Stock Analysis

- Germany

- /

- Transportation

- /

- XTRA:SIX2

There Is A Reason Sixt SE's (ETR:SIX2) Price Is Undemanding

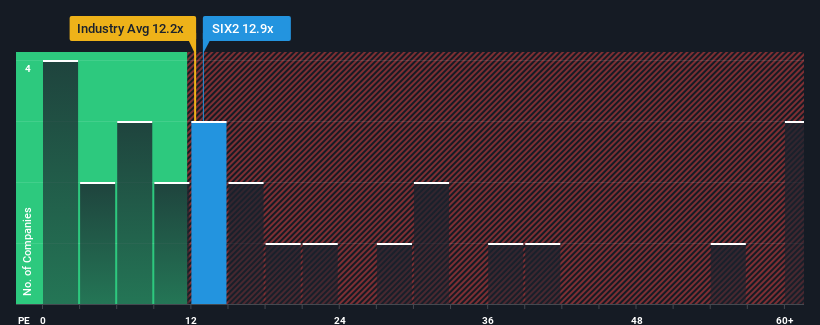

When close to half the companies in Germany have price-to-earnings ratios (or "P/E's") above 18x, you may consider Sixt SE (ETR:SIX2) as an attractive investment with its 12.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Sixt as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Sixt

Is There Any Growth For Sixt?

Sixt's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 2.6% per annum over the next three years. With the market predicted to deliver 14% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Sixt's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sixt maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Sixt (of which 1 is a bit unpleasant!) you should know about.

You might be able to find a better investment than Sixt. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Sixt is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:SIX2

Sixt

Sixt SE, through its subsidiaries, provides mobility services through corporate and franchise station network for private and business customers worldwide.

Adequate balance sheet and fair value.