- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

AI Chips Today - Empower and Marvell Innovate Power Solutions for AI Development

Reviewed by Simply Wall St

Empower Semiconductor and Marvell Technology have announced a collaboration to create next-generation integrated power delivery solutions tailored for AI and cloud platforms. This partnership aims to optimize chip-level power delivery for high-performance 4+ kilowatt processors, enhancing efficiency and performance for AI and cloud data centers through advanced integrated voltage regulator technology. By bringing power delivery closer to the processor, the collaboration seeks to reduce power transmission losses and support the increasing demands of modern computing infrastructures. This initiative marks a significant push towards more efficient power management solutions in the burgeoning AI chip sector.

- Marvell Technology (NasdaqGS:MRVL) last closed at $74.95 up 7.1%.

In other market news, Credo Technology Group Holding (NasdaqGS:CRDO) was trading firmly up 7.4% and closing at $85.59, not far from its 52-week high. At the same time, Giga Device Semiconductor (SHSE:603986) lagged, down 3.4% to end trading at CN¥118.96.

Best AI Chip Stocks

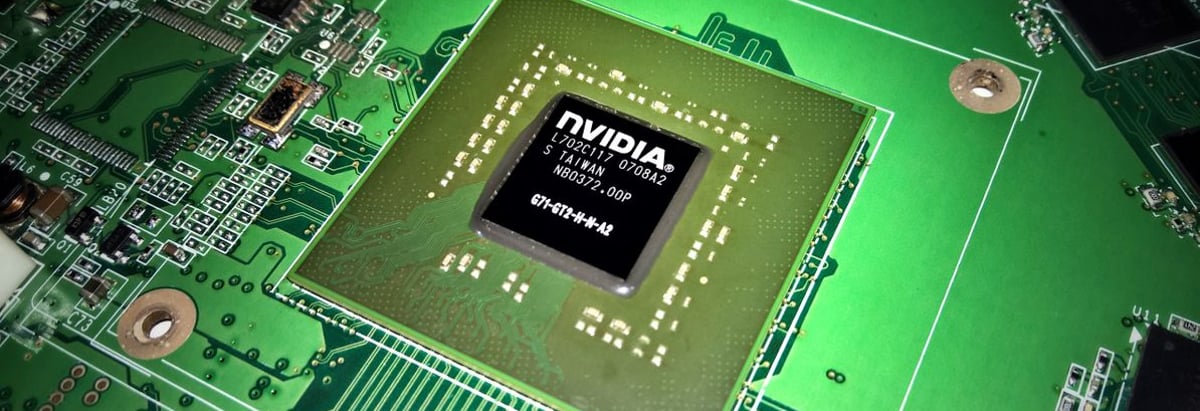

- NVIDIA (NasdaqGS:NVDA) ended the day at $145.48 up 0.9%, near its 52-week high. Three days ago, the company collaborated with Tech Soft 3D to enhance 3D interoperability using the Omniverse platform and HOOPS Exchange.

- Advanced Micro Devices (NasdaqGS:AMD) closed at $126.79 down 0.2%.

- QUALCOMM (NasdaqGS:QCOM) closed at $153.63 down 0.5%. This week, Qualcomm participated in MWC Shanghai 2025 with presentations from senior engineering and marketing leaders.

Summing It All Up

- Click here to access our complete index of 52 AI Chip Stocks, which features SK hynix, Teradyne and NXP Semiconductors.

- Interested In Other Possibilities? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Sources:

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives