- United States

- /

- Tobacco

- /

- NYSE:UVV

Are Universal's (NYSE:UVV) Statutory Earnings A Good Guide To Its Underlying Profitability?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Universal's (NYSE:UVV) statutory profits are a good guide to its underlying earnings.

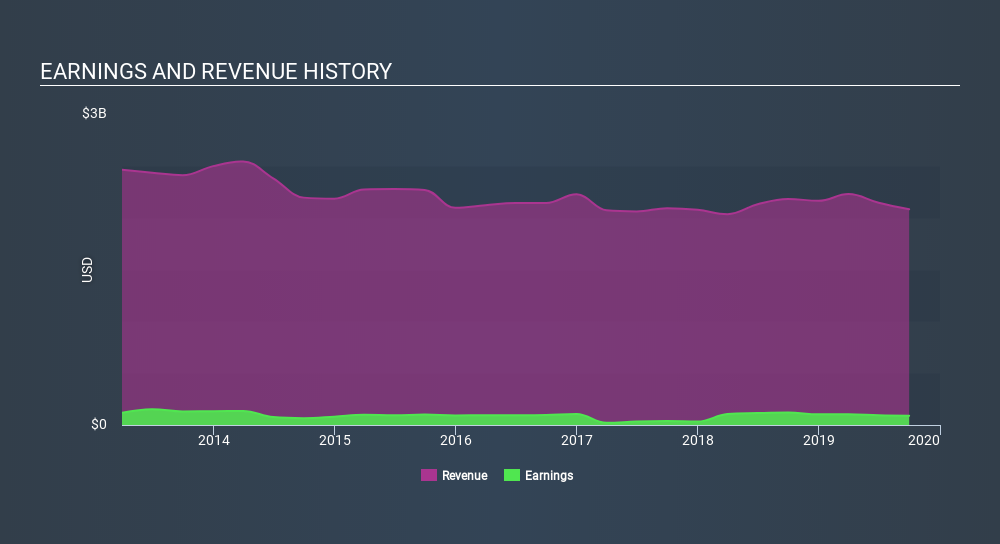

We like the fact that Universal made a profit of US$89.6m on its revenue of US$2.08b, in the last year. In the last few years both its revenue and its profit have fallen, as you can see in the chart below.

See our latest analysis for Universal

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. This article will discuss how unusual items have impacted Universal's most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Universal.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Universal's profit was reduced by US$20m, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Universal doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Universal's Profit Performance

Because unusual items detracted from Universal's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Universal's statutory profit actually understates its earnings potential! On the other hand, its EPS actually shrunk in the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. You can seeour latest analysis on Universal's balance sheet health here.

This note has only looked at a single factor that sheds light on the nature of Universal's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:UVV

Universal

A business-to-business agriproducts company, provides leaf tobacco and plant-based ingredients to food and beverage end markets worldwide.

6 star dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives