- Sweden

- /

- Entertainment

- /

- OM:G5EN

Announcing: G5 Entertainment (STO:G5EN) Stock Soared An Exciting 320% In The Last Five Years

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held G5 Entertainment AB (publ) (STO:G5EN) shares for the last five years, while they gained 320%. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 33% over the last quarter.

See our latest analysis for G5 Entertainment

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

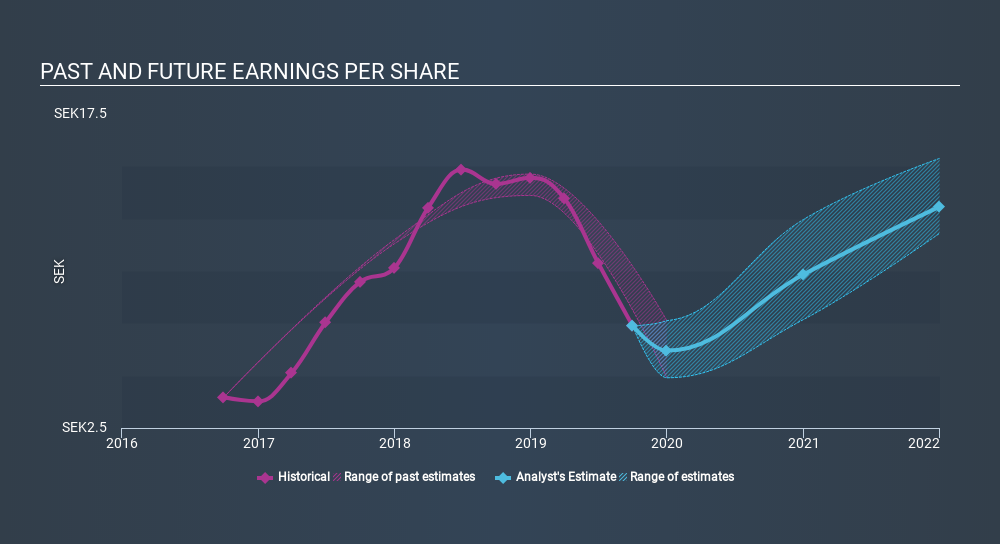

During the last half decade, G5 Entertainment became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the G5 Entertainment share price is down 34% in the last three years. In the same period, EPS is up 23% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -13% a year for three years.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on G5 Entertainment's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, G5 Entertainment's TSR for the last 5 years was 335%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

G5 Entertainment shareholders gained a total return of 4.7% during the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 34% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for G5 Entertainment you should be aware of.

We will like G5 Entertainment better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:G5EN

G5 Entertainment

Develops and publishes free-to-play games for smartphones, tablets, and personal computers in Sweden.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives