Stock Analysis

- Canada

- /

- Hospitality

- /

- TSX:MTY

Investors Don't See Light At End Of MTY Food Group Inc.'s (TSE:MTY) Tunnel

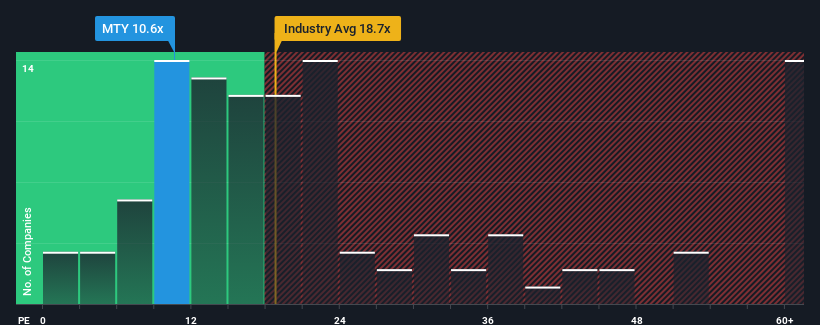

With a price-to-earnings (or "P/E") ratio of 10.6x MTY Food Group Inc. (TSE:MTY) may be sending bullish signals at the moment, given that almost half of all companies in Canada have P/E ratios greater than 15x and even P/E's higher than 30x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for MTY Food Group as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for MTY Food Group

Does Growth Match The Low P/E?

In order to justify its P/E ratio, MTY Food Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 35%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 19% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that MTY Food Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of MTY Food Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for MTY Food Group (1 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on MTY Food Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether MTY Food Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MTY

MTY Food Group

MTY Food Group Inc. operates and franchises quick-service, fast-casual, and casual dining restaurants in Canada, the United States, and internationally.

Good value with proven track record and pays a dividend.