- China

- /

- Electrical

- /

- SHSE:603855

Asian Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As global trade tensions and economic policies continue to shape market sentiment, Asian markets have experienced mixed performances with some regions showing resilience amid these challenges. In this environment, dividend stocks in Asia are gaining attention as investors seek stable returns and income generation amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.09% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.92% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.04% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.32% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

LF (KOSE:A093050)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LF Corp. manufactures and sells ready-to-wear apparel products in South Korea, China, and internationally with a market cap of ₩486.68 billion.

Operations: LF Corp.'s revenue segments consist of Fashion at ₩1.44 billion, Food at ₩379.03 million, and Financial services at ₩215.91 million.

Dividend Yield: 3.9%

LF Corp. has demonstrated a commitment to enhancing shareholder value with its recent share repurchase program, which may positively impact its dividend profile. Although LF has only been paying dividends for six years, the payments have been stable and are well-covered by earnings and cash flows, with payout ratios of 25.5% and 19.7% respectively. The company's dividend yield is competitive in the Korean market at 3.95%, slightly above the market average of 3.82%.

- Click here and access our complete dividend analysis report to understand the dynamics of LF.

- Insights from our recent valuation report point to the potential undervaluation of LF shares in the market.

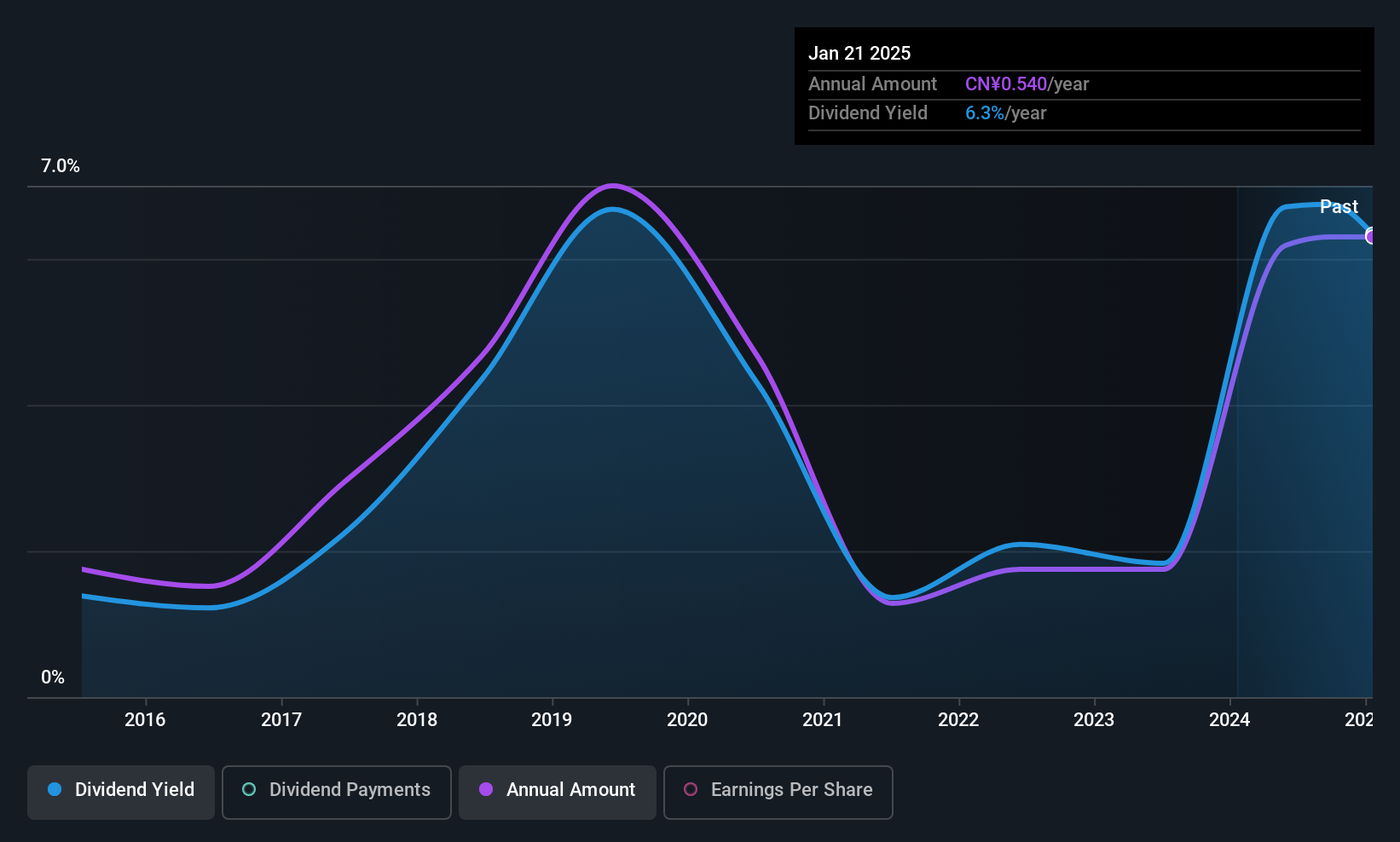

Bohai Ferry Group (SHSE:603167)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bohai Ferry Group Co., Ltd. operates in the water transportation sector in China with a market cap of CN¥4.71 billion.

Operations: Bohai Ferry Group Co., Ltd. generates revenue primarily from its water transportation business in China.

Dividend Yield: 8%

Bohai Ferry Group's dividend yield of 7.98% ranks in the top 25% of CN market payers, but its sustainability is questionable due to a high payout ratio of 117.6%. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent earnings show a decrease in revenue to CNY 314.52 million for Q1 2025 compared to last year, with net income also dropping slightly, highlighting potential challenges for future dividend stability.

- Click to explore a detailed breakdown of our findings in Bohai Ferry Group's dividend report.

- The analysis detailed in our Bohai Ferry Group valuation report hints at an deflated share price compared to its estimated value.

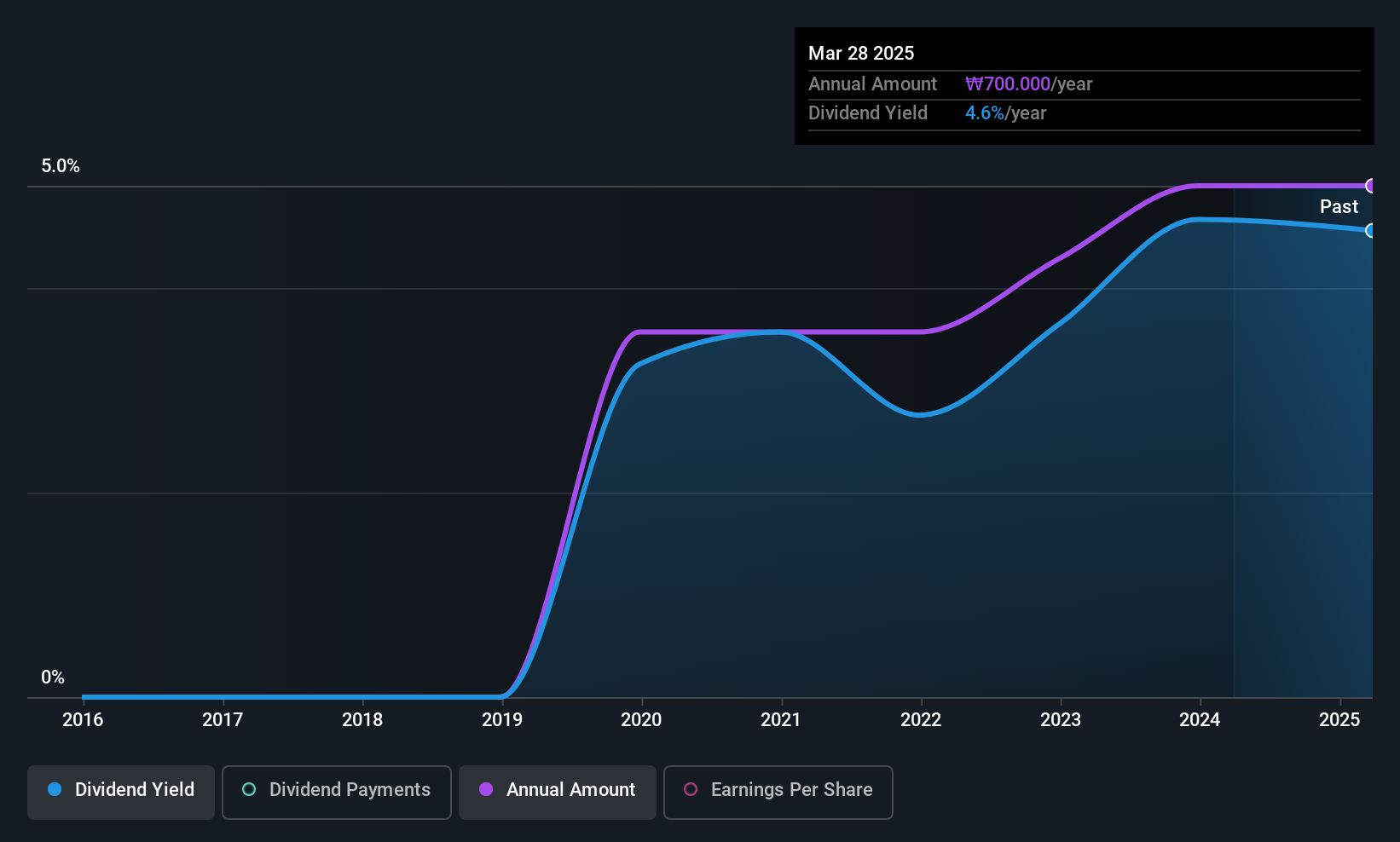

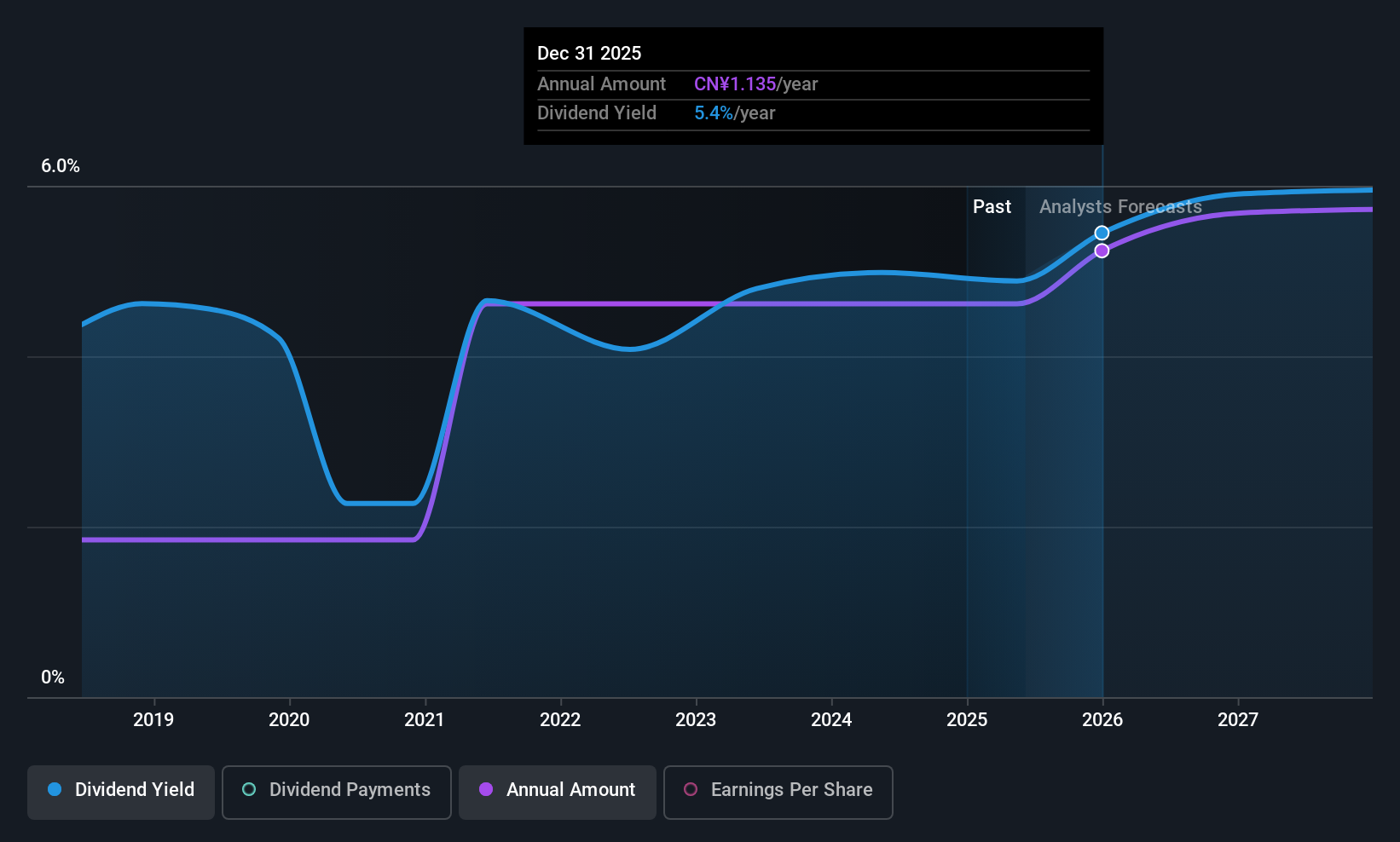

Warom Technology (SHSE:603855)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Warom Technology Incorporated Company specializes in researching, developing, manufacturing, and supplying explosion-proof electric apparatus and professional lighting equipment both in China and internationally, with a market cap of CN¥7.26 billion.

Operations: Warom Technology generates revenue from the development and supply of explosion-proof electric apparatus and professional lighting equipment for both domestic and international markets.

Dividend Yield: 4.6%

Warom Technology's dividend yield of 4.56% places it among the top 25% of CN market payers, supported by a sustainable payout ratio of 68.6%. Despite only seven years of dividend history, payments have been stable and growing. Recent earnings for Q1 2025 showed an increase in revenue to CNY 797.98 million and net income to CNY 116.07 million, indicating robust financial health that supports continued dividend payments covered by both earnings and cash flows.

- Click here to discover the nuances of Warom Technology with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Warom Technology is trading behind its estimated value.

Summing It All Up

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1228 more companies for you to explore.Click here to unveil our expertly curated list of 1231 Top Asian Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warom Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603855

Warom Technology

Researches and develops, manufactures, and supplies explosion-proof electric apparatus and professional lighting equipment in China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives