Stock Analysis

- United States

- /

- Auto

- /

- NYSE:XPEV

Market Cool On XPeng Inc.'s (NYSE:XPEV) Revenues Pushing Shares 25% Lower

Unfortunately for some shareholders, the XPeng Inc. (NYSE:XPEV) share price has dived 25% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

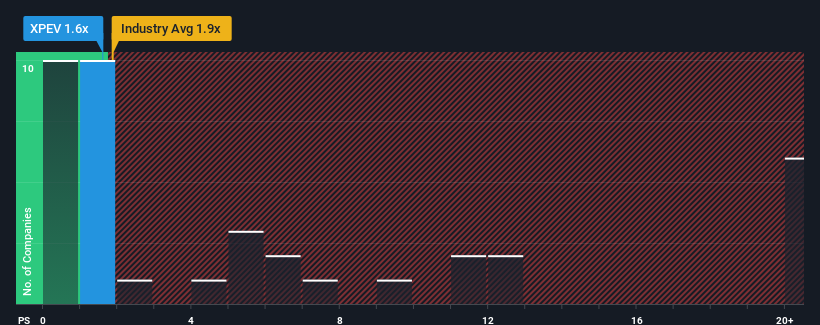

In spite of the heavy fall in price, it's still not a stretch to say that XPeng's price-to-sales (or "P/S") ratio of 1.6x right now seems quite "middle-of-the-road" compared to the Auto industry in the United States, where the median P/S ratio is around 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for XPeng

How XPeng Has Been Performing

XPeng could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on XPeng will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For XPeng?

XPeng's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 45% per year over the next three years. That's shaping up to be materially higher than the 20% each year growth forecast for the broader industry.

In light of this, it's curious that XPeng's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From XPeng's P/S?

Following XPeng's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, XPeng's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with XPeng, and understanding them should be part of your investment process.

If you're unsure about the strength of XPeng's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether XPeng is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NYSE:XPEV

XPeng

XPeng Inc. designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.