- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (AVAV) Reports Promising Earnings Results

Reviewed by Simply Wall St

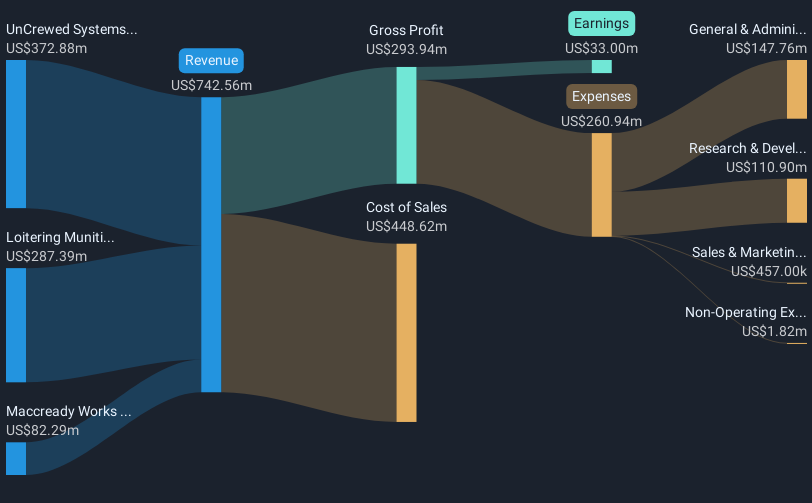

AeroVironment (AVAV) recently completed a follow-on equity offering and announced promising earnings results, contributing to its 89% stock price surge over the last quarter. The company's revenue and net income showed significant growth for its fourth quarter, aligning with market expectations of 15% annual earnings growth. Additionally, the expansion efforts, like the introduction of their Wildcat UAS and a memorandum with the Danish Ministry of Defence, likely bolstered investor confidence. Though the market remained flat recently, AeroVironment's robust activities, including strategic public offerings and innovative initiatives, complemented the broader 11% market climb over the past year.

The recent developments in AeroVironment's follow-on equity offering and strong earnings report may amplify the company's narrative centered around international defense spending and strategic acquisitions. These activities can potentially strengthen AeroVironment's expansion into high-value sectors, supported by increased demand for unmanned systems. With the introduction of products like the Wildcat UAS and new defense partnerships, the company is poised to capitalize on growth opportunities, despite challenges such as dependence on government contracts and integration hurdles.

AeroVironment's shares have shown significant growth over the long term, with a total return of 239.92% over the past three years. This performance highlights investor confidence and aligns with the broader industry trend. Over the past year, AeroVironment has exceeded the US market's 11.4% return and outperformed the Aerospace & Defense industry's 43.2% return, despite some headwinds faced by the sector.

The company's recent stock price movement, which reflects a discount to the consensus analyst price target of US$256.03, is noteworthy. Given AeroVironment’s current share price of US$265.00, the proximity to the target suggests a relatively narrow margin for price movement based on existing forecasts. The positive earnings outlook and ongoing revenue growth assumptions, driven by strong defense order pipelines and new product launches, may continue to support the stock price and align it with longer-term price targets. However, investors should weigh these prospects against potential risks outlined in the earnings and revenue forecasts.

Evaluate AeroVironment's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives