- United Kingdom

- /

- Professional Services

- /

- AIM:LTG

Announcing: Learning Technologies Group (LON:LTG) Stock Soared An Exciting 659% In The Last Five Years

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. To wit, the Learning Technologies Group plc (LON:LTG) share price has soared 659% over five years. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 35% over the last quarter.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for Learning Technologies Group

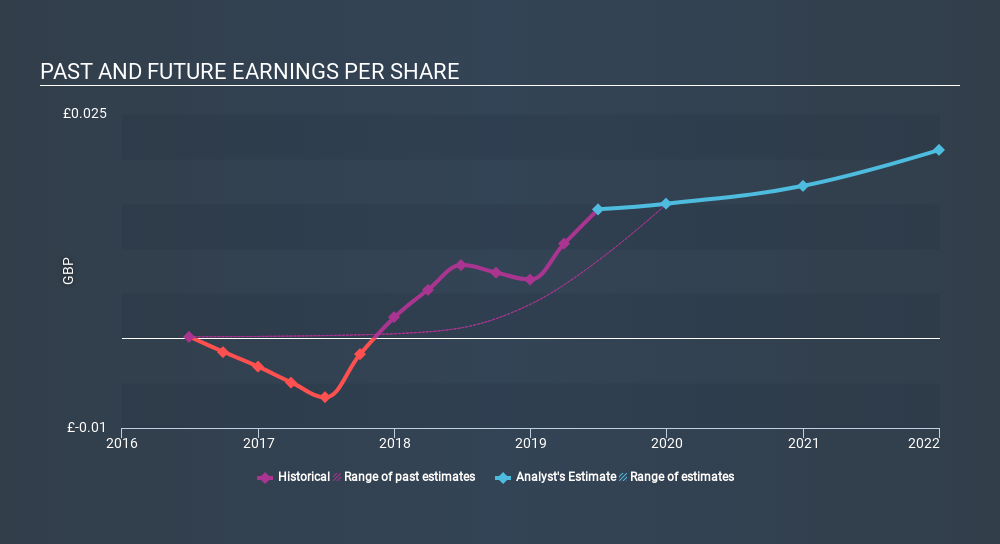

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Learning Technologies Group moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the Learning Technologies Group share price has gained 275% in three years. During the same period, EPS grew by 341% each year. This EPS growth is higher than the 55% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. Having said that, the market is still optimistic, given the P/E ratio of 112.14.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Learning Technologies Group, it has a TSR of 677% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Learning Technologies Group shareholders have received a total shareholder return of 141% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 51%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Learning Technologies Group better, we need to consider many other factors. For instance, we've identified 4 warning signs for Learning Technologies Group that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:LTG

Learning Technologies Group

Provides talent and learning solutions, content, services, and digital platforms to corporate and government clients.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives