- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (NasdaqGS:AVAV) Sees Net Income Surge To US$17 Million In Latest Quarter

Reviewed by Simply Wall St

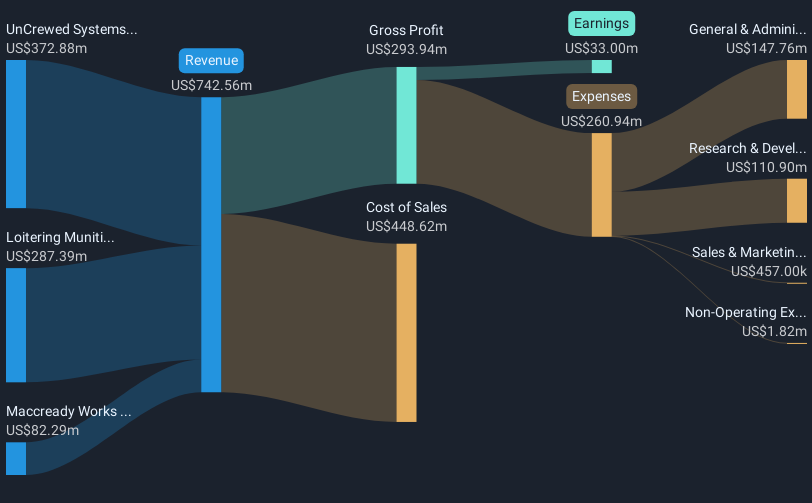

AeroVironment (NasdaqGS:AVAV) recently experienced significant developments, including a completed $875 million follow-on equity offering and a notable revenue increase in its fourth-quarter results, with net income rising from $6.05 million to $16.66 million. These financial milestones, alongside the advancement of its Wildcat UAS and the revenue guidance for fiscal year 2026 projecting substantial growth, likely bolstered the company’s share price by 121% in the last quarter. This sharp increase contrasts the market's 14% gain over the last year, highlighting AeroVironment's distinct positive movement in a largely positive market.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

The recent developments at AeroVironment, including the US$875 million follow-on equity offering and significant revenue increases, are poised to influence the company's growth trajectory. These factors could enhance its ability to capitalize on rising international defense spending and drive advancements in unmanned systems. Such financial momentum may positively impact future revenue and earnings forecasts, aiding the company's competitive positioning in the evolving defense sector. Analysts' forecasts reflect annual revenue growth of 46.6% and an increase in profit margins over the next three years, partly due to these strategic moves.

Over the past five years, AeroVironment's total return was 222.21%, demonstrating robust long-term share performance. This growth significantly outpaces the broader market's gains over the same period, indicating the company's distinct upward trajectory. Despite a 121% share price increase in the last quarter alone, the current share price of US$252.4 is just 5.8% above analysts' consensus price target of US$238.53, suggesting that current market enthusiasm aligns with future earnings potential but leaves limited immediate upside potential.

While the equity offering supports expansion and research capabilities, it also underscores the importance of achieving anticipated earnings to justify elevated market valuations. The potential synergies from the BlueHalo acquisition and expanding product offerings might enhance the price target reality, but any shortfall in realizing projected revenue growth could impact AeroVironment’s ability to meet high expectations embedded in its current Price-To-Sales and PE ratios. As the company navigates government reliance and integration challenges, sustaining this upward momentum will be critical to realizing its projected fiscal performance and maintaining market confidence.

Gain insights into AeroVironment's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives