Stock Analysis

- Germany

- /

- Hospitality

- /

- XTRA:TUI1

Improved Revenues Required Before TUI AG (ETR:TUI1) Stock's 27% Jump Looks Justified

TUI AG (ETR:TUI1) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

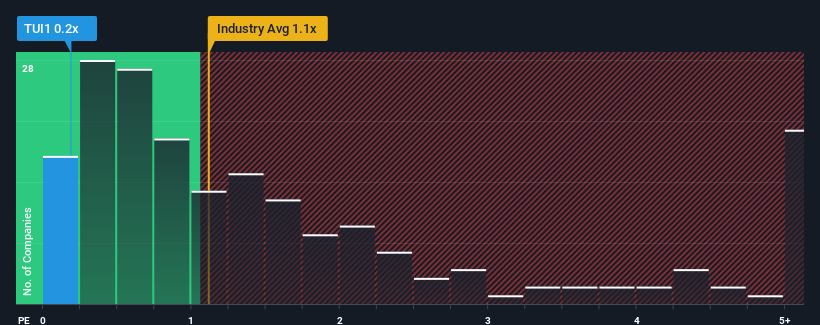

In spite of the firm bounce in price, given about half the companies operating in Germany's Hospitality industry have price-to-sales ratios (or "P/S") above 0.9x, you may still consider TUI as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for TUI

How TUI Has Been Performing

With revenue growth that's inferior to most other companies of late, TUI has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think TUI's future stacks up against the industry? In that case, our free report is a great place to start.How Is TUI's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like TUI's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.9% per year during the coming three years according to the twelve analysts following the company. That's shaping up to be materially lower than the 309% per annum growth forecast for the broader industry.

In light of this, it's understandable that TUI's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite TUI's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that TUI maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 2 warning signs we've spotted with TUI.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether TUI is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:TUI1

TUI

TUI AG, together with its subsidiaries, provides tourism services worldwide.

Undervalued with acceptable track record.