- United States

- /

- Life Sciences

- /

- NasdaqGS:MRVI

Aldeyra Therapeutics Leads The Pack Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

The market has stayed flat over the past week, but it is up 13% over the past year, with earnings forecasted to grow by 15% annually. In such a setting, investors often look for stocks that combine value and growth potential, particularly those that may not be on everyone's radar. Penny stocks—though an outdated term—still offer intriguing opportunities when backed by strong financials and fundamentals, making them worth considering for investors seeking promising under-the-radar companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.42 | $506.33M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.77 | $278.15M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.8841 | $154.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Talkspace (TALK) | $2.65 | $463.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.43 | $36.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84718 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.24 | $452.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.15 | $26.81M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 423 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Aldeyra Therapeutics (ALDX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on discovering and developing therapies for immune-mediated and metabolic diseases, with a market cap of $260.55 million.

Operations: Aldeyra Therapeutics does not report any revenue segments.

Market Cap: $260.55M

Aldeyra Therapeutics, with a market cap of US$260.55 million, is pre-revenue and unprofitable but shows potential in its pipeline. Recent developments include an FDA Special Protocol Assessment for ADX-2191 targeting primary vitreoretinal lymphoma and the resubmission of an NDA for reproxalap to treat dry eye disease, following successful Phase 3 trials. The company's financial stability is supported by cash exceeding total debt and sufficient short-term assets to cover liabilities. However, high volatility remains a concern despite reduced losses over five years. Aldeyra's seasoned management and board provide strategic leadership amidst these challenges.

- Click here to discover the nuances of Aldeyra Therapeutics with our detailed analytical financial health report.

- Gain insights into Aldeyra Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Maravai LifeSciences Holdings (MRVI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Maravai LifeSciences Holdings, Inc. is a life sciences company that offers products facilitating the development of drug therapies, vaccines, cell and gene therapies, and diagnostics across various global regions; it has a market cap of approximately $679.94 million.

Operations: The company's revenue is primarily derived from two segments: Nucleic Acid Production, which generated $179.08 million, and Biologics Safety Testing, contributing $62.78 million.

Market Cap: $679.94M

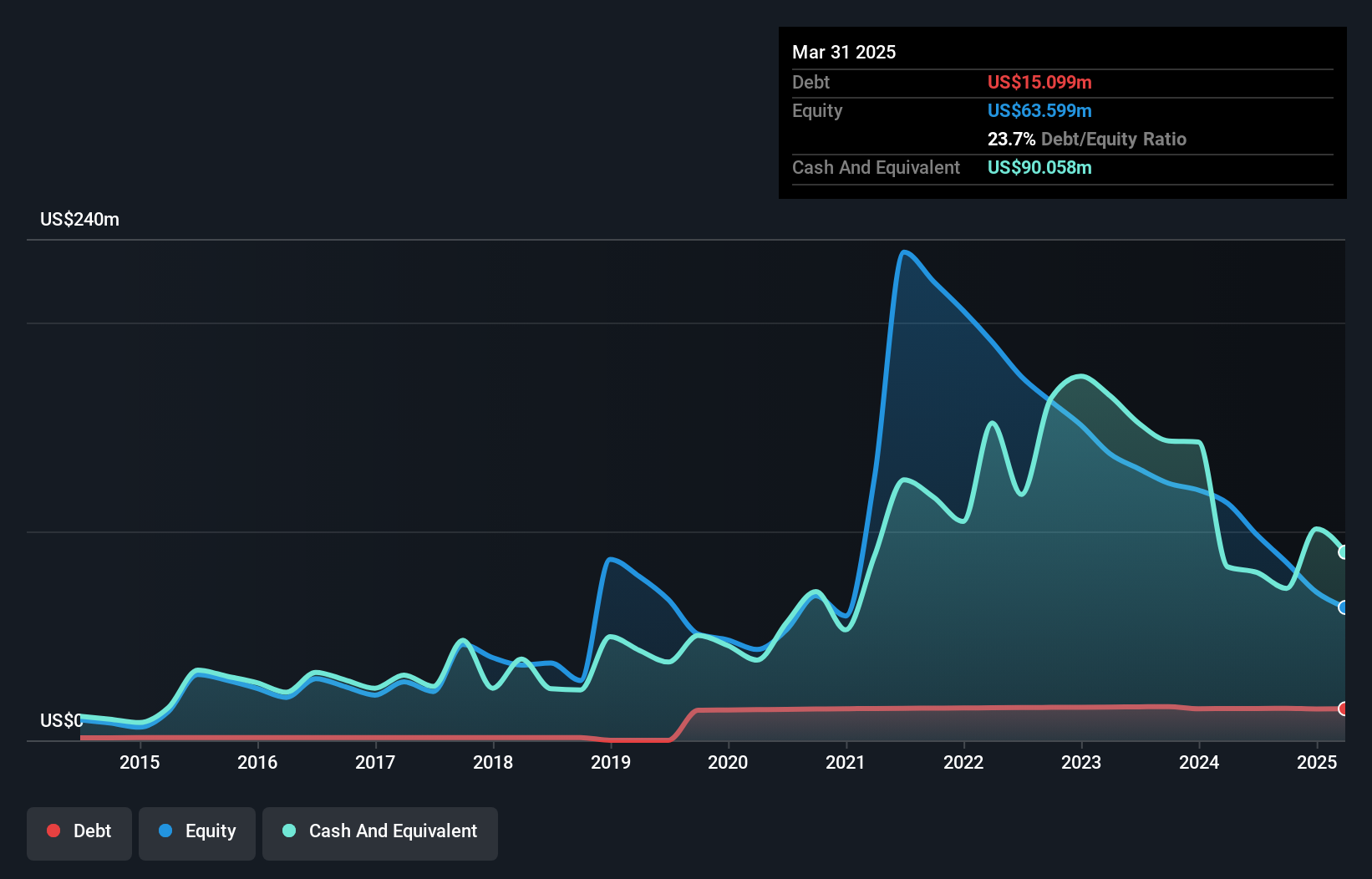

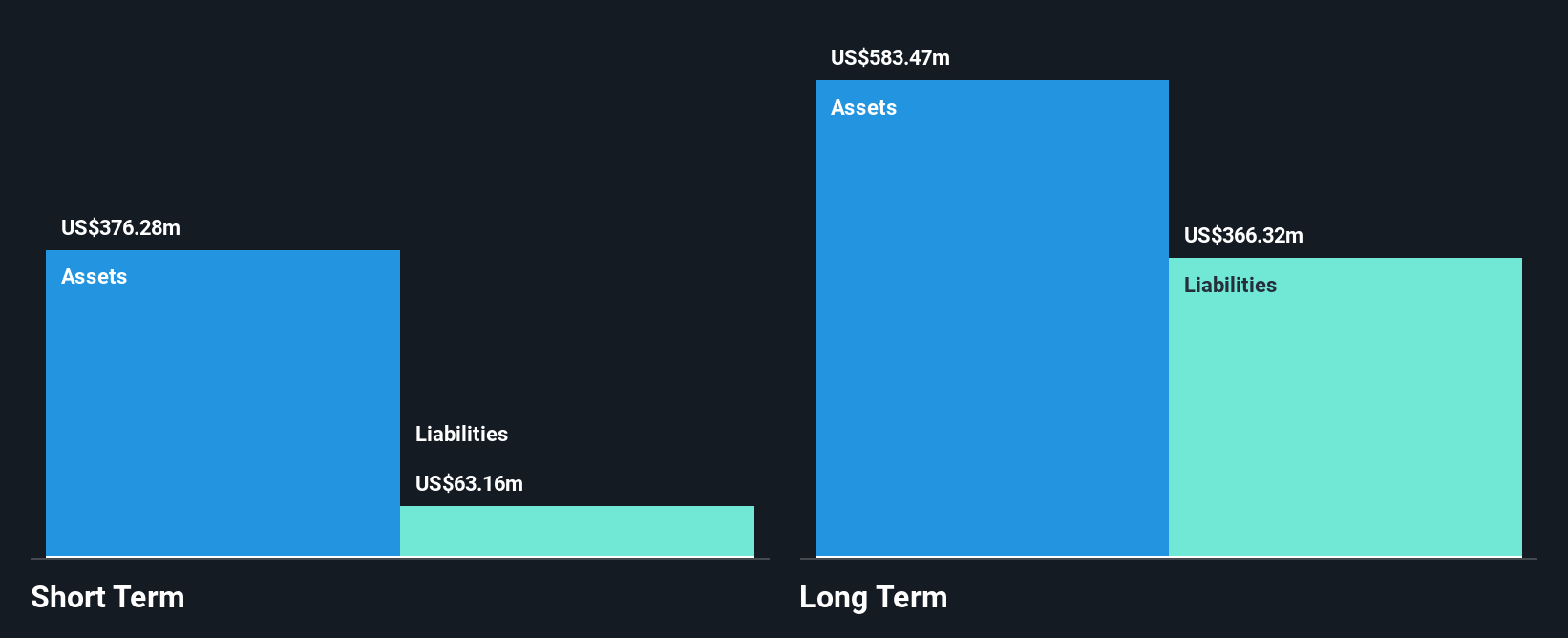

Maravai LifeSciences Holdings, with a market cap of approximately US$679.94 million, is experiencing executive changes that may influence its strategic direction. The recent appointment of Rajesh Asarpota as CFO and Bernd Brust as CEO aims to strengthen leadership with extensive experience in finance and operations. Despite being unprofitable, Maravai's short-term assets exceed both short- and long-term liabilities, indicating financial stability. However, the company faces challenges such as increased losses over five years and a goodwill impairment charge in its Nucleic Acid Production segment. Recent index reclassifications reflect shifting investor perceptions towards value-oriented benchmarks.

- Click to explore a detailed breakdown of our findings in Maravai LifeSciences Holdings' financial health report.

- Assess Maravai LifeSciences Holdings' future earnings estimates with our detailed growth reports.

Neumora Therapeutics (NMRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neumora Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases in the United States, with a market cap of $132.89 million.

Operations: Currently, Neumora Therapeutics does not report any revenue segments.

Market Cap: $132.89M

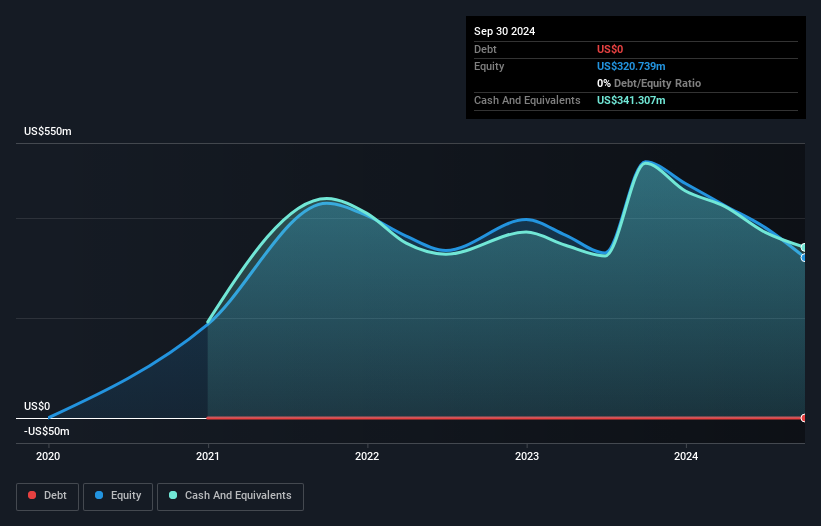

Neumora Therapeutics, with a market cap of US$132.89 million, is navigating challenges typical for penny stocks, including being pre-revenue and facing potential Nasdaq delisting due to non-compliance with the minimum bid price requirement. The company has proposed a reverse stock split to address this issue. Despite its unprofitability and increased losses over the past year, Neumora maintains financial resilience with no debt and short-term assets significantly exceeding liabilities. However, its management team is relatively inexperienced with an average tenure of 1.8 years, which may impact strategic execution in the near term.

- Take a closer look at Neumora Therapeutics' potential here in our financial health report.

- Gain insights into Neumora Therapeutics' future direction by reviewing our growth report.

Seize The Opportunity

- Discover the full array of 423 US Penny Stocks right here.

- Want To Explore Some Alternatives? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVI

Maravai LifeSciences Holdings

A life sciences company, provides products that enable the development of drug therapies, vaccines, drug therapies, cell and gene therapies, and diagnostics North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin and Central America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives