- Philippines

- /

- Food and Staples Retail

- /

- PSE:RRHI

Asian Dividend Stocks To Consider Now

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and trade-related concerns, Asian markets have experienced mixed performances, with Japan's stock market showing varied returns and Chinese indices reflecting deflationary pressures. In such an environment, dividend stocks can offer a degree of stability and income potential for investors seeking to navigate these uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.56% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.36% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.33% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.41% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.32% | ★★★★★★ |

| Daicel (TSE:4202) | 5.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.47% | ★★★★★★ |

Click here to see the full list of 1238 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

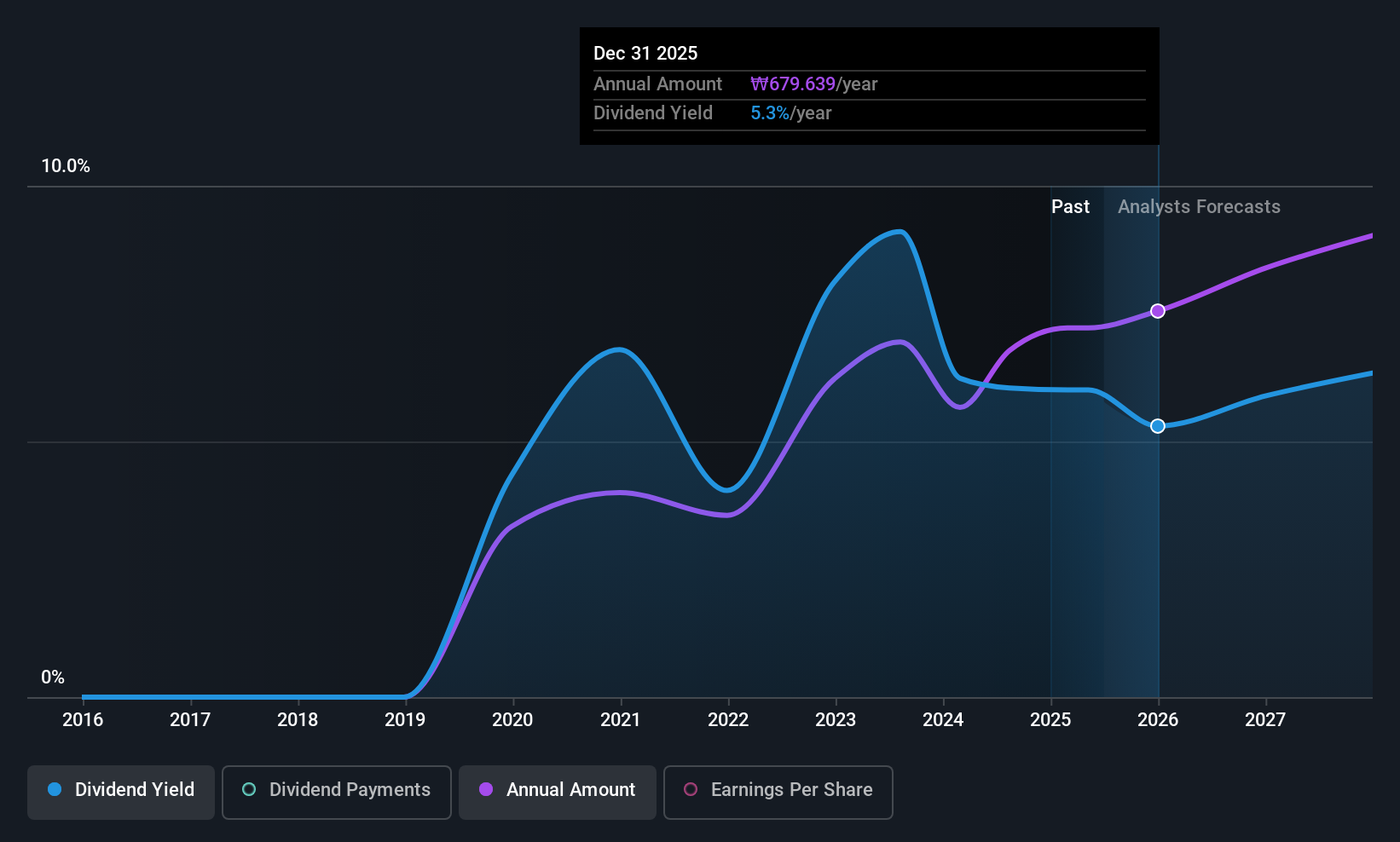

BNK Financial Group (KOSE:A138930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BNK Financial Group Inc., along with its subsidiaries, offers a range of financial products and services both in South Korea and internationally, with a market cap of approximately ₩3.80 trillion.

Operations: BNK Financial Group Inc. generates revenue through its subsidiaries, including Busan Bank with ₩1.29 trillion, Gyeongnam Bank with ₩954.54 billion, BNK Capital at ₩179.62 billion, BNK Savings Bank contributing ₩43.35 billion, and BNK Investments Securities at ₩76.07 billion.

Dividend Yield: 5.4%

BNK Financial Group's dividend yield is in the top 25% of the KR market, supported by a low payout ratio of 33.9%, indicating dividends are well covered by earnings. Despite trading at 60.4% below its estimated fair value and showing strong relative value compared to peers, its dividend history is volatile and unreliable, having been paid for only six years. Recent earnings reports show net income of KRW 166.6 billion for Q1 2025, reflecting ongoing profitability growth potential.

- Get an in-depth perspective on BNK Financial Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that BNK Financial Group is trading behind its estimated value.

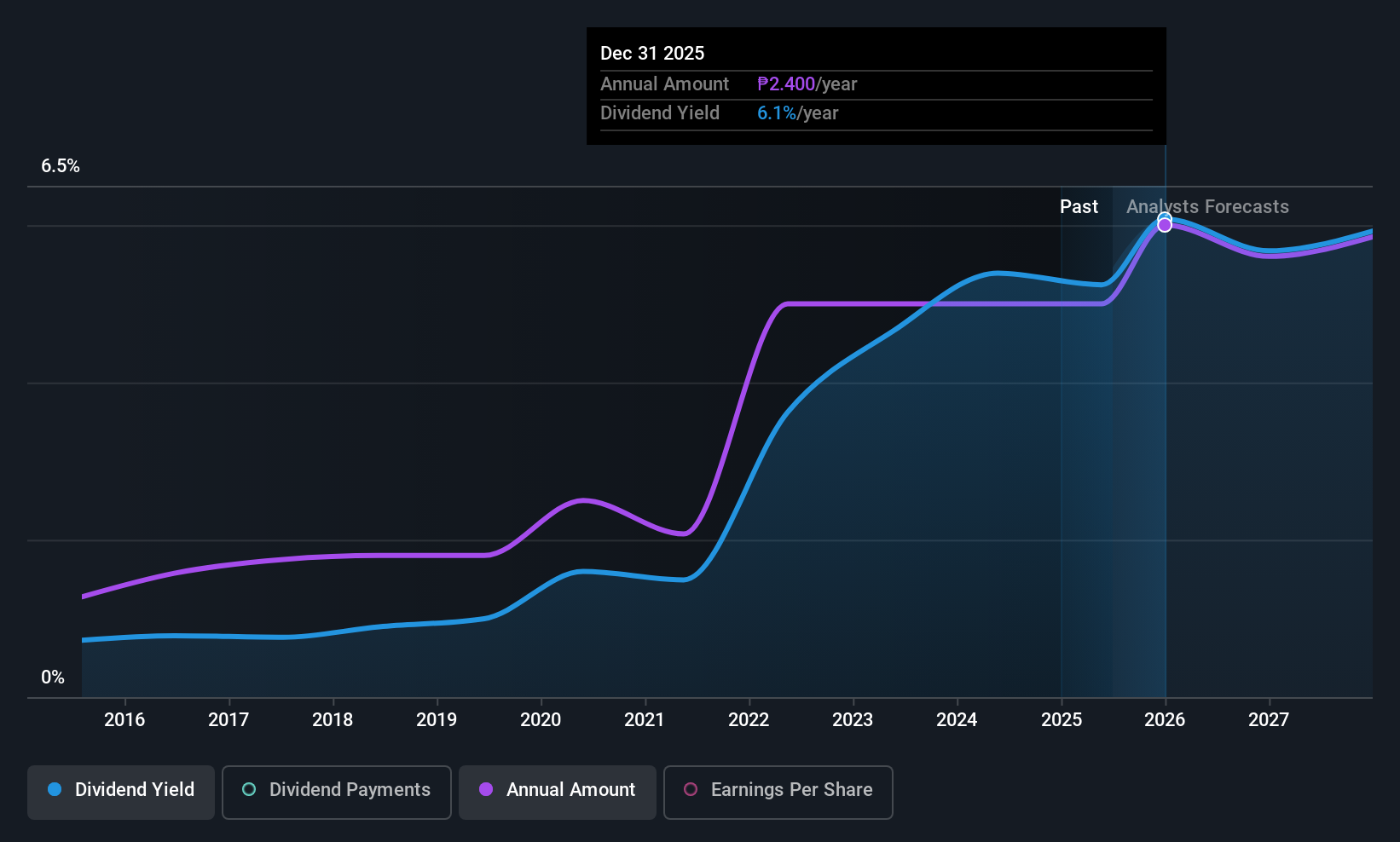

Robinsons Retail Holdings (PSE:RRHI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Robinsons Retail Holdings, Inc. is a multi-format retail company in the Philippines with a market capitalization of approximately ₱42.95 billion.

Operations: Robinsons Retail Holdings, Inc.'s revenue is derived from several segments including Food at ₱122.55 billion, Department Store at ₱16.85 billion, Specialty Stores at ₱14.85 billion, Drug Store Division at ₱36.78 billion, and Do It Yourself (DIY) at ₱11.75 billion.

Dividend Yield: 5.1%

Robinsons Retail Holdings offers a stable dividend profile with consistent payouts over the past decade. The company's recent PHP 2.00 per share dividend is well-supported by earnings and cash flows, with payout ratios of 48.2% and 27.9%, respectively, ensuring sustainability despite a lower yield compared to top Philippine payers. Recent executive changes following GCH Investment's divestment may impact governance but do not affect its reliable dividend track record or coverage by financial metrics.

- Take a closer look at Robinsons Retail Holdings' potential here in our dividend report.

- Our expertly prepared valuation report Robinsons Retail Holdings implies its share price may be lower than expected.

JBM (Healthcare) (SEHK:2161)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JBM (Healthcare) Limited is an investment holding company involved in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products across Hong Kong, Macau, Mainland China, and internationally with a market cap of HK$2.25 billion.

Operations: JBM (Healthcare) Limited generates its revenue from three main segments: Branded Medicines (HK$272.23 million), Health and Wellness Products (HK$104.61 million), and Proprietary Chinese Medicines (HK$405.45 million).

Dividend Yield: 8.3%

JBM (Healthcare) Limited has shown a strong dividend profile, with its recent HK$0.115 per share proposal supported by earnings and cash flows, maintaining payout ratios of 70.6% and 73.6%, respectively. Despite only three years of dividend history, payments have been stable and growing. The company's earnings surged to HK$197.26 million from HK$130.46 million year-over-year, bolstered by successful sales strategies in branded medicines and proprietary Chinese medicines segments across key markets.

- Navigate through the intricacies of JBM (Healthcare) with our comprehensive dividend report here.

- Our valuation report here indicates JBM (Healthcare) may be undervalued.

Turning Ideas Into Actions

- Reveal the 1238 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:RRHI

Robinsons Retail Holdings

Operates as a multi-format retail company in the Philippines.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives