- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (NYSE:ALB) Price Surges 23% Over Last Month

Reviewed by Simply Wall St

Albemarle (NYSE:ALB) has recently been added to multiple Russell indices, significantly boosting its visibility and potentially enhancing trading liquidity. Over the past month, the company's stock price rose by 23%. This movement comes amid strong market conditions, with the S&P 500 and Nasdaq reaching all-time highs following a robust jobs report. While the broader market climbed and Albemarle's visibility increased, its inclusion in the indices could have added weight to the positive momentum. Meanwhile, the overall market sentiment was positive, which likely complemented Albemarle's gains over this period.

You should learn about the 1 risk we've spotted with Albemarle.

The recent inclusion of Albemarle in various Russell indices could enhance liquidity and visibility, which might aid in stabilizing revenue projections amid volatile lithium prices. Over a five-year period, the company's total return, inclusive of share price and dividends, was a decline of 7.62%. This contrasts with its recent short-term boost, highlighting mixed longer-term performance. In the past year, Albemarle underperformed both the broader US market and the US Chemicals industry, which saw gains of 13.2% and 1.3%, respectively.

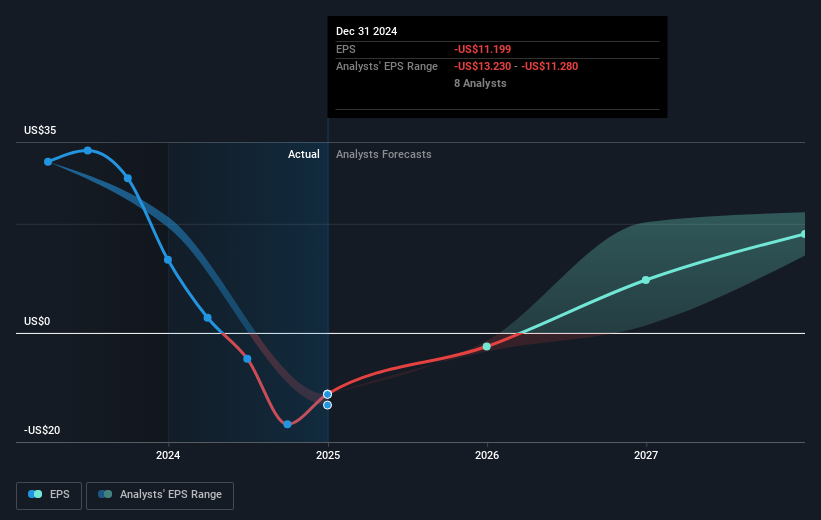

This news may positively influence Albemarle's revenue and earnings forecasts as improved liquidity can facilitate better investment opportunities and operational strategies. Analysts predict a revenue growth of 9.4% per year, and expect Albemarle to become profitable within three years. The share price's recent rise should be analyzed in the context of the consensus price target of US$88.42, which exceeds the current price of US$59.46 by 32.7%, indicating potential room for growth if the market aligns with analyst projections. Nonetheless, the company's unprofitable status and high leverage ratios remain significant risks to achieving these earnings targets.

Dive into the specifics of Albemarle here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives