Stock Analysis

- India

- /

- Electric Utilities

- /

- NSEI:CESC

CESC Limited's (NSE:CESC) Shares Bounce 25% But Its Business Still Trails The Market

CESC Limited (NSE:CESC) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The annual gain comes to 107% following the latest surge, making investors sit up and take notice.

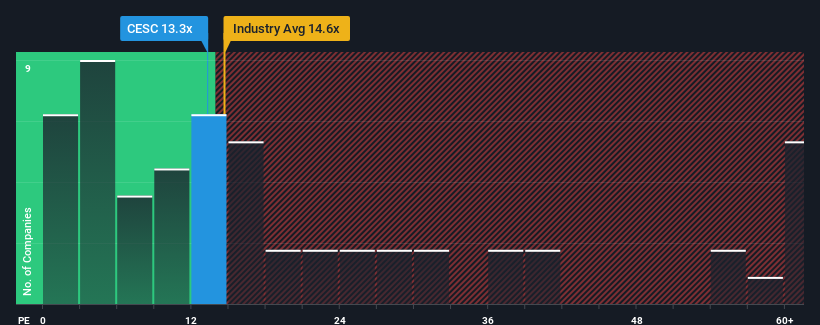

Although its price has surged higher, CESC's price-to-earnings (or "P/E") ratio of 13.3x might still make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 58x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

CESC could be doing better as it's been growing earnings less than most other companies lately. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for CESC

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as CESC's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 5.8%. The solid recent performance means it was also able to grow EPS by 5.9% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 10% over the next year. With the market predicted to deliver 24% growth , the company is positioned for a weaker earnings result.

With this information, we can see why CESC is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On CESC's P/E

Even after such a strong price move, CESC's P/E still trails the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of CESC's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with CESC.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether CESC is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:CESC

CESC

CESC Limited, an integrated electrical utility company, engages in the generation and distribution of electricity in India.

6 star dividend payer and undervalued.