- Japan

- /

- Construction

- /

- TSE:6540

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience varied performances, with the U.S. indices reaching record highs and China's stock markets showing modest gains, investors are increasingly looking towards Asia for opportunities in dividend stocks. In this dynamic environment, a good dividend stock is often characterized by consistent payouts and strong fundamentals, making them appealing to those seeking steady income amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.05% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.09% | ★★★★★★ |

| NCD (TSE:4783) | 4.22% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.31% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.40% | ★★★★★★ |

| Daicel (TSE:4202) | 4.93% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.12% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 5.98% | ★★★★★★ |

Click here to see the full list of 1218 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

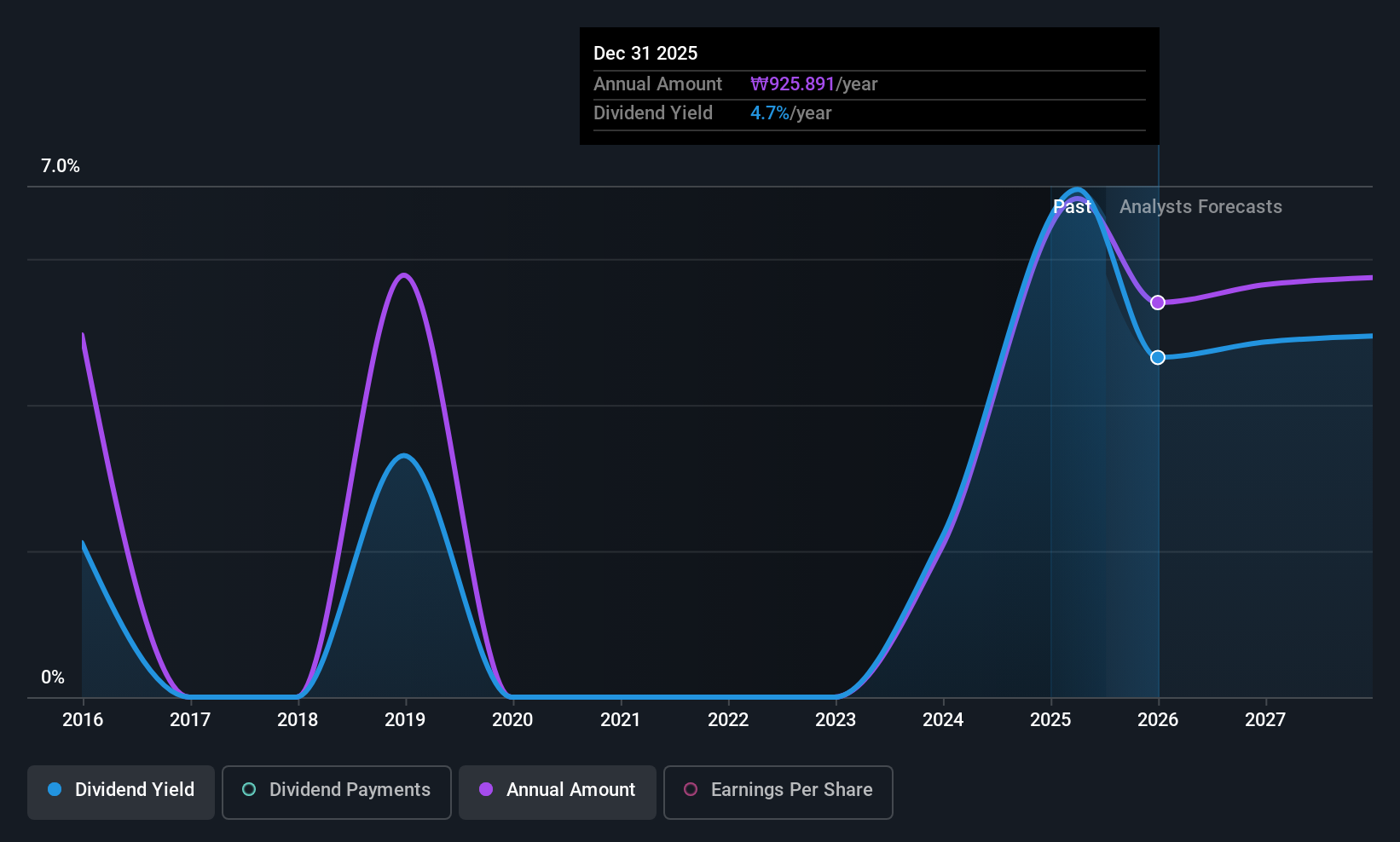

Kangwon Land (KOSE:A035250)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kangwon Land, Inc. operates in the casino, tourist hotel, and ski resort sectors in South Korea with a market cap of ₩3.97 trillion.

Operations: Kangwon Land, Inc.'s revenue is primarily derived from its operations in casinos, tourist hotels, and ski resorts in South Korea.

Dividend Yield: 5.9%

Kangwon Land offers a compelling dividend yield of 5.91%, placing it in the top 25% of dividend payers in the KR market. Despite a volatile and unstable dividend history, its current payout ratio of 53.8% suggests dividends are well-covered by earnings, while a cash payout ratio of 76.9% indicates coverage by cash flows. However, recent earnings have declined with net income at KRW 74.62 billion for Q1 2025, down from KRW 92.83 billion year-on-year, raising concerns about future sustainability amid forecasts for declining earnings over the next three years.

- Unlock comprehensive insights into our analysis of Kangwon Land stock in this dividend report.

- According our valuation report, there's an indication that Kangwon Land's share price might be on the cheaper side.

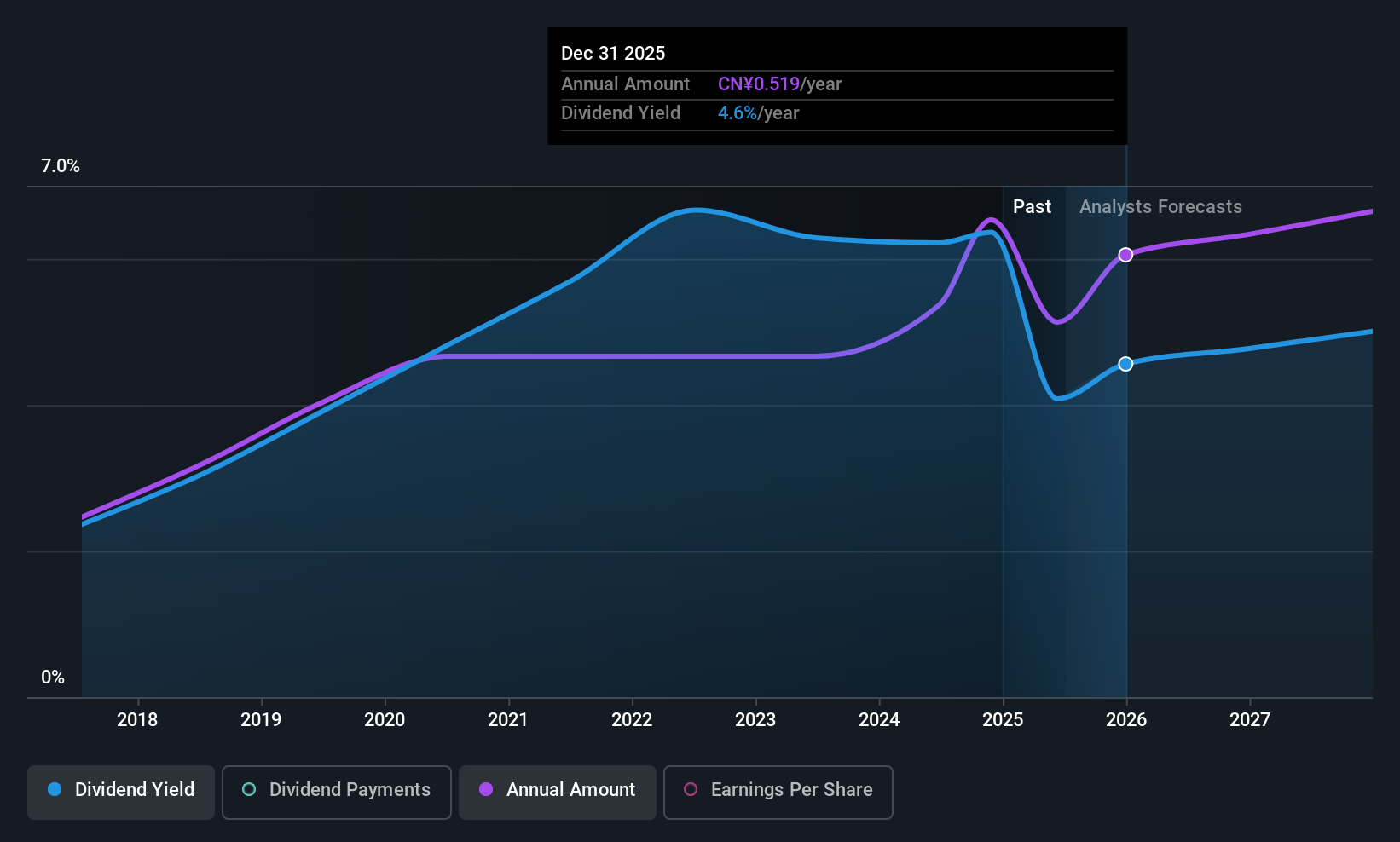

Bank of Shanghai (SHSE:601229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Shanghai Co., Ltd. offers a range of personal and corporate banking products and services mainly in Mainland China, with a market cap of CN¥162.41 billion.

Operations: Bank of Shanghai Co., Ltd. generates its revenue through diverse personal and corporate banking products and services in Mainland China.

Dividend Yield: 3.8%

Bank of Shanghai's dividend yield of 3.85% ranks it among the top 25% in China's market, though its dividend history is less than a decade old and marked by volatility with annual drops over 20%. The payout ratio is low at 31%, indicating dividends are well-covered by earnings, which grew modestly by 4.8% last year. Recent Q1 results show net income at ¥6.29 billion, up from ¥6.15 billion, supporting sustainable payouts despite past instability.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Shanghai.

- Upon reviewing our latest valuation report, Bank of Shanghai's share price might be too optimistic.

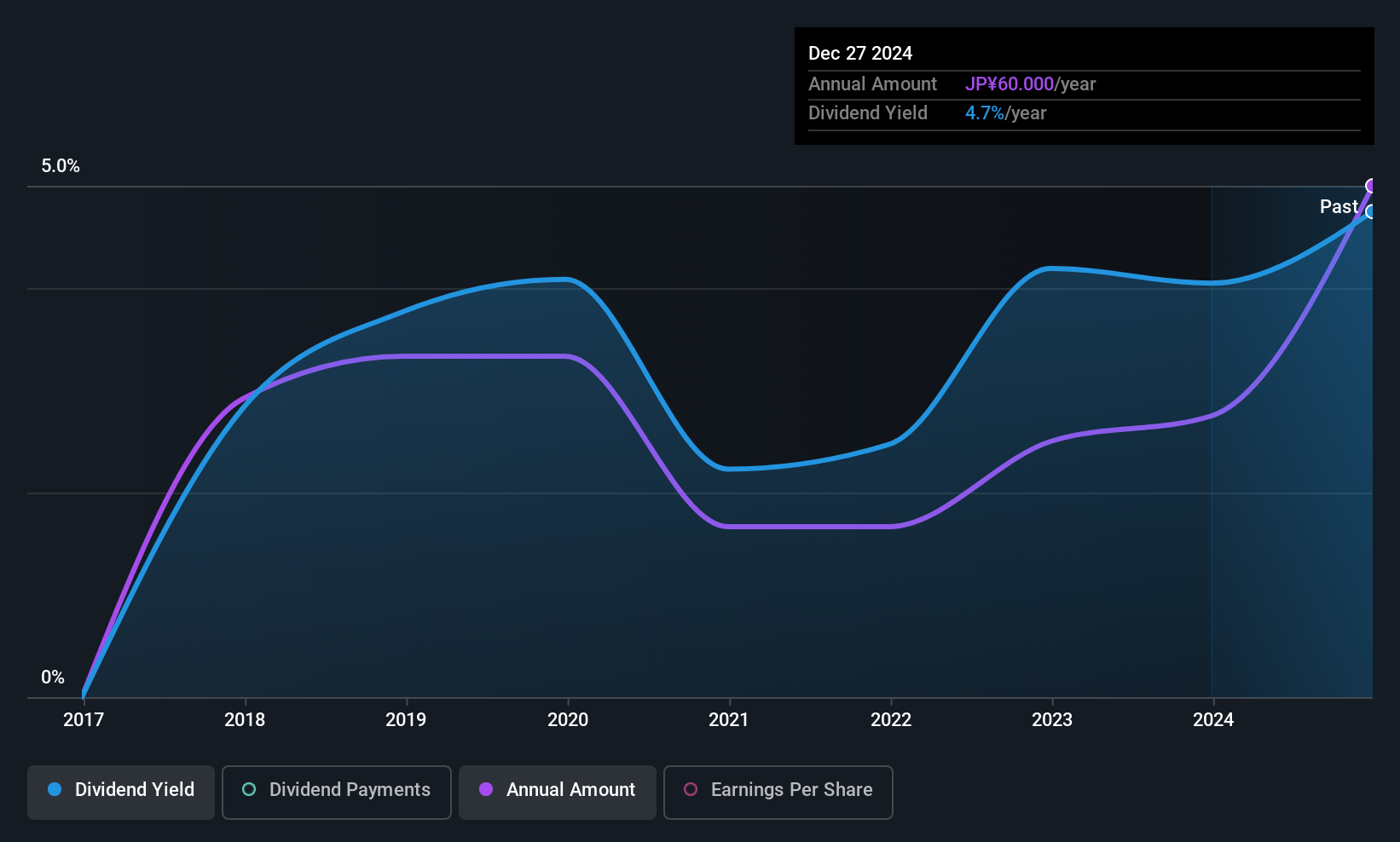

Semba (TSE:6540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Semba Corporation plans, designs, constructs, and supervises commercial spaces in Japan, Taiwan, and internationally with a market cap of ¥18.45 billion.

Operations: Semba Corporation generates revenue from planning, designing, constructing, and supervising commercial spaces across Japan, Taiwan, and international markets.

Dividend Yield: 4.3%

Semba's dividend yield of 4.34% places it in the top 25% of Japanese market payers, supported by a payout ratio of 36%, indicating strong earnings coverage. Despite only eight years of payments and volatility with drops over 20%, dividends are well-covered by cash flows, evidenced by a low cash payout ratio of 23.6%. Recent growth in earnings at 48.4% further supports potential sustainability, though its track record remains unstable.

- Delve into the full analysis dividend report here for a deeper understanding of Semba.

- The valuation report we've compiled suggests that Semba's current price could be quite moderate.

Key Takeaways

- Investigate our full lineup of 1218 Top Asian Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6540

Semba

Plans, designs, constructs, and supervises commercial spaces in Japan, Taiwan, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives