- United States

- /

- Biotech

- /

- NasdaqCM:AKTX

Akari Therapeutics (NASDAQ:AKTX) Will Have To Spend Its Cash Wisely

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Akari Therapeutics (NASDAQ:AKTX) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business's cash, relative to its cash burn.

Check out our latest analysis for Akari Therapeutics

When Might Akari Therapeutics Run Out Of Money?

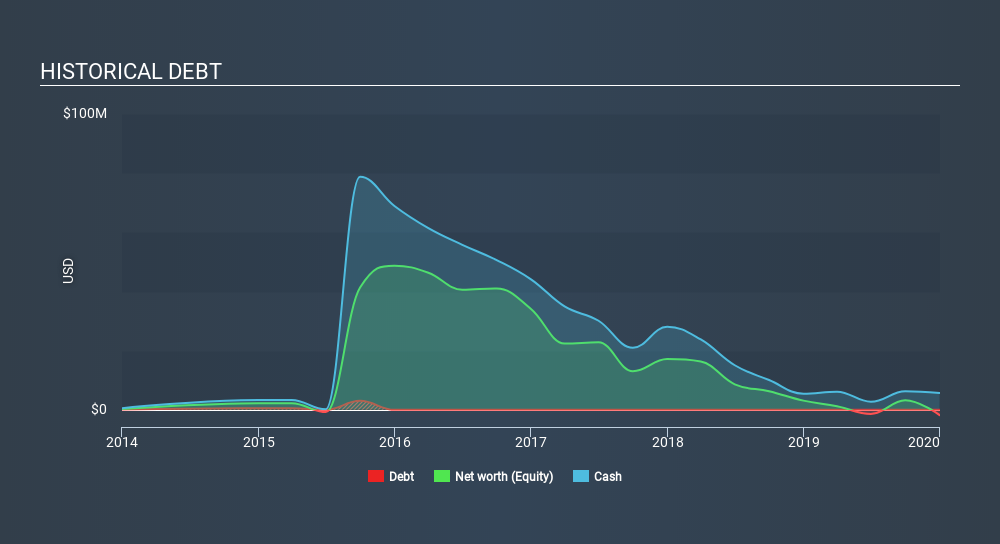

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Akari Therapeutics last reported its balance sheet in December 2019, it had zero debt and cash worth US$5.7m. Looking at the last year, the company burnt through US$13m. So it had a cash runway of approximately 5 months from December 2019. Importantly, analysts think that Akari Therapeutics will reach cashflow breakeven in 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. You can see how its cash balance has changed over time in the image below.

How Is Akari Therapeutics's Cash Burn Changing Over Time?

Because Akari Therapeutics isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Given the length of the cash runway, we'd interpret the 43% reduction in cash burn, in twelve months, as prudent if not necessary for capital preservation. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Akari Therapeutics Raise More Cash Easily?

While Akari Therapeutics is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of US$50m, Akari Therapeutics's US$13m in cash burn equates to about 26% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Akari Therapeutics's Cash Burn Situation?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Akari Therapeutics's cash burn reduction was relatively promising. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. On another note, Akari Therapeutics has 5 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:AKTX

Akari Therapeutics

An oncology company, develops next-generation antibody-drug conjugates (ADC) for cancer-killing toxins.

Slight and overvalued.

Market Insights

Community Narratives