- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Alexandria Real Estate Equities (NYSE:ARE) Secures Largest Life Science Lease in History

Reviewed by Simply Wall St

Alexandria Real Estate Equities (NYSE:ARE) recently secured a significant 16-year lease for a massive research hub in their San Diego megacampus, marking the largest life science lease in the company's history. This event underscores strong demand within the life science real estate sector, potentially supporting the company's 10% share price increase over the past month. During this time, while major indexes remained near all-time highs despite trade uncertainties, Alexandria's expansion move may have positively influenced investor sentiment, adding weight to the broader uptrend observed in the market.

Find companies with promising cash flow potential yet trading below their fair value.

The recent long-term lease secured by Alexandria Real Estate Equities for a research hub in their San Diego megacampus could bolster the company's revenue and occupancy stability, as highlighted in the narrative. This expansion caters to the sustained demand in the life science sector, potentially enhancing revenue projections. While the recent 10% increase in Alexandria's share price over the past month reflects positive sentiment, its 12-month total return of 33.76% illustrates broader challenges impacting its performance.

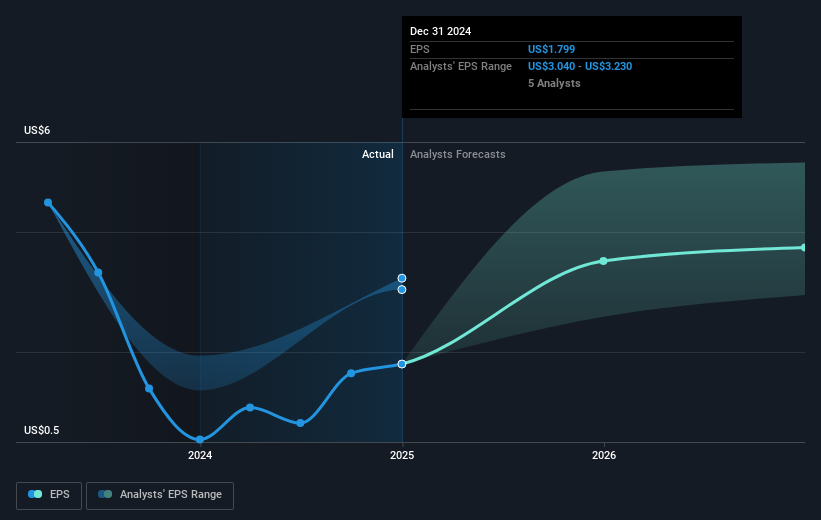

Over the past year, Alexandria's shares underperformed the US Health Care REITs industry, which posted a 19.7% return, and the broader US market's 11.4% gain. This underperformance factors into the valuation context, with the company's shares trading at a 33.5% discount to the consensus price target of US$107.69. With forecasted revenues of $3.11 billion translating into expected earnings of $406.2 million by May 2028, the market remains cautious. Current forecasts suggest a potential uplift in earnings, yet these remain contingent on successful execution amidst macroeconomic and regulatory pressures. The ongoing expansion could contribute positively to the company's long-term growth strategy, supporting both revenue and earnings growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives