- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Earnings Rise To US$7 Billion In Recent Quarter

Reviewed by Simply Wall St

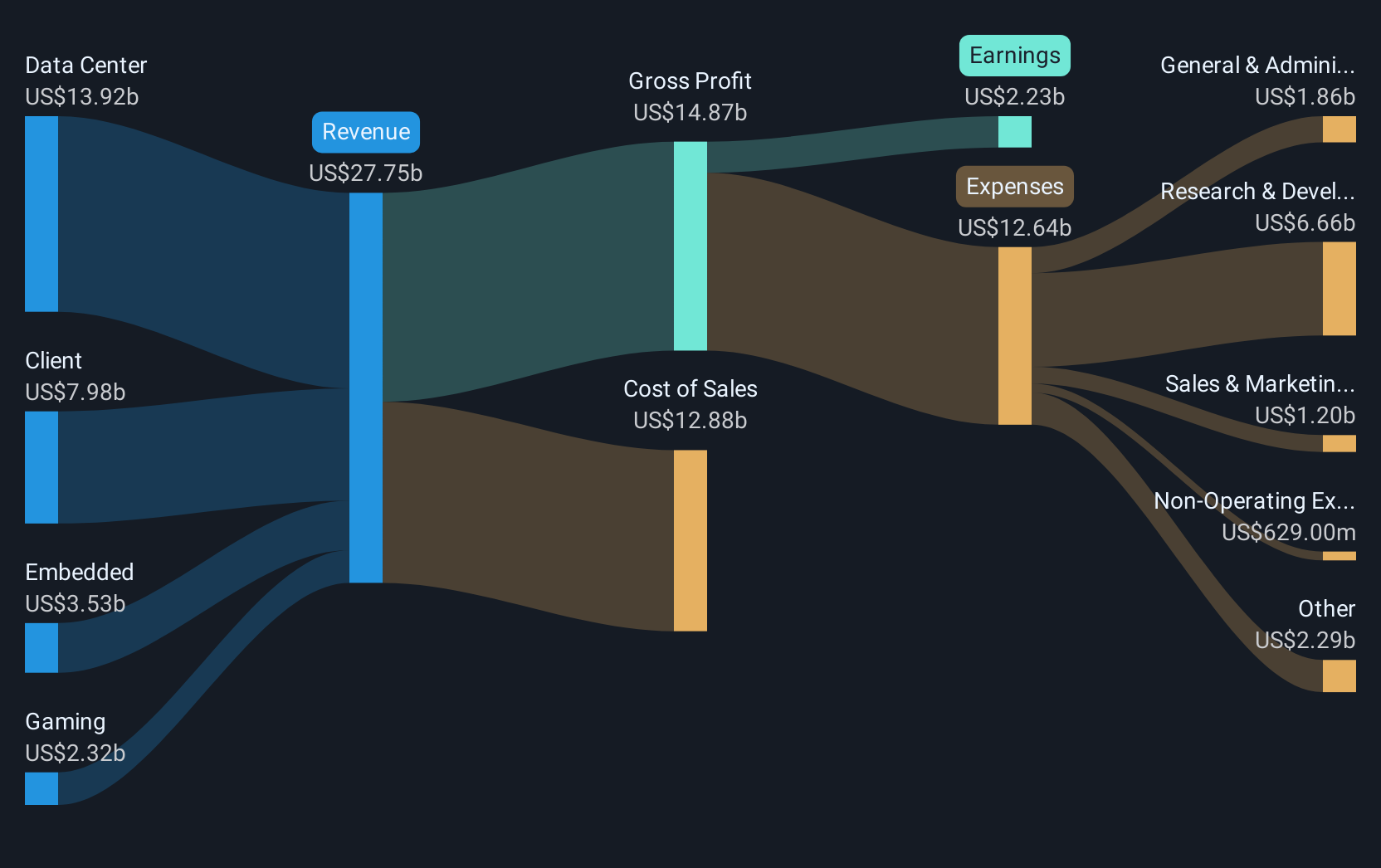

This quarter, Advanced Micro Devices (NasdaqGS:AMD) experienced a significant 20% increase in share price. This uptick aligns with major announcements, like its collaboration with Oracle to integrate MI355X GPUs into Oracle Cloud Infrastructure, offering improved price-performance for AI workloads. Partnerships with Infobell and mimik further highlight AMD's focus on AI innovation and cloud applications. The company's earnings announcement in May, with sales rising to $7.438 billion and net income markedly improving, also strengthened investor confidence. These developments would have added weight to the company's share price move, despite the broader market remaining flat over the last week.

Find companies with promising cash flow potential yet trading below their fair value.

The recent surge in Advanced Micro Devices' share price, bolstered by strategic partnerships in AI and cloud computing, signifies potential growth in these lucrative markets. This aligns with analysts' expectations of accelerating revenue and earnings growth driven by increased demand for high-performance computing. Notably, the collaboration with Oracle for GPU integration into Oracle Cloud Infrastructure promises enhanced AI workload capabilities, potentially boosting AMD's revenue and solidifying its market position. These developments reflect positively on AMD's narrative, given the focus on diversification and resilience.

Over the past five years, AMD's total shareholder return reached 155.97%. However, in the past year alone, AMD lagged behind the US Semiconductor industry, which saw a 7.3% gain. This disparity highlights the challenges AMD faces within a competitive landscape, marked by rivals like NVIDIA and evolving supply chain risks. Despite this, AMD's substantial long-term growth outlines a strong trajectory enhanced by its AI and cloud initiatives.

In terms of valuation, the current share price of US$98.62 is close to the consensus price target of US$130.47 but above the more bearish target of US$76.70. This suggests mixed analyst sentiment regarding AMD's future prospects. The company's recent partnerships and innovations may positively impact revenue and earnings forecasts. Still, these must counteract regulatory barriers and heightened competition. Investors should consider AMD's position and its ability to maintain momentum amid evolving industry dynamics.

Review our growth performance report to gain insights into Advanced Micro Devices' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives