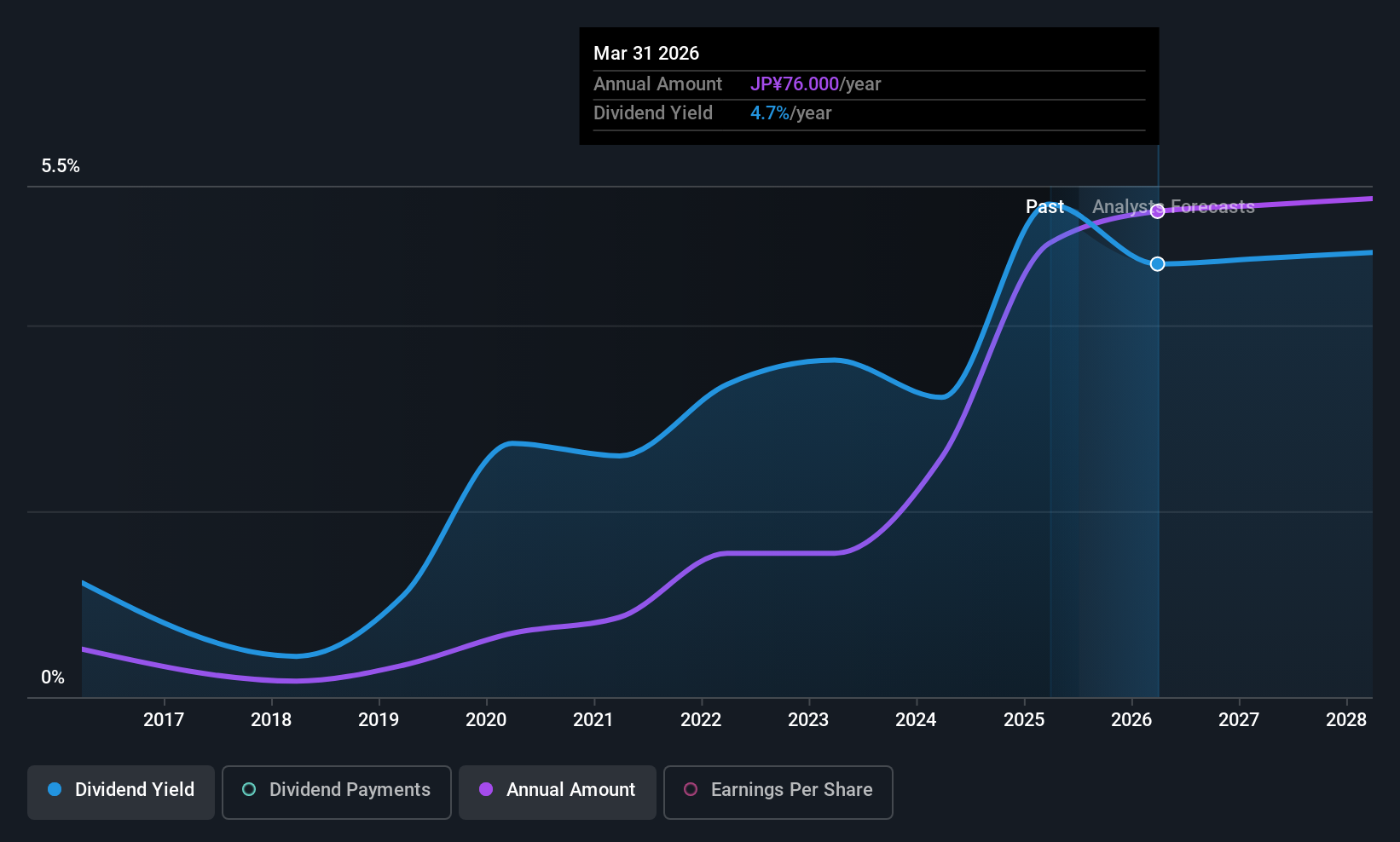

TOA (TSE:1885)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TOA Corporation, with a market cap of ¥128.24 billion, offers construction and engineering services in Japan.

Operations: TOA Corporation's revenue segments include construction services at ¥159.75 billion and engineering services at ¥28.43 billion.

Dividend Yield: 4.7%

TOA Corporation's dividend yield of 4.67% ranks it among the top 25% in Japan, yet its dividends are not well-covered by free cash flow despite a low payout ratio of 22.8%. The company's earnings have grown significantly, but dividend payments have been volatile over the past decade. Recent developments include a share buyback program aimed at enhancing shareholder returns and an increased year-end dividend to ¥76 per share, reflecting improved business performance.

- Navigate through the intricacies of TOA with our comprehensive dividend report here.

- Our expertly prepared valuation report TOA implies its share price may be lower than expected.

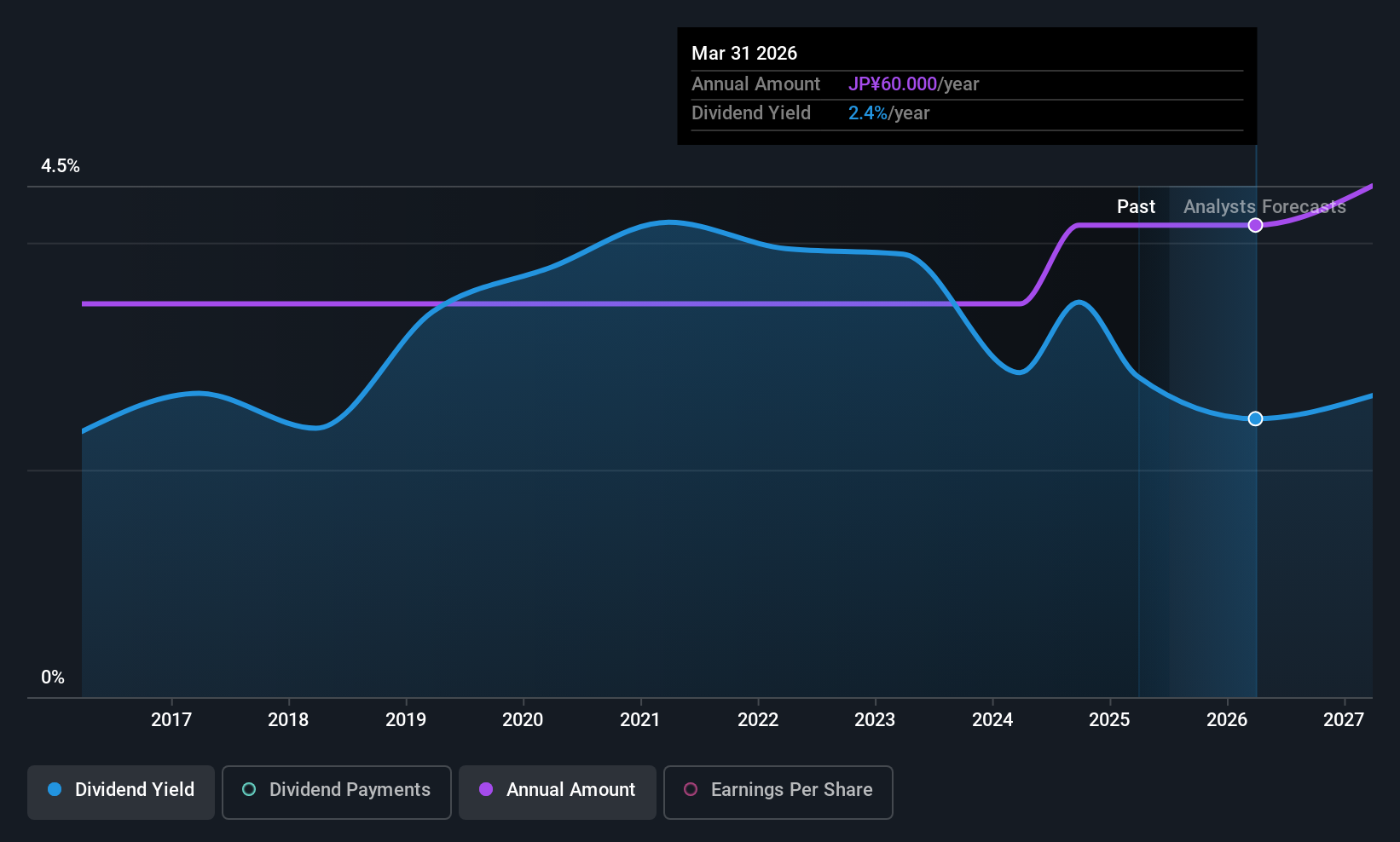

FurukawaLtd (TSE:5715)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Furukawa Co., Ltd., with a market cap of ¥77.63 billion, operates globally through its subsidiaries to manufacture and sell machinery, metals, electronics, and chemical products.

Operations: Furukawa Co., Ltd. generates revenue through its global operations in manufacturing and selling machinery, metals, electronics, and chemical products.

Dividend Yield: 3.1%

Furukawa Ltd.'s dividend yield of 3.1% is below the top tier in Japan, with dividends not well covered by free cash flows despite a low payout ratio of 20.9%. Dividends have grown steadily over the past decade, although recent reductions from ¥55 to ¥30 per share indicate volatility. The company projects earnings growth for fiscal year ending March 2026, and recent management changes aim to strengthen its corporate foundation for sustainable growth.

- Click to explore a detailed breakdown of our findings in FurukawaLtd's dividend report.

- Our comprehensive valuation report raises the possibility that FurukawaLtd is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Explore the 1223 names from our Top Asian Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1885

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives