Stock Analysis

- United Kingdom

- /

- Capital Markets

- /

- LSE:POLN

Investors Still Aren't Entirely Convinced By Pollen Street Group Limited's (LON:POLN) Earnings Despite 25% Price Jump

Pollen Street Group Limited (LON:POLN) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

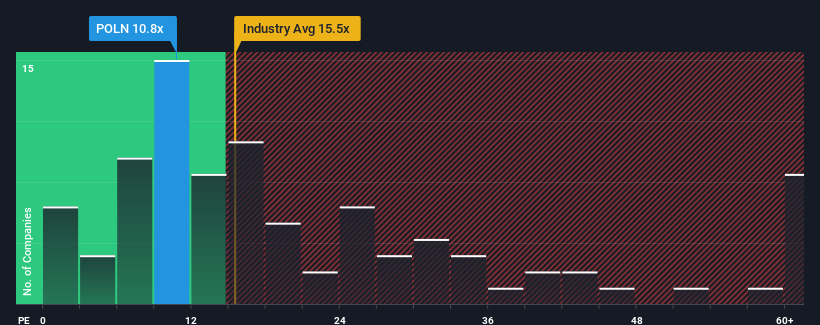

In spite of the firm bounce in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may still consider Pollen Street Group as an attractive investment with its 10.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Pollen Street Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Pollen Street Group

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Pollen Street Group's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Regardless, EPS has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 12% per year over the next three years. That's shaping up to be similar to the 13% each year growth forecast for the broader market.

In light of this, it's peculiar that Pollen Street Group's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Pollen Street Group's P/E?

Pollen Street Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Pollen Street Group currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Pollen Street Group you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Pollen Street Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:POLN

Pollen Street Group

Pollen Street PLC was founded in 2015 and is headquartered in London, Greater London, United Kingdom.

Very undervalued with flawless balance sheet.