Stock Analysis

Corus Entertainment Inc.'s (TSE:CJR.B) Business Is Yet to Catch Up With Its Share Price

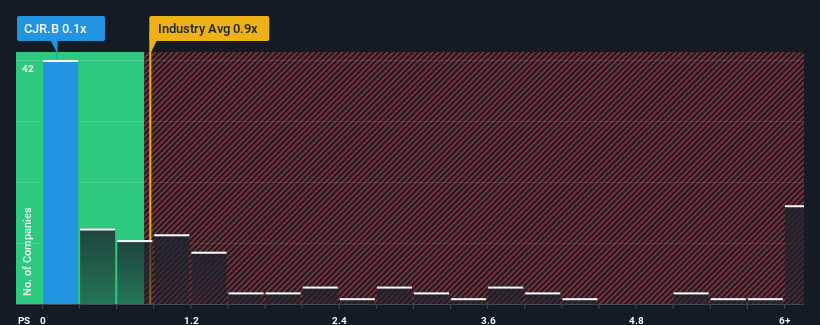

There wouldn't be many who think Corus Entertainment Inc.'s (TSE:CJR.B) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Media industry in Canada is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Corus Entertainment

What Does Corus Entertainment's P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Corus Entertainment has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Corus Entertainment.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Corus Entertainment's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.4%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.0% as estimated by the eight analysts watching the company. That's not great when the rest of the industry is expected to grow by 4.0%.

With this in consideration, we think it doesn't make sense that Corus Entertainment's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Corus Entertainment's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Corus Entertainment that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Corus Entertainment is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CJR.B

Corus Entertainment

Corus Entertainment Inc., a media and content company, operates specialty and conventional television networks, and radio stations in Canada and internationally.

Undervalued with imperfect balance sheet.