- Switzerland

- /

- Machinery

- /

- SWX:STGN

Are Starrag Group Holding's (VTX:STGN) Statutory Earnings A Good Guide To Its Underlying Profitability?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Starrag Group Holding (VTX:STGN).

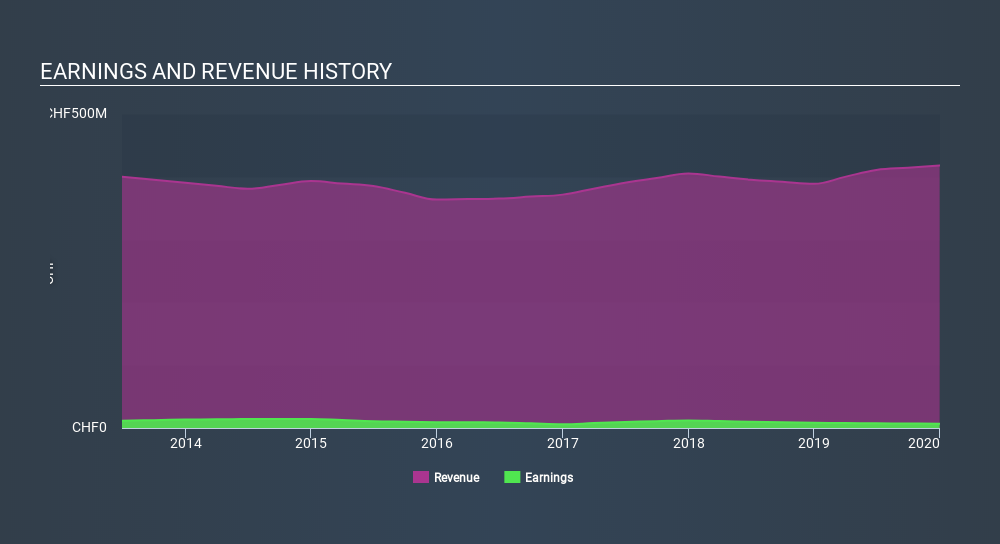

It's good to see that over the last twelve months Starrag Group Holding made a profit of CHF6.80m on revenue of CHF418.1m. In the chart below, you can see that its profit and revenue have both grown over the last three years, although its profit has slipped in the last twelve months.

See our latest analysis for Starrag Group Holding

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. This article, will discuss how unusual items and a tax benefit have impacted Starrag Group Holding's most recent bottom line results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

To properly understand Starrag Group Holding's profit results, we need to consider the CHF8.7m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Starrag Group Holding took a rather significant hit from unusual items in the year to December 2019. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Starrag Group Holding received a tax benefit of CHF3.0m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Starrag Group Holding's Profit Performance

In its last report Starrag Group Holding received a tax benefit which might make its profit look better than it really is on a underlying level. But on the other hand, it also saw an unusual item depress its profit. Based on these factors, we think that Starrag Group Holding's profits are a reasonably conservative guide to its underlying profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 2 warning signs for Starrag Group Holding you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SWX:STGN

StarragTornos Group

Develops, manufactures, and distributes precision machine tools for milling, turning, boring, grinding, and machining of work pieces of metal, composite materials, and ceramics.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.