- United States

- /

- Packaging

- /

- NYSE:AMCR

Amcor (NYSE:AMCR) Advances Packaging Innovation With Recyclable AmFiber™ Performance Paper In Brazil

Reviewed by Simply Wall St

Amcor (NYSE:AMCR) has recently highlighted its commitment to sustainability with the success of its AmFiber™ Performance Paper recycling initiative in Brazil. This development underscores the company's efforts to align with a circular economy model, enhancing its packaging recyclability. Despite this positive impetus, Amcor's share price remained relatively flat over the past week compared to the market's broader 1.4% rise, suggesting that while the news is constructive, it did not significantly counter or amplify broader market trends influenced by global economic and trade discussions.

We've discovered 3 risks for Amcor that you should be aware of before investing here.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

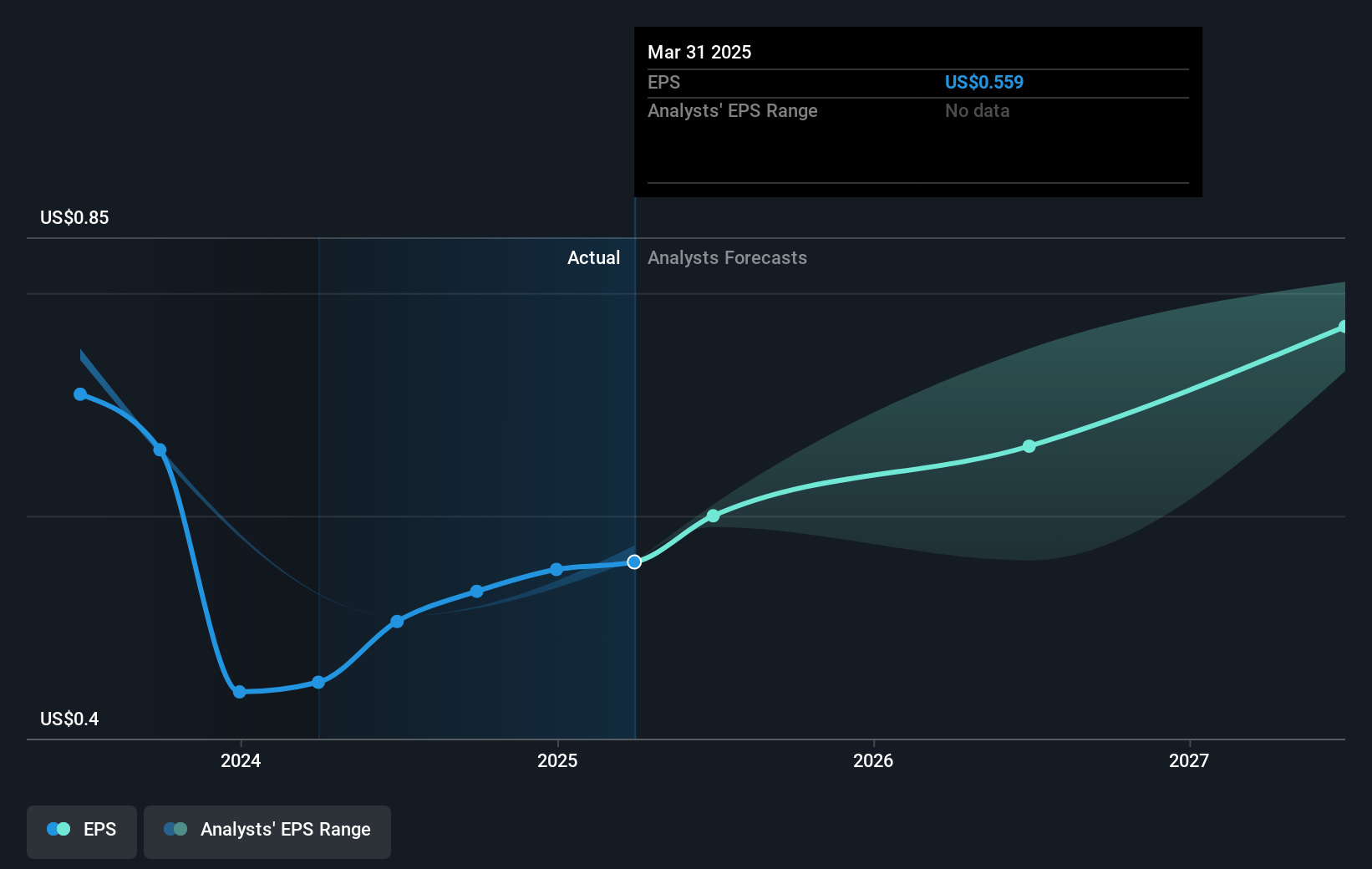

The recent success of Amcor's AmFiber™ Performance Paper recycling initiative in Brazil underscores its commitment to sustainability and aligns with its long-term growth strategy. While short-term market reactions have been modest, this initiative may reinforce the narrative of Amcor's focus on innovation and scalability, potentially enhancing its revenue and earnings forecasts. Analysts expect Amcor’s earnings to grow significantly over the next three years, driven by synergies from the merger with Berry Global and a refinement of its business portfolio toward higher-value markets.

Over the longer-term five-year period, Amcor has delivered a total shareholder return of 15.70%, illustrating a steady upward trajectory despite recent flat share price movement. This performance, though positive, remains below the US packaging industry's one-year decline of 8.4% and underperformed the broader US market's increase of 11.6% during the same period, reflecting ongoing challenges within the packaging sector.

Current analyst consensus places Amcor's price target at US$11.59, a 20.8% increase from its current share price of US$9.18. Achieving this target would require Amcor to meet or exceed projected revenue and earnings growth, leveraging both the recycling initiative and merger synergies. Investors will likely keep a close eye on how Amcor capitalizes on these opportunities, as well as how it manages potential risks related to economic uncertainties and integration challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Develops, produces, and sells packaging products in Europe, North America, Latin America, and the Asia Pacific.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives