- United States

- /

- Banks

- /

- NasdaqCM:ACNB

ACNB Corporation (NASDAQ:ACNB) Looks Interesting, And It's About To Pay A Dividend

Readers hoping to buy ACNB Corporation (NASDAQ:ACNB) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Investors can purchase shares before the 28th of August in order to be eligible for this dividend, which will be paid on the 13th of September.

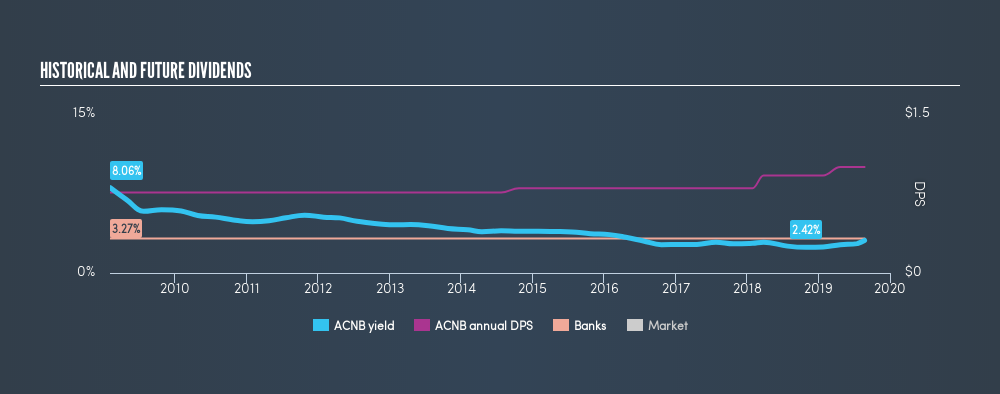

ACNB's next dividend payment will be US$0.25 per share. Last year, in total, the company distributed US$1.00 to shareholders. Based on the last year's worth of payments, ACNB stock has a trailing yield of around 3.1% on the current share price of $32.51. If you buy this business for its dividend, you should have an idea of whether ACNB's dividend is reliable and sustainable. As a result, readers should always check whether ACNB has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for ACNB

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see ACNB paying out a modest 28% of its earnings.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit ACNB paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Fortunately for readers, ACNB's earnings per share have been growing at 17% a year for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. ACNB has delivered an average of 2.8% per year annual increase in its dividend, based on the past 10 years of dividend payments. It's good to see both earnings and the dividend have improved - although the former has been rising much quicker than the latter, possibly due to the company reinvesting more of its profits in growth.

To Sum It Up

Should investors buy ACNB for the upcoming dividend? Companies like ACNB that are growing rapidly and paying out a low fraction of earnings, are usually reinvesting heavily in their business. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. We think this is a pretty attractive combination, and would be interested in investigating ACNB more closely.

Curious about whether ACNB has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:ACNB

ACNB

A financial holding company, offers banking, insurance, and financial services to individual, business, and government customers in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives