- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Alexandria Real Estate Equities, Inc. Just Missed Earnings And Its EPS Looked Sad - But Analysts Have Updated Their Models

It's been a good week for Alexandria Real Estate Equities, Inc. (NYSE:ARE) shareholders, because the company has just released its latest first-quarter results, and the shares gained 5.1% to US$157. Results overall were not great, with earnings of US$0.14 per share falling drastically short of analyst expectations. Meanwhile revenues hit US$440m and were slightly better than forecasts. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Alexandria Real Estate Equities

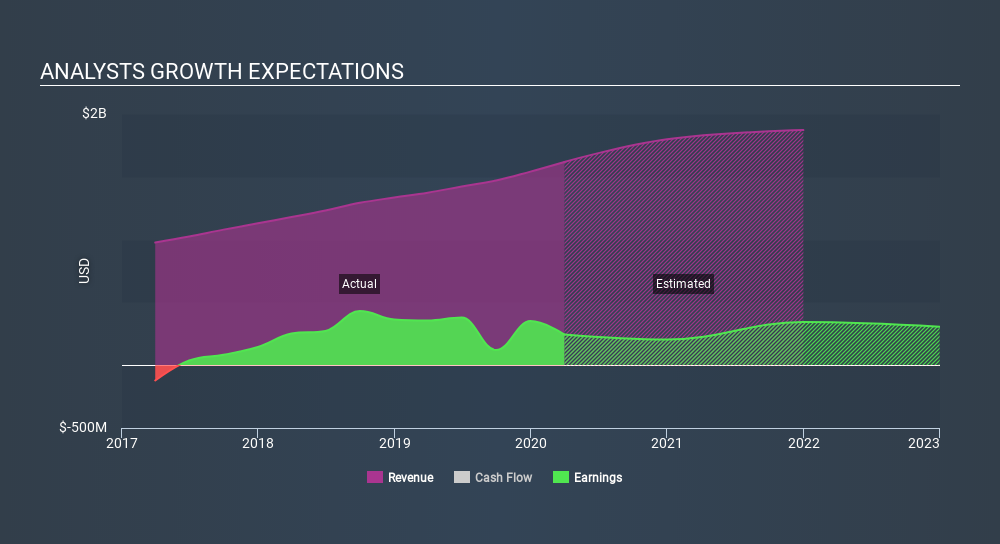

Taking into account the latest results, the most recent consensus for Alexandria Real Estate Equities from four analysts is for revenues of US$1.80b in 2020 which, if met, would be a decent 11% increase on its sales over the past 12 months. Statutory earnings per share are expected to crater 23% to US$1.63 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$1.68b and earnings per share (EPS) of US$2.98 in 2020. While next year's revenue estimates increased, there was also a pretty serious reduction to EPS expectations, suggesting the consensus has a bit of a mixed view of these results.

The consensus price target was unchanged at US$170, suggesting the business is performing roughly in line with expectations, despite some adjustments to profit and revenue forecasts. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Alexandria Real Estate Equities, with the most bullish analyst valuing it at US$190 and the most bearish at US$152 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Alexandria Real Estate Equities' revenue growth will slow down substantially, with revenues next year expected to grow 11%, compared to a historical growth rate of 15% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 4.3% next year. Even after the forecast slowdown in growth, it seems obvious that Alexandria Real Estate Equities is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target held steady at US$170, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Alexandria Real Estate Equities going out to 2021, and you can see them free on our platform here..

You should always think about risks though. Case in point, we've spotted 2 warning signs for Alexandria Real Estate Equities you should be aware of, and 1 of them makes us a bit uncomfortable.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives