- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (AEM) Reports Strong Earnings Growth Despite Slight Decline in Gold Production

Reviewed by Simply Wall St

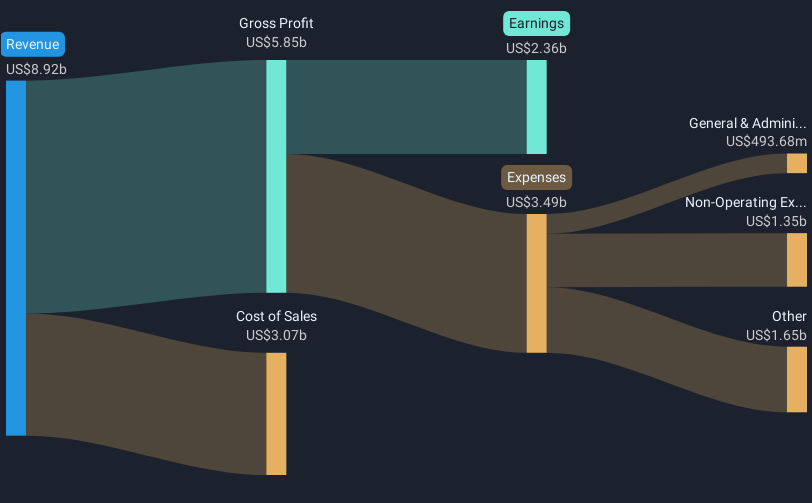

Agnico Eagle Mines (AEM) recently reported a mixed second quarter 2025 performance, with a 9.60% increase in its share price over the last quarter. Despite a slight decline in gold production, the significant rise in net income and earnings per share indicates robust financial health. Their reaffirmed production guidance and dividend declaration further reflect confidence in ongoing operations. This share price movement aligns with the general market trend, where optimism from strong corporate earnings has been prevalent. Such positive indicators have likely bolstered investor sentiment and supported the stock's performance relative to broader market gains.

We've spotted 1 warning sign for Agnico Eagle Mines you should be aware of.

Agnico Eagle Mines' recent positive financial indicators, including a significant net income increase and reaffirmed production guidance, suggest potential for robust revenue and earnings growth. Despite a slight gold production decline, their efforts in expanding key assets such as Detour and Malartic, coupled with new mine developments like Upper Beaver, could mitigate any short-term impacts on production forecasts, reinforcing expectations for revenue enhancement. The company's commitment to cost control and shareholder returns, evidenced by significant dividends and buybacks, aligns with these growth prospects.

Over the last three years, Agnico Eagle Mines has delivered a total shareholder return of 214.11%, including both share price appreciation and dividends. This impressive long-term performance is complemented by a 401.1% profit growth over the past year, which substantially surpassed both the US market, with a 15.7% return, and the Metals and Mining industry, which returned 6.7% over the year. These figures underscore the company's resilience and strong positioning within its sector.

The recent 9.60% quarterly share price increase moves Agnico Eagle Mines closer to the consensus analyst price target of US$139.83, currently reflecting a 0.13 discrepancy. This relative proximity to the target suggests some market confidence in the growth strategies and financial guidance presented. Although there are potential risks from gold price fluctuations and project execution challenges, the company's strategic direction and financial health may continue to support its price trajectory and facilitate realization of projected earnings milestones.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives