- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1258

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate economic uncertainties and trade tensions, Asian markets have shown resilience with China's recent stimulus efforts providing a boost to investor sentiment. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors looking to enhance their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.46% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.07% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.22% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.30% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.17% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.40% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

Click here to see the full list of 1251 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

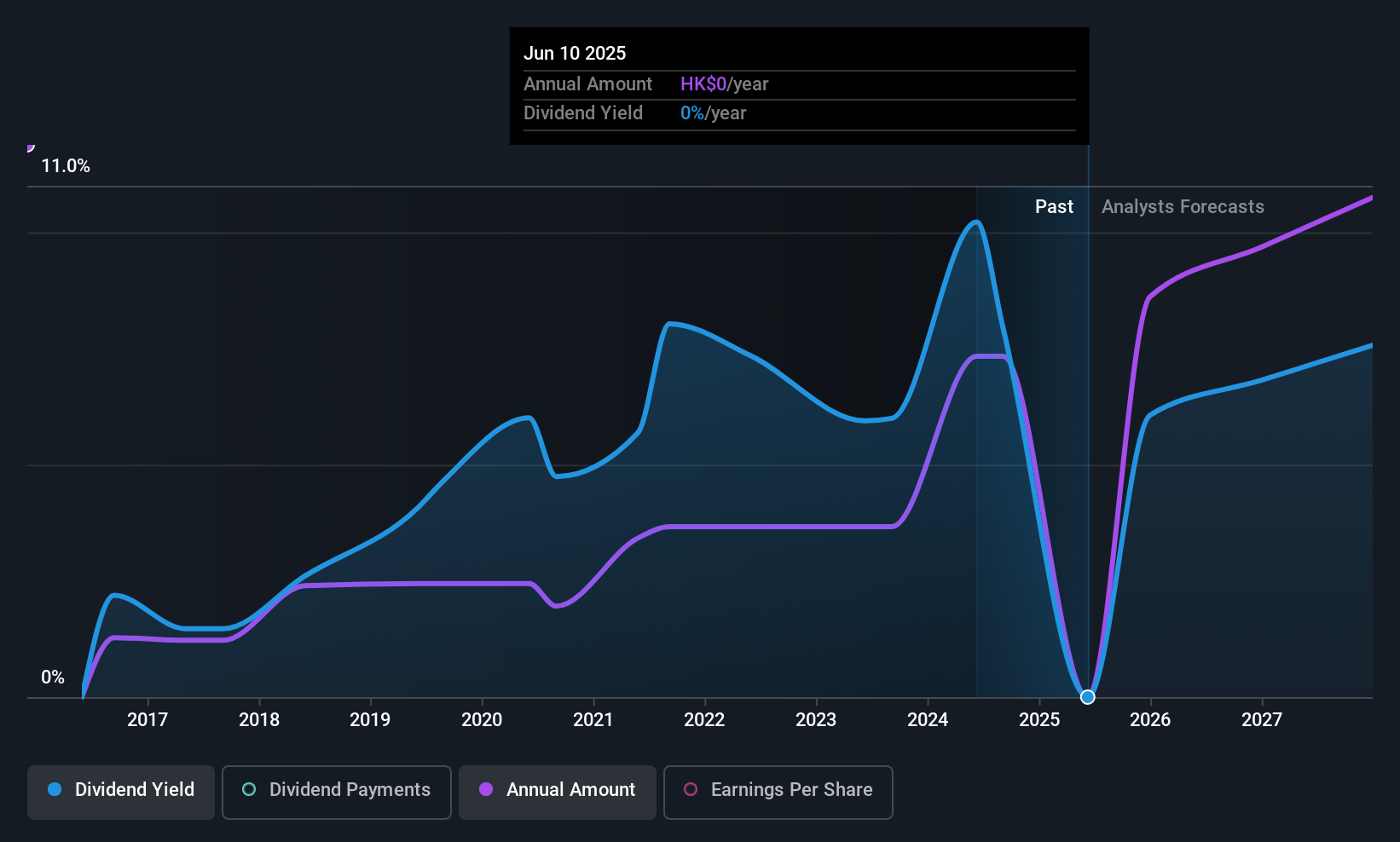

China Nonferrous Mining (SEHK:1258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Nonferrous Mining Corporation Limited operates in the exploration, mining, ore processing, leaching, smelting, and sale of copper and cobalt primarily in Zambia and the Democratic Republic of Congo with a market capitalization of HK$24.78 billion.

Operations: China Nonferrous Mining Corporation Limited generates revenue from its leaching operations, amounting to $1.09 billion, and smelting operations, totaling $2.77 billion.

Dividend Yield: 5.3%

China Nonferrous Mining's dividend payments have been volatile, with an unreliable track record over the past decade. Despite this, recent improvements in earnings and cash flow coverage indicate a sustainable payout ratio of 41.5% and a cash payout ratio of 27.6%. The company recently proposed a final ordinary dividend of US$0.042893 per share for 2024, amidst strong financial performance driven by increased copper production and rising global copper prices. However, its dividend yield remains below top-tier levels in Hong Kong.

- Click to explore a detailed breakdown of our findings in China Nonferrous Mining's dividend report.

- The valuation report we've compiled suggests that China Nonferrous Mining's current price could be quite moderate.

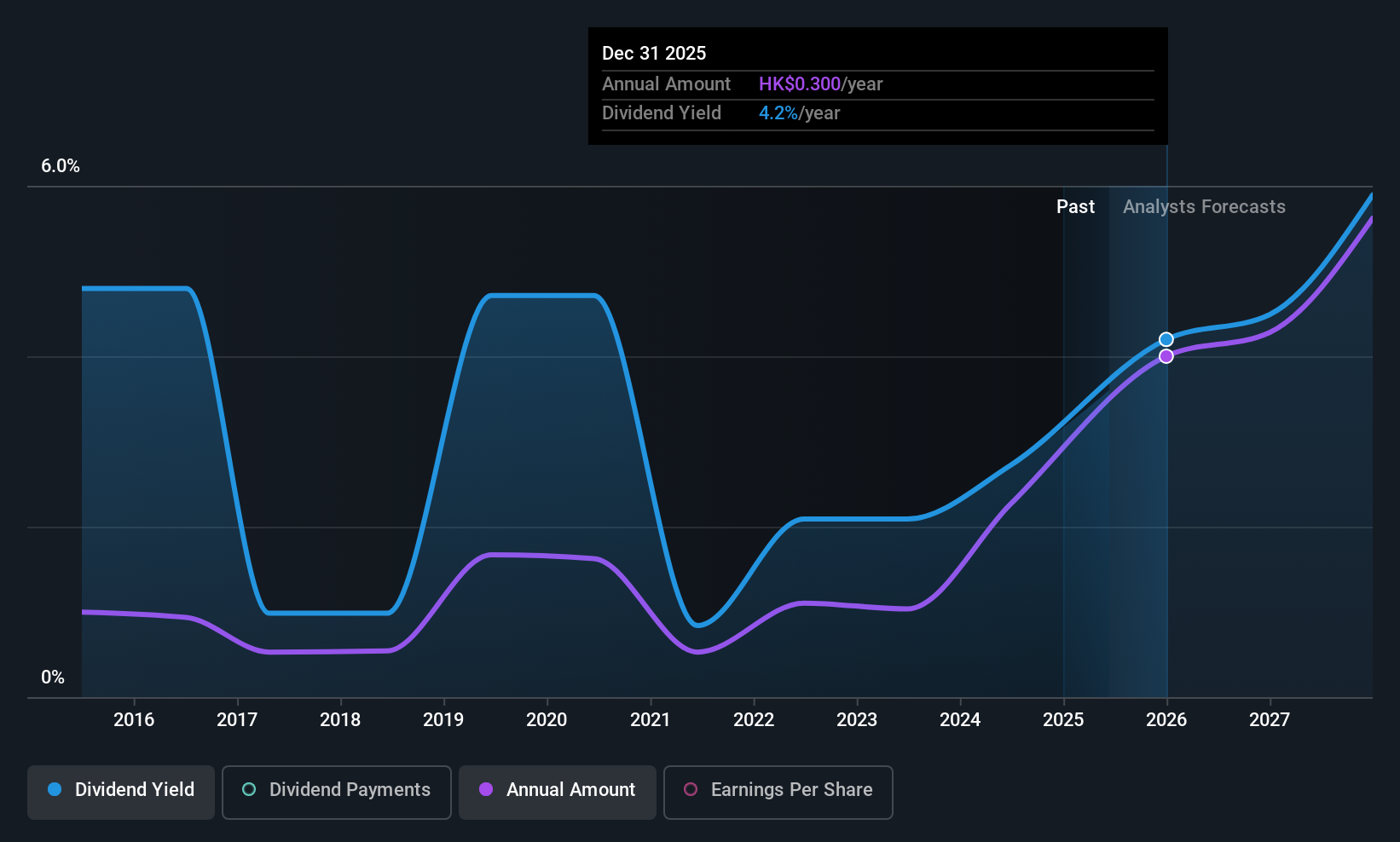

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consun Pharmaceutical Group Limited focuses on the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China, with a market cap of HK$9.70 billion.

Operations: Consun Pharmaceutical Group's revenue is primarily derived from the Consun Pharmaceutical Segment, contributing CN¥2.53 billion, and the Yulin Pharmaceutical Segment, contributing CN¥442.84 million.

Dividend Yield: 5.1%

Consun Pharmaceutical Group's dividends have been inconsistent over the past decade, despite a reasonable payout ratio of 50.8% and cash payout ratio of 46.8%, indicating coverage by earnings and cash flows. The company recently declared a final dividend of HK$0.3 per share for 2024, reflecting stable financial performance with net income growth to CNY910.46 million from CNY784.53 million previously, though its dividend yield is below Hong Kong's top-tier levels.

- Navigate through the intricacies of Consun Pharmaceutical Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Consun Pharmaceutical Group's share price might be too pessimistic.

CMOC Group (SEHK:3993)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CMOC Group Limited, along with its subsidiaries, is involved in the mining, beneficiation, smelting, and refining of base and rare metals with a market cap of approximately HK$171.51 billion.

Operations: CMOC Group Limited generates revenue through its operations in mining, beneficiation, smelting, and refining of base and rare metals.

Dividend Yield: 4.1%

CMOC Group's dividend yield of 4.08% is below the top 25% in Hong Kong, and its dividends have been volatile over the last decade despite a low payout ratio of 36.1%, indicating coverage by earnings and cash flows. Recent earnings growth to CNY3.95 billion for Q1 2025 from CNY2.07 billion previously highlights financial strength, though board changes may impact future stability. A proposed final dividend of RMB2.55 per share awaits shareholder approval on May 30, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of CMOC Group.

- Our valuation report unveils the possibility CMOC Group's shares may be trading at a discount.

Next Steps

- Take a closer look at our Top Asian Dividend Stocks list of 1251 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1258

China Nonferrous Mining

An investment holding company, engages in the exploration, mining, ore processing, leaching, smelting, and sale of copper and cobalt in Zambia and the Democratic Republic of Congo.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives