Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Advanced Drainage Systems, Inc. (NYSE:WMS) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Advanced Drainage Systems

How Much Debt Does Advanced Drainage Systems Carry?

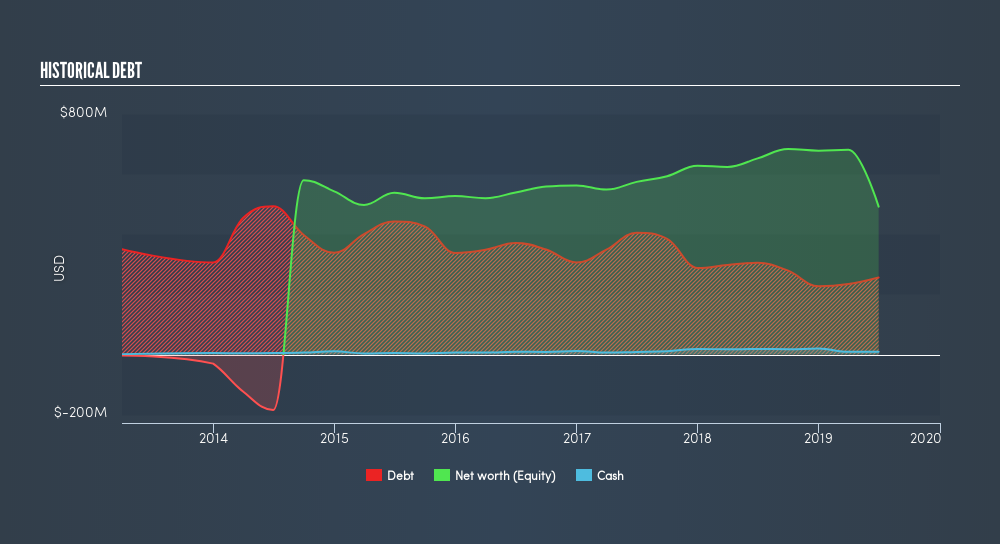

As you can see below, Advanced Drainage Systems had US$256.3m of debt at June 2019, down from US$384.4m a year prior. On the flip side, it has US$9.36m in cash leading to net debt of about US$246.9m.

How Strong Is Advanced Drainage Systems's Balance Sheet?

According to the last reported balance sheet, Advanced Drainage Systems had liabilities of US$244.0m due within 12 months, and liabilities of US$332.4m due beyond 12 months. On the other hand, it had cash of US$9.36m and US$231.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$335.2m.

Given Advanced Drainage Systems has a market capitalization of US$1.86b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Advanced Drainage Systems's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Advanced Drainage Systems managed to grow its revenue by 3.7%, to US$1.4b. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Importantly, Advanced Drainage Systems had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost US$120m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of-US$192.4m. So in short it's a really risky stock. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Advanced Drainage Systems insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives