Stock Analysis

- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

Basic-Fit (AMS:BFIT) adds €65m to market cap in the past 7 days, though investors from a year ago are still down 43%

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Basic-Fit N.V. (AMS:BFIT) share price slid 43% over twelve months. That's disappointing when you consider the market returned 20%. We note that it has not been easy for shareholders over three years, either; the share price is down 40% in that time. The falls have accelerated recently, with the share price down 27% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Basic-Fit

Because Basic-Fit made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Basic-Fit increased its revenue by 32%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 43%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

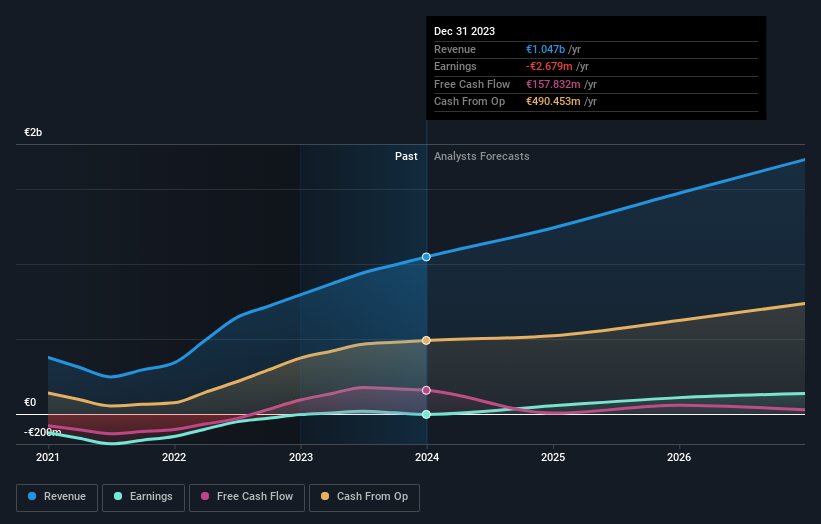

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in Basic-Fit had a tough year, with a total loss of 43%, against a market gain of about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Basic-Fit you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Basic-Fit is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTAM:BFIT

Basic-Fit

Basic-Fit N.V., together with its subsidiaries, engages in the operation of fitness clubs.

High growth potential with imperfect balance sheet.