- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch (NYSE:ANF) Reports Mixed Q1 2025 Earnings With Sales Up To US$1097 Million

Reviewed by Simply Wall St

Abercrombie & Fitch (NYSE:ANF) recently posted mixed financial results for Q1 2025, which included a year-over-year sales increase to $1,097 million, but a decrease in net income. The company also adjusted its fiscal 2025 guidance downward, alongside updates to its stock buyback program. These financial movements coincided with a 9.5% price rise over the past month, reflecting broader market trends that have seen modest gains amid favorable trade discussions between the U.S. and China. This market optimism likely added weight to Abercrombie's price performance, despite its mixed earnings report and reduced income projections.

Be aware that Abercrombie & Fitch is showing 1 weakness in our investment analysis.

The recent developments surrounding Abercrombie & Fitch have mixed implications for the company's outlook. The increase in Q1 2025 sales to US$1.1 billion contrasts with a decline in net income, which has led to a downward adjustment to its fiscal 2025 guidance. This downturn, despite a 9.5% share price rise over the past month, suggests that market optimism, possibly stemming from favorable U.S.-China trade discussions, temporarily bolstered investor sentiment.

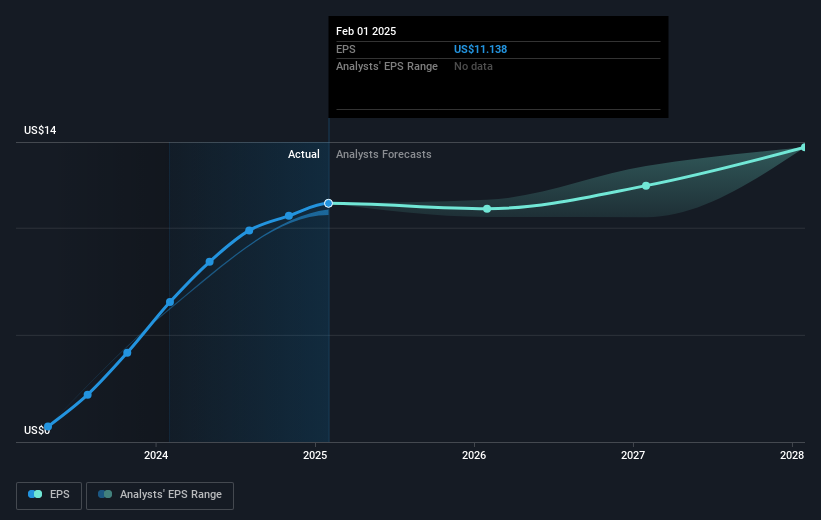

Looking at a broader horizon, Abercrombie & Fitch's total shareholder returns, including dividends, skyrocketed by a very large percentage over the past five years, indicating robust long-term value creation. However, the company has underperformed relative to the US Specialty Retail industry over the past year, which returned 12.3%. Despite strong historical returns, short-term challenges in international market conditions and elevated costs could impact revenue and earnings forecasts. Analysts now anticipate revenue growth of 3.1% per year, with earnings forecasted to reach US$559 million by May 2028.

Although the stock has experienced recent gains, it's still priced significantly below the analyst consensus price target of US$121.47, indicating potential upside. The current share price remains at a 42.7% discount to this target, reflecting analyst confidence in future prospects despite present setbacks. Investors should weigh these analyst expectations against their understanding of the company's capacity to manage ongoing risks.

Evaluate Abercrombie & Fitch's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives